Spain Property Interest Rate Forecast 2026: Towards a Decline in Euribor?

Introduction

Are you planning a property purchase in Spain and asking the most crucial financial question: what will be the Spanish property interest rate forecasts in 2026? After the volatility and rapid increases of 2023 and 2024, it's natural to seek clarity. As experts in the Spanish real estate market, we must be clear: no one can predict the exact figure. Financing involves significant financial decisions, and a "forecast" should be an analysis of factors, not a crystal ball.

The key to understanding Spanish interest rates is not in Madrid, but in Frankfurt, at the headquarters of the European Central Bank (ECB). Mortgage rates in Spain (fixed or variable) are directly linked to the Euribor index, which itself follows the ECB's decisions on inflation. This article analyzes the probable scenarios for 2026 and their concrete impact on your borrowing capacity as a non-resident buyer.

Euribor: The True Driver of Spanish Rates

Forget everything else: if you want to know the future of Spanish interest rates, you must monitor the 12-month Euribor. This is the benchmark index upon which almost all Spanish banks (Santander, CaixaBank, BBVA, Sabadell...) base their loan offers, especially variable rates.

Euribor represents the rate at which European banks lend money to each other. It is directly correlated with the ECB's key interest rate. The ECB's objective is to maintain inflation in the Eurozone at 2%. The rate hikes of 2023-2024 aimed to curb inflation. Future rate cuts will only occur when the ECB is convinced that this 2% target is sustainably achieved.

Euribor Forecasts and Scenarios for 2026

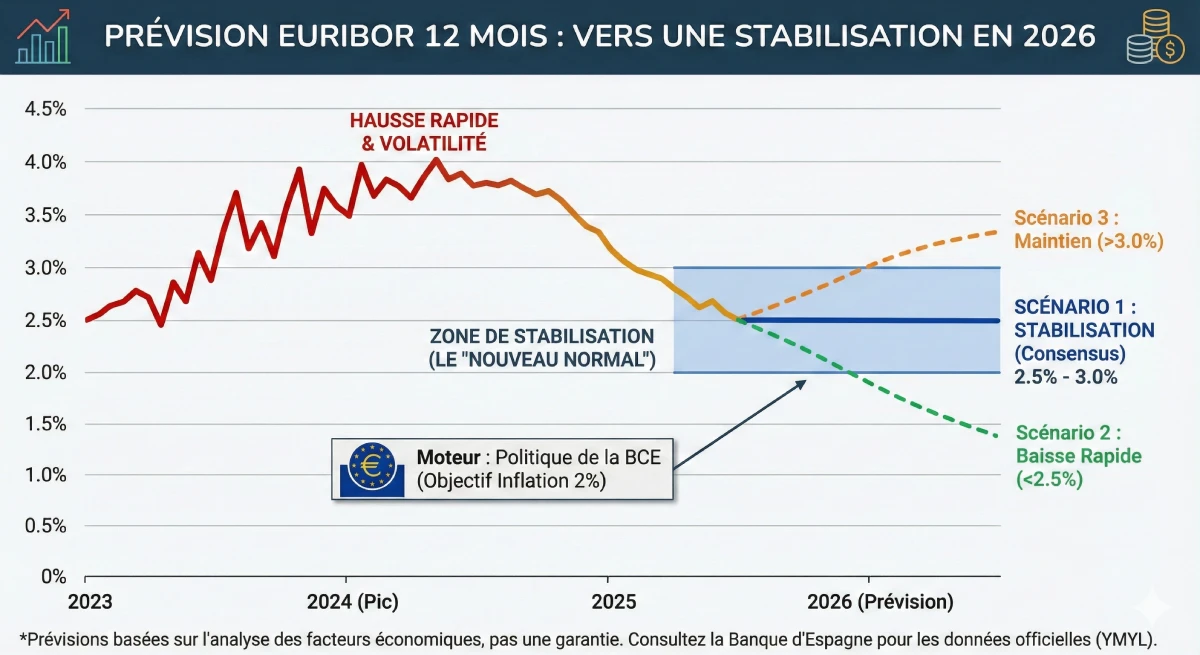

After the 2024 peak, the consensus among analysts (such as those at Bankinter and other financial institutions) points towards normalization and stabilization. The era of 0% interest rates is over. We are entering a "new normal" where rates will settle at a healthier level for the economy.

Here are the three most probable scenarios for the 12-month Euribor in 2026:

- ✅ Scenario 1 (Realistic/Consensus): Stabilization. Inflation is controlled around 2%. The ECB has implemented its rate cuts in 2025. Euribor stabilizes within a healthy range, between 2.5% and 3.0%. Spanish banks offer fixed rates around 3.0% - 3.5%.

- 📉 Scenario 2 (Optimistic): Rapid Decrease. The Eurozone economy slows more than expected. The ECB must cut rates quickly to stimulate growth. Euribor could temporarily fall below 2.5%.

- 📈 Scenario 3 (Pessimistic): Sustained High Rates. Inflation proves persistent ("sticky"). The ECB is forced to keep its key interest rates high for longer. Euribor would then remain above 3.0%, possibly even 3.5%.

Fixed vs. Variable Rates in 2026: The New Choice

In Spain, the choice between a `tipo fijo` (fixed rate) and a `tipo variable` (variable rate) is a real dilemma. A variable rate is calculated as follows: 12M Euribor + Bank Margin (the `diferencial`). If Euribor is at 2.5% and your margin is +0.7%, your rate is 3.2% (revisable annually).

| Rate Type | Main Advantage | Main Risk | Who is it for in 2026? |

|---|---|---|---|

| Fixed Rate (`Fijo`) | Absolute security. Your monthly payment is locked in for the life of the loan, regardless of ECB decisions. | You pay an "insurance premium". If Euribor plummets, you won't benefit. | The cautious non-resident buyer who wants complete visibility on their budget. |

| Variable Rate (`Variable`) | If Scenario 2 (decrease) materializes, your monthly payment will decrease over the years. | Uncertainty. If Scenario 3 (sustained high rates) occurs, your monthly payments will remain high. | The investor or buyer who firmly believes in a sustainable drop in Euribor below 2.5%. |

Expert Advice: The Mixed Rate Loan (`Tipo Mixto`)

The most popular product in Spain right now is the mixed rate loan. The bank offers you a fixed rate for the first 5, 7, or 10 years, then the loan switches to a variable rate (Euribor + margin). It's a good compromise to have security at the start, while betting on a long-term decline in Euribor.

Impact: Your Borrowing Capacity in 2026

An interest rate forecast is only useful if applied to your specific project. The interest rate has a direct impact on your borrowing capacity. Remember that as a non-resident, a Spanish bank will only finance 60% to 70% of the purchase price.

Let's look at the impact of a "stabilized" rate (Scenario 1) on the same monthly payment, compared to the era of zero rates.

| Characteristic | Scenario A (Rate at 1.0%) | Scenario B (Rate at 3.0%) |

|---|---|---|

| Target Monthly Payment | ~€800 | ~€800 |

| Loan Term | 20 years | 20 years |

| Borrowing Capacity (max) | ~ €175,000 | ~ €145,000 |

| Impact | With the same monthly payment, you can borrow €30,000 less with a 3.0% rate than with a 1.0% rate. | |

Official Resource & Disclaimer

All forecasts are, by definition, uncertain. The only fact is the current rate. For official data on interest rates and Euribor, the sole authoritative source is the Bank of Spain (Banco de España).

This article does not constitute financial advice. Consult the official statistics of the Bank of Spain and speak to a qualified financial advisor.

Conclusion

In conclusion, Spanish property interest rate forecasts for 2026 point towards stabilization. The era of 0% rates is over. The most probable scenario is Euribor maintaining within a range of 2.5% to 3.0%, allowing banks to offer fixed rates around 3.0% to 3.5%.

For a non-resident buyer, this means that borrowing capacity remains lower than a few years ago. The key to your project in 2026 will be to have a **strong personal down payment** (at least 40-50% of the total price, including fees) and to aggressively compare bank offers, looking beyond the advertised rate (pay attention to insurance and related products, known as `bonificaciones`).

Your Borrowing Capacity in 2026?

Take advantage of market opportunities. Let's discuss your project.

FAQ: Spanish Mortgage Rate Forecast 2026

Further questions about Euribor, the ECB, and the impact of rate changes on your borrowing capacity in 2026.

YMYL (Your Money Your Life) Disclaimer (E-E-A-T)

These forecasts and analyses are based on our expertise (E-E-A-T) and current market consensus. Real estate financing is a YMYL (Your Money Your Life) topic that carries risks and depends on your personal situation. This article does not constitute financial advice. We recommend that you consult a qualified financial advisor or mortgage broker for a personalised analysis.

The most probable scenario (analyst consensus) is stabilisation. The era of 0% rates is over. The 12-month Euribor index, which dictates Spanish rates, is expected to stabilise within a healthy range of 2.5% to 3.0%. Fixed rates offered by banks should be just above this, between 3.0% and 3.5%.

The ECB sets key interest rates for the entire Eurozone to control inflation (targeting 2%). The Euribor (the rate at which banks lend money to each other) closely follows these decisions. As Spanish banks use Euribor as the calculation basis for their loans (especially variable ones), any decision by the ECB in Frankfurt has a direct impact on your monthly mortgage payment in Alicante or Marbella.

Euribor (Euro Interbank Offered Rate) is the "cost of money" for banks. If the bank lends to you at a variable rate, it will charge you: [12M Euribor Rate] + [Its fixed commercial margin]. For example, if Euribor is 2.7% and the bank's margin is 0.8%, your interest rate will be 3.5%. This rate is revised annually based on the new Euribor.

A fixed rate is an "insurance" you pay to the bank. The bank bets that the average Euribor will be below 3.3% over the term of your loan. You therefore pay a premium (the 0.5% difference) for the security and peace of mind of knowing that your monthly payment will never change, even if Euribor rises to 4% or 5%.

There is no "best" choice; it all depends on your risk profile (YMYL):

- ✅ Fixed: For cautious buyers (especially non-residents) who want total budget security.

- ✅ Variable: For investors who anticipate a fall in rates below 2.5% and can afford a rise in monthly payments if their bet fails.

- ✅ Hybrid: The right compromise. You benefit from a secure fixed rate for 5 or 10 years, then switch to a variable rate, betting that Euribor will be low at that time.

It's a risk/reward calculation. If you wait, rates might be slightly lower (for example, Euribor at 2.7% instead of 3.0%). However, if buyer demand picks up due to this drop, property prices could increase, negating any gain from the lower rate. Many experts consider rate stabilisation a good time to buy, as it offers clarity.

Yes, it is the most critical impact. As the article shows, for the same monthly payment of €800 over 20 years, a rate of 3.0% allows you to borrow €30,000 less than a rate of 1.0%. Your borrowing capacity is directly reduced by rising rates.

Yes. Euribor is the same for everyone. The difference for a non-resident is not the base rate, but:

- The bank's margin (diferencial), which may be slightly higher.

- The loan-to-value (LTV), which is capped at 60-70% (compared to 80% for a resident).

No. A pre-approval ("pre-aprobación") is simply a non-binding solvency study. The firm and definitive loan offer, the FEIN (Ficha Europea de Información Normalizada - European Standardised Information Sheet), is only issued once you have a specific property (with an appraisal/valuation). This offer has a very short validity period (a few weeks), so you cannot "lock in" a rate for a year.

Financially, you will pay more than if you had opted for a variable rate. However, you are not "losing out" because you have bought peace of mind. You can also (depending on your contract) attempt to renegotiate your mortgage (subrogación, i.e., transferring your mortgage) with another bank to get a better rate, but this incurs fees.

Almost always. To give you the promotional fixed rate (e.g., 3.0%), the bank "incentivises" you in exchange for subscribing to its products: life insurance (seguro de vida), home insurance (seguro de hogar), direct debiting of income (nómina). If you refuse these products, the "normal" (non-incentivised) rate will be much higher (e.g., 4.0%).

Yes, retirees are often considered excellent profiles because they have stable and guaranteed income (their pension). The only limit is age: most banks require the loan to be fully repaid before the age of 75. If you are 65, you will get a loan for a maximum of 10 years.

As a non-resident, you should favour banks that have specialised departments for non-residents, such as Sabadell or Bankinter. Large banks like Santander are excellent, but their local branches are often not well-trained to handle complex non-resident applications. An expert mortgage broker will know which bank to target.

Spanish banks are generally stricter than banks in the UK/US. They apply a rule of 30% to 35% maximum of your net income. They will take into account *all* your liabilities, including rent or loans you have in your home country.

Yes. While it's not 0%, it's a sign of a healthy and stabilised market. Rates around 3% are historically normal and sustainable. The end of 2023-2024 volatility is the best news for buyers, as it brings the necessary visibility to calmly plan a YMYL project like a property purchase.