Spanish Mortgage for Retirees with Low Income: 4 Tailored Solutions

Introduction

Retiring in sunny Spain is a dream for thousands. However, this life project, which involves both real estate and finance, often encounters a major obstacle: access to credit. Obtaining a mortgage in Spain as a retiree, especially with what are considered "low" or "modest" incomes, can seem like an uphill battle.

As experts in non-resident financing, we must be transparent: Spanish banks are cautious. They appreciate the stability of retirement pensions, but they apply strict rules regarding age and debt-to-income ratios. Fortunately, solutions exist. It's not about seeking a "classic" loan, but about finding a tailored solution adapted to your senior profile.

The Two Main Hurdles: Age at Loan Maturity and Debt-to-Income Ratio

For a Spanish bank, the "retiree" profile presents two major challenges that determine borrowing capacity, far more than the pension amount itself.

| Key Hurdle | Spanish Banking Rule | Concrete Impact on Retiree |

|---|---|---|

| 1. Age at Loan Maturity | Spanish banks require the loan to be fully repaid before the age of 75 (sometimes 80, but this is rare). | A 68-year-old retiree will only be able to borrow over a maximum of 7 years. Such a short term drastically increases the monthly payment. |

| 2. Debt-to-Income Ratio | The "Tasa de Esfuerzo" (debt-to-income ratio) must not exceed 30% to 35% of net income (pensions, rental income...). | With a "low pension" (e.g., €1,800/month), the maximum monthly payment cannot exceed ~€630, severely limiting the amount that can be borrowed. |

The real problem is the 'scissor effect': age forces you to repay over a short period, which increases the monthly payment, while your income limits you to a low monthly payment.

How Spanish Banks Analyze "Low Incomes"

Our expertise shows that Spanish banks (such as CaixaBank, Sabadell, BBVA) have a positive view of the stability of pensions. A retiree is often seen as a more reliable client than a young person on a temporary contract. The bank will analyze all your net and stable incomes:

- Retirement pensions (from France, Belgium, Switzerland, etc.).

- Rental income (if proven by tax declarations).

- Disability pensions (if they are lifelong and stable).

However, borrower's insurance (seguro de vida) will be a major cost. The older you are, the more expensive it is, and this cost is included in the debt-to-income ratio calculation, further reducing your borrowing capacity.

Tailored Financing Solutions for Retirees

Given these constraints, "tailored" solutions for retirees with modest incomes aim less at securing a large loan than at structuring the purchase differently.

Solution 1: The Substantial Down Payment

This is the most realistic and straightforward solution. If your income doesn't allow for a classic loan, the bank will be much more flexible if you only request a small capital amount. For non-residents, banks typically require a minimum down payment of 30% (+ 10-15% for fees). For a retiree with a modest income, the key is to aim for a down payment of 50% to 70%.

Concrete Example:

For a property costing €150,000. If you provide €75,000 (50%), you only request a loan of €75,000. Over 10 years (up to age 75), this represents a manageable monthly payment (approximately €700), which can align with your debt-to-income ratio.

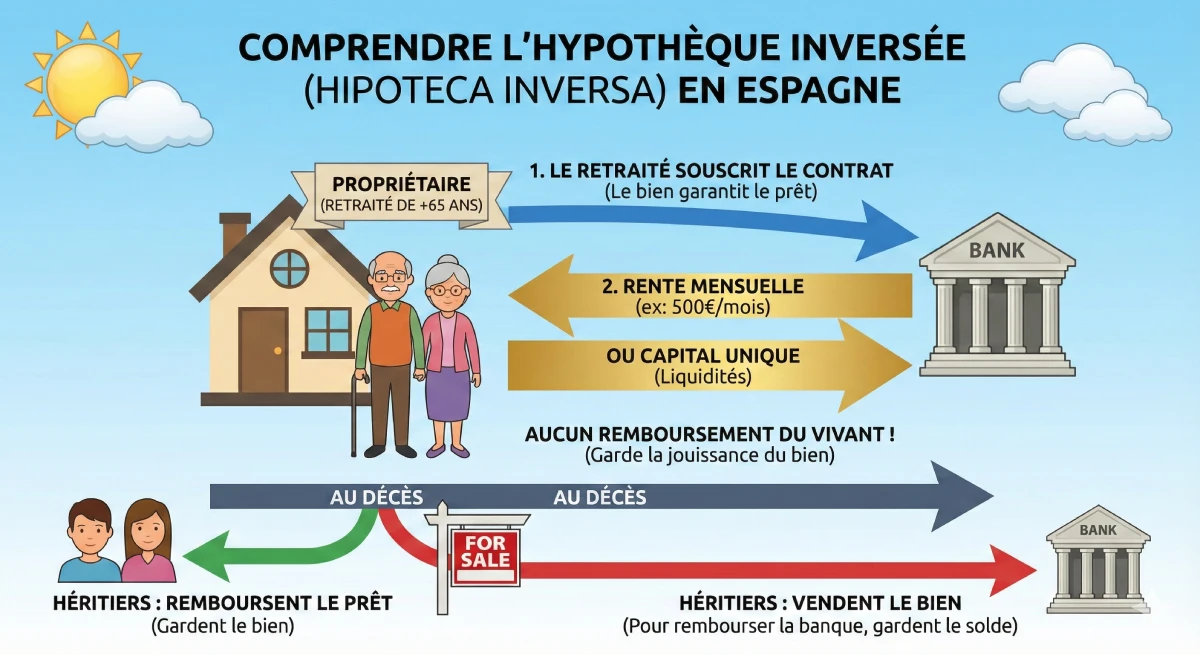

Solution 2: The Reverse Mortgage ('Hipoteca Inversa')

Please note: This solution is not for new buyers, but for retirees who already own property in Spain and need liquidity. It's a powerful tool to supplement a modest pension.

The principle: The bank pays you a monthly annuity (or a lump sum) by taking out a mortgage on your property. You do not repay anything during your lifetime. Upon your death, your heirs have the choice: either they repay the loan to keep the house, or the bank sells the property to recover its funds.

Solution 3: Life Annuity ('Nuda Propiedad' or 'Renta Vitalicia')

Rather than a loan, this is a purchase modality. You buy the "bare ownership" (nuda propiedad) of a property belonging to another retiree (the usufructuary). You pay an initial "bouquet" (a lump sum much lower than the market price) and sometimes an annuity. You only recover full ownership upon the seller's death. This is a long-term investment strategy, not for immediate enjoyment.

Expert Advice

The Spanish "viager", or "venta con nuda propiedad" (sale with bare ownership), is an excellent solution if your goal is to build wealth at a lower cost for the future, but it does not solve the problem of buying a primary residence to live in immediately.

Solution 4: Add a Guarantor or Co-Borrower

This is often the most effective solution. If your children are creditworthy, they can act as co-borrowers (cotitulares). The bank will then analyze all combined incomes (your pension + their salaries) and take into account the age of the youngest borrower to calculate the loan term. This resolves both the age and income issues.

| Solution | Target Profile | Main Advantage | Major Drawback |

|---|---|---|---|

| Classic Loan + Substantial Down Payment | New retiree (buyer) | Immediate purchase, full ownership. | Requires very significant savings. |

| Reverse Mortgage (Hipoteca Inversa) | Retiree already a homeowner | Generates income (liquidity). | Does not allow buying a new property. |

| Life Annuity (Nuda Propiedad) | Retiree investor (buyer) | Highly discounted purchase price. | No immediate enjoyment of the property. |

| Co-borrower (Child) | New retiree (buyer) | Resolves age and income issues. | Financially involves a third party. |

Official Resource

To understand your rights as a senior borrower and the different mortgage products, the reference source in Spain is the client portal of the Bank of Spain.

Conclusion

Obtaining a mortgage in Spain with a modest pension is a challenge, but not an impossibility. The "classic" 25-year loan is inaccessible, not because of the stability of your income, but due to the 75-year age limit that imposes shorter loan terms.

The key to success lies in the realistic planning of your project: the most viable solution is to maximize your personal down payment (50% or more) to reduce the capital borrowed, or to involve a younger co-borrower. Other solutions, such as reverse mortgages, are excellent tools to supplement your retirement income, but only once you are already a homeowner.

Is Your Retirement Project Financable?

Take advantage of market opportunities. Let's discuss your project.

Article Summary

- Introduction

- The Two Main Hurdles: Age at Loan Maturity and Debt-to-Income Ratio

- How Spanish Banks Analyze "Low Incomes"

- Tailored Financing Solutions for Retirees

- Solution 1: The Substantial Down Payment

- Solution 2: The Reverse Mortgage ('Hipoteca Inversa')

- Solution 3: Life Annuity ('Nuda Propiedad' or 'Renta Vitalicia')

- Solution 4: Add a Guarantor or Co-Borrower

- Conclusion

FAQ: Property Loans for Retirees in Spain

Solutions for buying property with a modest pension: age limits, down payments, and reverse mortgages.

Yes, but it's challenging. Spanish banks appreciate the stability of retirement pensions, but they apply very strict rules regarding the maximum age for loan repayment and the debt-to-income ratio, which complicates access to credit for seniors.

The main obstacle isn't income, but the maximum age for loan repayment. Most Spanish banks require the loan to be fully repaid before the borrower reaches the age of 75 (very rarely 80 years old).

This drastically reduces your loan term. For example, if you are 68 years old, you will only be able to borrow for a maximum of 7 years (75 - 68 = 7). If you are 62, you can borrow for a maximum of 13 years.

The debt-to-income ratio, or "Tasa de Esfuerzo" in Spanish. Your monthly loan payments (including all your current credit obligations, whether from the UK, US, or Spain) must not exceed 30% to 35% of your total net income (pensions, rental income, etc.).

This is the core of the problem:

-

Age (limit at 75 years) forces you into a short loan term.

-

A short term results in a very high monthly payment.

-

Your lower income (limited to 35%) only allows for a low monthly payment. These two conditions contradict each other, making a 'classic' loan impossible.

Yes, absolutely. Banks (such as Sabadell, CaixaBank, BBVA) consider stable pensions from the UK, US, or other EU countries as excellent income, as they are guaranteed. The issue is not the origin of the income, but its amount relative to the loan term.

Yes. Life insurance (seguro de vida) is almost always required. The older you are, the more expensive it becomes. This cost is included in the calculation of your debt-to-income ratio (the 35%), which further reduces your borrowing capacity.

Solution 1: A substantial down payment. If you can only borrow €700 per month over 10 years (totaling €84,000), but the property costs €200,000, you will need to provide a down payment of €116,000 (plus purchase costs). The key is to reduce the loan amount to the absolute minimum.

Solution 4: Add a co-borrower (cotitular). This is the ideal solution. If you (70 years old) borrow with your child (40 years old), the bank will base the loan term on the age of the younger individual (40 years old) (up to 75 years, meaning a 35-year term!).

It solves both problems simultaneously:

-

The age problem: The loan term is extended, which significantly lowers the monthly payment.

-

The income problem: The bank adds your pensions + your child's salaries to calculate the 35% debt-to-income ratio.

No, it's the opposite. A reverse mortgage (Solution 2) is reserved for individuals who already own their property in Spain (without an existing mortgage). It allows you to receive a regular income from the bank in exchange for a mortgage on that property. It's a tool to supplement a modest pension, not to buy property.

You don't make any repayments during your lifetime. Upon your death, your heirs have the choice: either they repay the capital owed to the bank to keep the property, or the bank sells the property to recover its funds.

This is a purchase method (Solution 3), not a loan. You buy the 'bare ownership' (nuda propiedad) of a property from a seller (often another retiree) who retains the 'usufruct' (the right to live in it until their death).

-

Advantage: You purchase the property at a significant discount (often -40% to -60%) because you cannot use it immediately.

-

Disadvantage: This is not a solution if you are looking for a home for your own retirement. You will only take full possession of the property upon the seller's death.

A 'standard' non-resident typically needs to account for approximately 40-45% of the total purchase price as a down payment (30% of the price + 10-15% for purchase costs and taxes like Stamp Duty). For a retiree with a lower income who needs to reduce their monthly payments, it is more realistic to aim for a total down payment of 50% to 70% of the purchase price.