GUIDE: How Spanish Banks Calculate Your Borrowing Capacity (Debt-to-Income & Property Valuation)

Introduction

It's the most crucial question for any property purchase project: how much can I borrow? However, when it comes to buying in Spain, the calculation is fundamentally different from what you might be familiar with in your home country. The "borrowing capital" doesn't depend on what you wish to buy, but rather on what the Spanish bank is willing to lend you based on two key pillars: the property's value and your income.

The golden rule for a non-resident buyer is to understand that the borrowed capital will be the lowest amount between two calculations: 1) The financing limit based on the property's valuation (the "tasación") and 2) The limit of your debt-to-income capacity (the "tasa de esfuerzo"). This guide explains step-by-step how Spanish banks (Sabadell, CaixaBank, BBVA...) calculate this amount.

Pillar 1: The Property Value Limit (LTV & Tasación)

For a non-tax resident in Spain, banks will never finance 100% of your purchase. The maximum financing (Loan-to-Value or LTV) is capped at 60% or 70%. But 70% of what? This is where the trap lies.

Spanish banks base their calculation on the lower amount between the sale price and the "Tasación" (the official property valuation carried out by an expert mandated by the bank). The borrowed capital can never exceed 70% of this figure.

The Tasación Trap

This is the most common mistake. You might think you're buying a property for €300,000 and expect a loan of €210,000 (70%). However, if the expert values the property (tasación) at €280,000, the bank will only lend you 70% of €280,000.

| Scenario | Sale Price | Tasación Value | Calculation Basis (Lower of the two) | Loan Amount (70%) |

|---|---|---|---|---|

| Favorable Case | €300,000 | €310,000 | €300,000 | €210,000 |

| Trap Case (Frequent) | €300,000 | €280,000 | €280,000 | €196,000 |

In the trap scenario, your personal contribution must increase by €14,000 (€210,000 - €196,000) to cover the difference. Your maximum borrowing capital is therefore €196,000.

Pillar 2: The Income Limit (Tasa de Esfuerzo - Debt-to-Income Ratio)

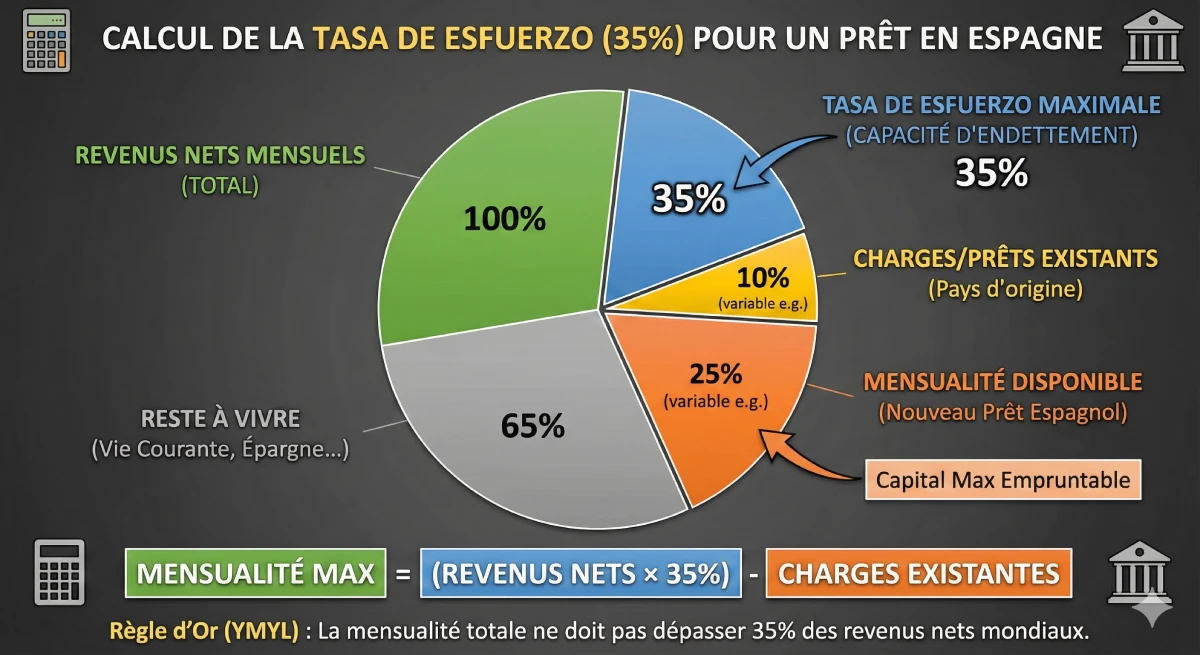

The second calculation is for your repayment capacity. Spanish banks are strict and apply a debt-to-income ratio, the "Tasa de Esfuerzo", which should not exceed 30% to 35% of your net monthly income.

This calculation includes all your global debts: your new Spanish loan + your existing mortgages, personal loans, or car loans in your home country + any alimony payments.

How Banks Analyze Your Income

The Spanish bank will examine your stable net income. They will pay close attention to:

- ✅ Salaried Employees: Permanent employment contract, last 3 payslips, latest tax assessment notice.

- ✅ Self-Employed: Your last 2 or 3 balance sheets, income statements, and professional bank statements.

- ✅ Retirees: Your pension certificates. This is a highly valued profile due to its stability.

The bank will request proof of your current credits (e.g., from your national credit registry or similar credit reporting agencies).

Concrete Example: Calculating Borrowing Capital

Let's take a concrete example to calculate the maximum capital a non-resident couple can borrow.

| Borrower Profile (Example) | |

|---|---|

| Net Monthly Income (Couple) | €6,000 |

| Monthly Liabilities (Car loan in home country) | €400 |

| Max Debt-to-Income Ratio (35%) | €6,000 x 0.35 = €2,100 |

| Available Monthly Payment for Spain | €2,100 (Max Total) - €400 (Existing Liability) = €1,700 |

The Result: Your Maximum Borrowing Capital

With a maximum monthly payment of €1,700, and based on a 20-year loan (max duration for non-residents) at a fixed rate of 3.5%:

Your maximum borrowing capital is approximately €290,000.

Conclusion: The Real Figure to Remember

In this example, the couple can borrow €290,000 (based on their income). They must therefore look for a property where 70% of the valuation (Tasación) is equal to or less than €290,000. This corresponds to a maximum purchase price of approximately €414,000.

To purchase this property for €414,000, they will need:

- Down Payment for the property: €414,000 - €290,000 = €124,000

- Fees (Transfer Tax, Notary, ~12%): ~ €49,680

- Total Savings Required: ~ €173,680

For official information on loans, consult the portal of the Bank of Spain (Banco de España).

Conclusion

To calculate the capital you can borrow in Spain, you should not start with the property price, but with your income. The first step is to calculate your maximum available monthly payment (35% of your net income minus your outstanding credits). This monthly payment, converted into capital (over a maximum of 20 years), gives you the maximum amount the bank will lend you.

Next, you must ensure that this capital does not exceed 70% of the appraisal value (tasación) of the property you are targeting. The key to a successful project in Spain is to have a substantial personal contribution, covering 30% of the price and an additional 10-15% for fees.

Need to validate your budget?

Take advantage of market opportunities. Let's discuss your project.

FAQ: Spanish Mortgages – Your Borrowing Capacity Explained

Our experts at Voguimmo demystify Spanish bank calculations for non-resident investors, covering the crucial 'Tasación' valuation and the debt-to-income ratio pitfalls.

The capital the Spanish bank will lend you will always be the lowest amount between two distinct calculations:

-

The financing limit based on the property's value (the "Tasación").

-

The limit of your repayment capacity (your "Tasa de Esfuerzo" or debt-to-income ratio).

As a non-tax resident, UK/US investors can typically expect a maximum Loan-to-Value (LTV) capped at 60% or 70% of the property's value. Spanish banks never finance 100% of a purchase for a non-resident.

The "Tasación" is the official valuation (appraisal) of the property, carried out by an independent expert mandated by the bank. It is crucial because the bank uses this value (and not the sale price) as the basis for its mortgage calculation.

No, and this is the main pitfall for international buyers. The 70% loan is calculated on the lowest amount between the sale price and the "Tasación" value.

The bank will reduce the amount of your mortgage.

-

Example: You are buying a property for €300,000.

-

You expect a mortgage of €210,000 (70%).

-

However, the expert values the property ("Tasación") at €280,000.

-

The bank will only lend you 70% of €280,000, which is €196,000. Your personal down payment will therefore need to increase by €14,000 to cover the difference.

This is the debt-to-income ratio (DTI) or repayment capacity that Spanish banks apply to assess your financial profile.

Spanish banks typically require that your debt-to-income ratio ("Tasa de Esfuerzo") does not exceed 30% to 35% of your net monthly income.

Yes, absolutely. The calculation of the debt-to-income ratio includes your future Spanish mortgage payment PLUS all your existing global debts (e.g., mortgages, car loans, personal loans, alimony payments in your home country).

You must take 35% of your net monthly income, then subtract all your existing credit charges.

-

Example: If you earn €6,000 net/month, your maximum debt capacity is €2,100 (35%). If you already have a €400 car loan in your home country, your available monthly payment for Spain is €1,700 (€2,100 - €400).

Banks look for stable net income. Retirees (thanks to their guaranteed pensions) are a highly appreciated profile. Employees on permanent contracts and self-employed individuals (with 2 or 3 years of solid financial statements) are also considered strong profiles.

For non-residents, the maximum mortgage repayment period is generally 20 years.

No. This €300,000 capital (calculated based on your income) must also comply with rule #1: it must not exceed 70% of the property's valuation. Furthermore, you must pay your down payment (30%) and associated purchase costs (12-14%) with your personal savings.

This is the most important conclusion for international investors. You must have sufficient personal savings to cover two things:

-

The portion not financed by the bank (the 30% of the purchase price).

-

All associated purchase costs (e.g., transfer tax (ITP), notary fees, solicitor's fees, Land Registry fees, Stamp Duty, etc.) which represent approximately 12% to 14% of the price.

Exactly. For a purchase as a non-resident, the total personal capital required (down payment plus fees) is typically between 40% and 45% of the sale price (30% down payment + 12-14% purchase costs).

Voguimmo works with leading Spanish banks such as Sabadell, CaixaBank, and BBVA, which have dedicated departments experienced in dealing with international clients and non-resident mortgage applications.