Buying Property in Spain: 5 Pitfalls to Avoid (Nota Simple, Lawyer, Arras)

Introduction

Acquiring property in Spain appeals to many international buyers seeking a pleasant climate and more affordable prices. However, this significant financial investment involves specific considerations that should be understood. A sunny dream can quickly turn into an administrative nightmare if one is not prepared.

As experts in the Spanish market, we have identified the 5 main pitfalls to avoid when buying property in Spain. This guide provides you with the keys to secure your project, from legal verification (Nota Simple) to signing the preliminary contract (Contrato de Arras).

Pitfall #1: Neglecting the Legal Status of the Property (the Nota Simple)

This is the most critical pitfall. In Spain, it is possible to sell a property with irregularities (undeclared swimming pool, illegal extension, etc.) or existing debts. The buyer inherits these problems if they are not cleared before the sale.

Before paying any money, your lawyer (abogado) must request and analyze the “Nota Simple Informativa”. This document, issued by the Property Registry (Registradores de España), is the legal x-ray of the property.

What does the Nota Simple verify?

- ✅ Owner's Identity: Is the seller indeed the sole owner?

- ✅ Property Description: Does the registered area (m²) correspond to reality? (Beware of undeclared swimming pools/extensions).

- ✅ Charges and Debts (Cargas): Is the property encumbered by a mortgage (hipoteca), an embargo, or other debts (community fees, IBI taxes...)?

Buying without an up-to-date Nota Simple is buying with your eyes closed. You must also verify the cadastral reference and the first occupancy license (Licencia de Primera Ocupación) for new builds.

Official Resource

To verify the property registry and order a Nota Simple, the only official source is the portal of the Spanish Registrars.

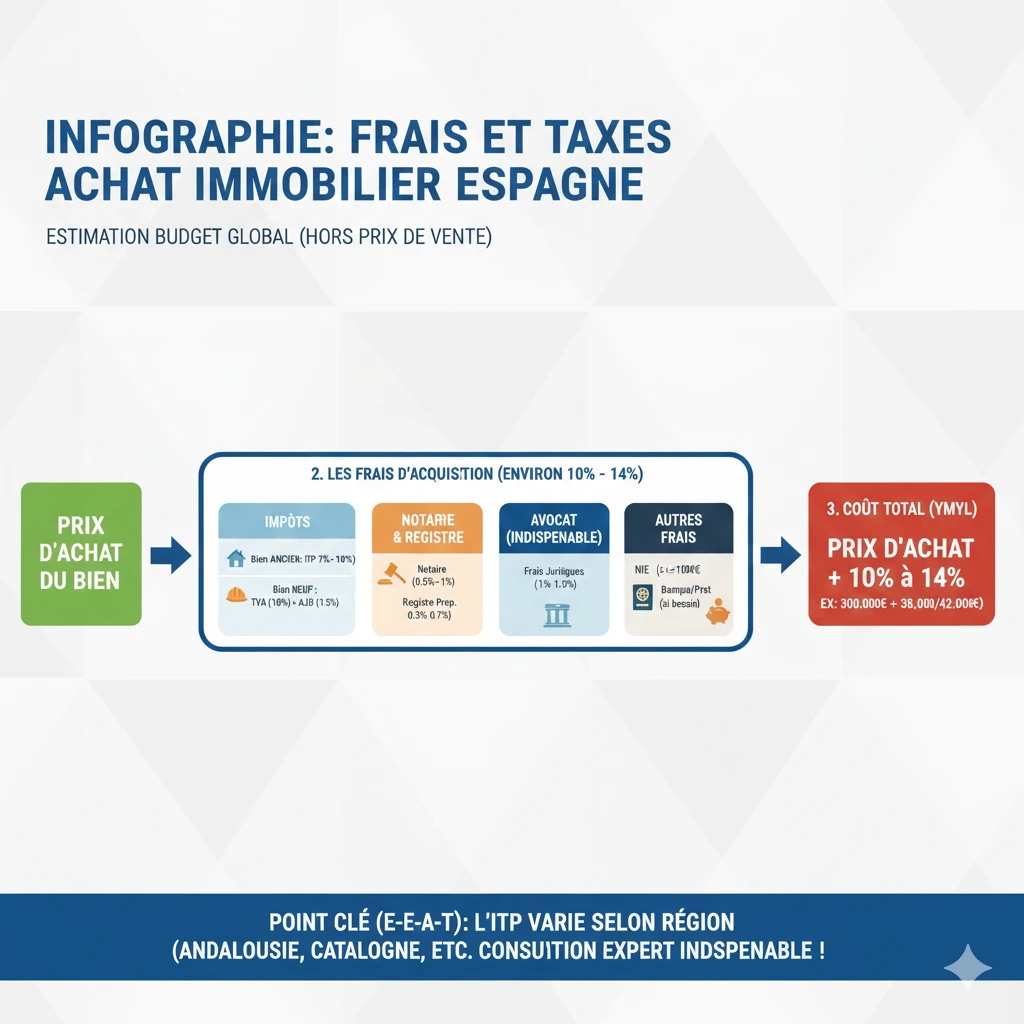

Pitfall #2: Underestimating Fees and Taxes (10-14% of the Price)

A price advertised at €300,000 is never the final cost. Many buyers do not budget for acquisition fees, which are high in Spain. Plan for an additional 10% to 14% of the purchase price.

| Type of Fee | Cost (Estimate) | Notes |

|---|---|---|

| Tax (ITP or IVA) | 7% to 10% (ITP) or 10% (IVA) | ITP for resale properties (varies by region). IVA (VAT) for new builds (+1.5% Stamp Duty - AJD). |

| Notary (Notaría) | 0.5% to 1% | Fees regulated by the State. |

| Property Registry | 0.3% to 0.7% | Fees for registering the deed of sale. |

| Lawyer (Abogado) | 1% to 1.5% (+IVA) | Essential for non-residents. |

Pitfall #3: Relying Solely on the Real Estate Agent (Without a Lawyer)

This is a common cultural mistake. In many countries, the notary plays a role in protecting both parties. In Spain, the roles are very different, and the agent profession is not as heavily regulated.

| Party | Role in Spain | Who do they protect? |

|---|---|---|

| Real Estate Agent | Salesperson. Their objective is to close the sale. | The seller (who pays them). |

| Notary (Notario) | Public official. They verify identities, read the deed, and register it. They do not verify urbanistic legality. | The State (they are neutral). |

| Lawyer (Abogado) | Your representative. They verify the Nota Simple, urbanistic planning, debts, and negotiate the contract (Arras). | The buyer (you). |

Not appointing your own independent lawyer (abogado) is the biggest risk you can take. They are the one who analyzes the Nota Simple, verifies urbanistic compliance, and drafts a contract protecting your interests.

Pitfall #4: Forgetting About Community Rules (Comunidad) and Rental Licenses

You've found the perfect apartment with a pool. But have you checked the rules?

- ✅ Community Debts: Your lawyer must request a certificate from the community administrator (Administrador) confirming that the seller is up to date with their community fees (gastos de comunidad). Otherwise, you inherit their debts!

- ✅ Internal Rules: Are there any major works (façade, elevator) approved and requiring payment?

- ✅ Tourist License: Want to list on Airbnb? This is the #1 pitfall for investors. Many cities (Barcelona, Palma, Valencia) have blocked licenses, or homeowners' associations prohibit them. Check local legislation *before* buying.

Pitfall #5: Signing the Preliminary Contract ("Contrato de Arras") Too Quickly

The "Contrato de Arras" is the preliminary sale agreement. By signing it, you pay a deposit (usually 10%). If you withdraw, you lose this deposit. If the seller withdraws, they must return double the amount to you.

Never sign this contract without your lawyer having completed all verifications (Pitfall #1). This is the document that must contain all guarantees for you.

Key Suspensive Clauses to Add

Your lawyer should negotiate suspensive clauses (cláusulas suspensivas) to protect you, including:

- A clause for obtaining financing (if you are applying for a loan in Spain).

- A clause for urbanistic regularization (if a swimming pool needs to be declared by the seller).

- A "free of charges" clause (libre de cargas), guaranteeing the absence of debts.

Bonus: Obtain your NIE (Foreigner’s Identification Number)

The NIE is your foreign tax identification number. It is mandatory for buying a property, opening a bank account, or signing at the notary's office. The application can take several weeks, so anticipate it from the start of your project.

Conclusion: Secure Your Project

Buying property in Spain is an excellent opportunity, but it's a process that doesn't forgive amateurism. The 5 pitfalls (legality, costs, lawyer, community, contract) are all avoidable with proper preparation.

Don't let the Spanish dream turn into a legal nightmare. Take your time, inform yourself, and be accompanied by competent professionals (a lawyer and an agent) who defend your interests. This is the key to a successful and serene investment in the sun.

Need to secure your acquisition?

Take advantage of market opportunities. Let's discuss your project.

Article Table of Contents

- Introduction

- Pitfall #1: Neglecting the Legal Status of the Property (the Nota Simple)

- Pitfall #2: Underestimating Fees and Taxes (10-14% of the Price)

- Pitfall #3: Relying Solely on the Real Estate Agent (Without a Lawyer)

- Pitfall #4: Forgetting About Community Rules (Comunidad) and Rental Licenses

- Pitfall #5: Signing the Preliminary Contract ("Contrato de Arras") Too Quickly

- Key Suspensive Clauses to Add

- Conclusion: Secure Your Project

FAQ : Avoiding Pitfalls When Buying Property in Spain

Our experts answer your questions on the Nota Simple, hidden costs, and the crucial role of your solicitor in securing your purchase.

The number one pitfall is neglecting the property's legal status. In Spain, it is possible to sell a property with existing debts (mortgage, unpaid taxes) or irregularities (e.g., an illegal swimming pool). The buyer automatically inherits all these problems if they are not thoroughly checked before signing.

The "Nota Simple" is the legal snapshot of the property, issued by the Land Registry. It is essential because it alone confirms three vital points:

-

Who the true owner is (does the seller have the right to sell?).

-

The legal description of the property (are the surface area, pool, etc., properly declared?).

-

If there are any encumbrances ("cargas") (such as a mortgage, an embargo, or outstanding debts).

You will inherit an illegal construction. You will be responsible for its regularization (if possible), which involves costs, taxes, and administrative procedures. In the worst-case scenario (if the construction cannot be legalized), you could be forced to demolish it at your own expense.

As a buyer, you should budget an additional 10% to 14% of the purchase price. These costs cover the main property transfer tax (ITP or VAT), notary fees, Land Registry fees, and your solicitor's fees.

This depends on whether the property is new or second-hand:

-

For a second-hand property (resale): You pay the ITP (Impuesto sobre Transmisiones Patrimoniales – Property Transfer Tax), which varies from 7% to 10% depending on the region.

-

For a new-build property (from a developer): You pay VAT (IVA) at 10%, plus a Stamp Duty equivalent tax (AJD - Impuesto sobre Actos Jurídicos Documentados) of approximately 1.5%.

No. This is a fundamental cultural difference. The Spanish notary (Notario) is a neutral public official. They certify the identity of the parties and the authenticity of the deed, but they do not verify the urbanistic legality or the existence of debts in the same way a UK/US solicitor would.

This is the role of your independent solicitor (Abogado). They are the only professional who defends your interests. It is your solicitor who analyses the Nota Simple, checks urban planning permits, ensures there are no outstanding debts, and negotiates the contract clauses to protect you.

The estate agent is a sales professional whose objective is to conclude the sale. They are generally paid by the seller and therefore protect the seller's interests. They cannot and should not replace the legal advice of a solicitor dedicated to you.

This is the Spanish pre-purchase agreement or preliminary contract. By signing it, you pay a deposit (usually 10% of the price) to reserve the property. It is a very binding contract: if you withdraw without a valid reason (a suspensive clause), you will lose this deposit.

Never sign this contract before your solicitor has received and thoroughly analysed the Nota Simple, checked urbanistic compliance, and confirmed the absence of any debts. All due diligence must be completed before you commit.

Your solicitor must include suspensive clauses (cláusulas suspensivas) in the Contrato de Arras. The most important is the finance contingency clause, which stipulates that if the bank denies you the loan, you can cancel the sale and recover your 10% deposit.

This is a very common pitfall. You must check two things:

-

Local Law: Many cities (Barcelona, Valencia, Palma) have severely restricted or blocked the granting of tourist licenses.

-

Community Regulations: The Comunidad (the homeowners' association/building management) may prohibit tourist rentals in the building.

These checks are absolutely essential before purchasing.

Your solicitor must request an official certificate from the community administrator (Administrador) confirming that the seller is up-to-date with their community fees (gastos de comunidad). If you do not have this document, you could inherit the seller's outstanding community debts.

The NIE (Número de Identificación de Extranjero – Foreigner's Identification Number) is your Spanish tax identification number. It is mandatory for purchasing property, opening a bank account, and paying your taxes. Obtaining it can take a long time (several weeks), so you should start the process at the very beginning of your project.

Your solicitor's (Abogado) fees. They typically represent around 1% to 1.5% of the price, but it is the only expense that guarantees you a complete legal verification and prevents you from inheriting problems (debts, illegal constructions) that could cost you far more in the long run.