Spanish Mortgage Repaid? 4 Key Steps to Cancel the Charge at the Property Registry

Introduction

Congratulations! You've made your final mortgage payment – a major milestone. After years of effort, you have finally finished paying your Spanish mortgage. Your first reaction is celebration, but your second should be an administrative question: "What now?". This is a crucial financial decision, as a common misconception persists.

Contrary to popular belief, the bank will not remove the mortgage on its own initiative. Your loan is "financially settled," but it is not "legally cancelled" at the Property Registry (Registro de la Propiedad). Your property still appears to be burdened by debt on the Nota Simple. As experts in the Spanish market, we guide you through the essential procedure: the "cancelación registral de la hipoteca" (mortgage cancellation at the registry).

Why is it vital to cancel the mortgage at the Registry?

Even if the debt is zero, the mortgage "charge" (la carga) remains registered at the Property Registry (Registro de la Propiedad). This registration does not disappear automatically over time (except after 21 years, and under complex conditions).

This situation is problematic for two main reasons:

- Blocked Resale: No buyer will agree to sign a deed of sale for a property that still shows an active mortgage on the Nota Simple. The buyer will demand that the property be sold "libre de cargas" (free of encumbrances).

- Inability to Secure New Loans: If you wish to apply for a new loan using this property as collateral (for example, for renovations), the bank will refuse, as the old mortgage still has priority.

The cancellation of the mortgage, also known as "levantamiento de la carga" (lifting of the charge), is therefore an administrative step that you must initiate for your property to be legally "clean" and free from any encumbrance.

The 4-Step Process to Cancel Your Mortgage

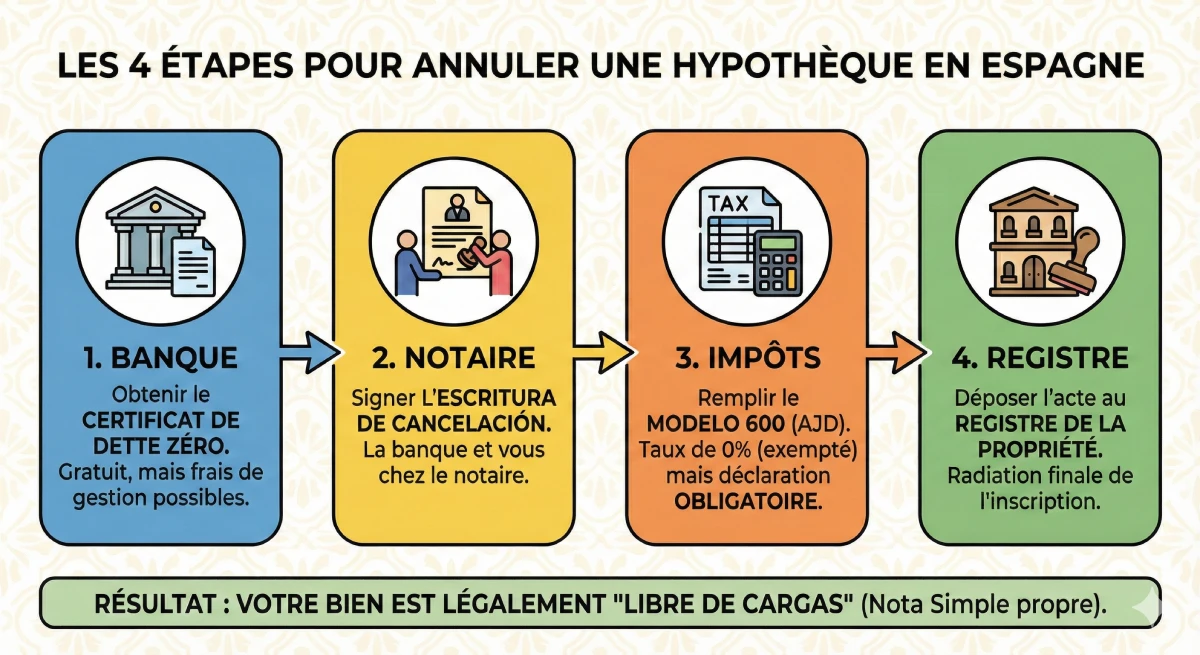

Cancelling a mortgage in Spain is a formal process involving the bank, a notary, and the Property Registry. Here are the 4 essential steps.

- Obtain the "Certificado de Deuda Cero" (Zero Debt Certificate)

The first step is to contact your bank to request this official document. It certifies that the mortgage loan (loan number "préstamo") has been fully repaid. By law, the bank must provide you with this certificate free of charge. - Sign the "Escritura de Cancelación" (Deed of Cancellation) at the Notary

You must then make an appointment with a notary of your choice (it does not have to be the original notary from the purchase). A representative (apoderado) from your bank must be present to sign the Deed of Mortgage Cancellation (Escritura de Cancelación de Hipoteca), confirming that the bank agrees to lift the charge. - Complete the Tax Form (AJD - Modelo 600)

Mortgage cancellation is subject to the Impuesto de Actos Jurídicos Documentados (AJD) (Stamp Duty). The good news is that this act is tax-exempt (the rate is 0%). However, even if there is nothing to pay, you have a legal obligation to present the declaration (Modelo 600) to the tax office (Hacienda) of your Autonomous Community. - File the Deed at the Property Registry (Registro)

Once you have the notarized deed and proof of tax declaration (Modelo 600), you must submit everything to the Property Registry where your property is registered. The registrar will examine the documents and, after a few weeks, proceed with the physical cancellation of the mortgage entry. Your Nota Simple will then finally be "clean."

Cost Analysis: How Much Does Cancellation Cost?

Although you have finished paying your loan, this final administrative step is not free. It is crucial to anticipate these fees to finalize your property project.

| Expense Item | Description | Estimated Cost |

|---|---|---|

| Bank Fees | The "Certificado de Deuda Cero" is free. However, the bank may charge for the travel of its representative (apoderado) to the notary's office. | €0 to €250 (highly variable) |

| Notary Fees (Notaría) | For drafting and signing the cancellation deed. Fees (aranceles) are state-regulated and depend on the initial mortgage amount. | €150 - €300 |

| Registry Fees (Registro) | For the registration of the cancellation and the removal of the charge. These fees are also regulated. | €100 - €250 |

| Tax (AJD) | The declaration (Modelo 600) is mandatory, but the amount payable is zero. | €0 |

Expert Advice on Bank Fees

This is the main point of contention. The Banco de España (the Spanish central bank) stipulates that the zero-debt certificate is free. However, the bank can legally charge "management fees" or "travel expenses" for sending its representative to sign at the notary's office. Negotiate these fees or compare with the services of an independent "gestoría" (administrative agency), which is often faster and sometimes cheaper than the gestoría offered by the bank itself.

DIY or Mandate a "Gestoría" (Administrative Agency)?

You have two options for completing these 4 steps: doing it yourself or delegating. Your choice will depend on your time, your proficiency in Spanish, and the administrative complexity.

| Method | Advantages | Disadvantages | Cost (in addition to fees) |

|---|---|---|---|

| Do It Yourself (DIY) | Economical (you only pay notary and registry fees). | Complex and time-consuming. Requires proficiency in Spanish, coordinating the appointment with the bank, completing Modelo 600, and managing back-and-forth with the Registry. | €0 |

| Mandate a "Gestoría" (Administrative Agency) | Simple and quick. The "gestor" (administrative advisor) handles everything for you, from making appointments to retrieving the final deed. | Additional cost. This is the convenience solution. | €300 - €600 |

Official Resource

To carry out your procedures, you will need to locate the competent Property Registry (Registro de la Propiedad) office for your property. You can find the competent office on the official portal of Spanish registrars.

Conclusion

Congratulations on fully repaying your mortgage in Spain. This is a major financial accomplishment. However, to truly finalize your project and become the owner of a property "libre de cargas" (free of encumbrances), the cancellation of the mortgage at the Property Registry is an indispensable administrative step.

While not legally mandatory if you retain the property for life, it is commercially essential for any future resale or new financing application. By anticipating the costs (approximately €300 to €800) and choosing between doing it yourself or mandating a gestoría (administrative agency), you secure the legal value of your Spanish asset.

Is your mortgage repaid?

Take advantage of market opportunities. Let's discuss your project.

FAQ: I've finished paying my mortgage, how do I cancel the mortgage in Spain?

All the steps and costs (Notary, Land Registry, AJD tax) to achieve 'cancelación registral' and an 'unencumbered' property.

No. This is the most common misconception. While your loan is 'financially settled', the mortgage registration (the 'carga' or charge) remains visible in the Land Registry.

The bank has no legal obligation to initiate this process. It is the property owner's (your) responsibility to request the administrative cancellation (the 'cancelación registral') to clear the legal status of your property title.

It's not illegal, but it's highly problematic if you wish to sell or apply for a new loan. Your property will not be considered 'libre de cargas' (unencumbered or free of charges).

-

- Sale Blockage: The Nota Simple (an extract from the Land Registry) will still show a debt. No buyer or notary/solicitor will agree to sign the sale until this charge is lifted.

- Inability to obtain new loans: If you want to remortgage your property for another project, the bank will refuse because the old mortgage still holds legal priority.

It is referred to as the "cancelación registral de la hipoteca" (cancellation of the mortgage at the Land Registry) or the "levantamiento de la carga" (the lifting of the charge).

You must contact your bank (the one that granted you the loan) and request the "Certificado de Deuda Cero" (Zero Debt Certificate).

No. The Banco de España (Spain's Central Bank) stipulates that the issuance of this certificate is completely free of charge for the client.

You must make an appointment with the Notary Public (Notaría) of your choice to sign the official cancellation deed, known as the "Escritura de Cancelación de Hipoteca" (Deed of Mortgage Cancellation).

Yes. An official representative of the bank (an apoderado or legal proxy) must be present to sign the deed with you, attesting that the bank renounces its mortgage security.

Yes and no. The deed is subject to the Tax on Documented Legal Acts (AJD), which is similar to a type of Stamp Duty, but it is exempt from payment. The rate is 0%.

Even if the cost is zero, submitting the tax declaration (the Modelo 600 form) to your regional tax office (Hacienda) is a mandatory administrative step before proceeding to the final stage.

Once you have the notarized deed and proof of the AJD declaration, you must submit the entire file to the Land Registry (Registro de la Propiedad) for the registrar to physically remove the mortgage entry.

The tax (AJD) is €0, and the certificate (Deuda Cero) is free, but you will have to pay:

-

Notary fees (for the deed): Approximately €150 - €300.

-

Land Registry fees (for registration): Approximately €100 - €250.

The bank cannot charge for the certificate, but it almost always charges for the travel costs of its representative (apoderado or legal proxy) to the notary for the signing. These fees can range from €0 to €250.

A Gestoría is an administrative consultancy firm that can manage this entire process for you: contacting the bank, scheduling the notary appointment, coordinating the bank's representative, completing the Modelo 600, and submitting to the Land Registry. It's a convenient solution if you don't speak Spanish or lack the time, but they charge their own fees (approximately €300 - €600) in addition to the notary and Land Registry costs.