Spanish Mortgage: 50% Debt-to-Income Ratio? Myth or Reality for Investors

Introduction

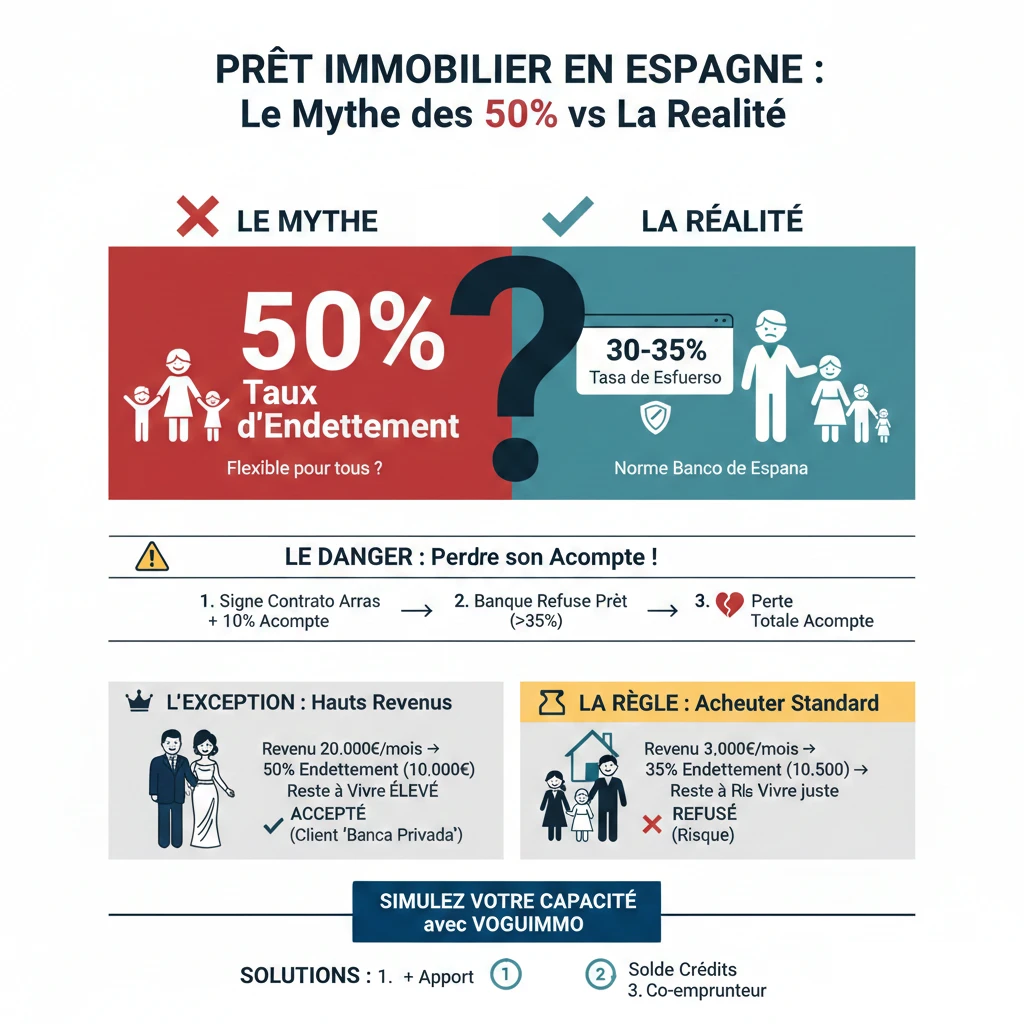

You may have heard that Spanish banks are more "flexible" than those in other countries, and that it's common to secure a mortgage with a 50% debt-to-income (DTI) ratio. While some countries have strict DTI limits (e.g., France's HCSF standard at 35%, including insurance), this supposed flexibility in Spain attracts numerous investors. However, for 99% of buyers, this notion is more myth than reality. This is a critical financial topic that demands your full attention.

As experts in Spanish property financing, we frequently witness buyers taking immense risks based on this misconception. The significant danger? Signing a "Contrato de Arras" (a binding preliminary sales agreement) and paying a 10% deposit, under the false assumption of securing a loan with a 50% DTI. This often leads to financing refusal and the loss of their entire deposit. The truth is, the Spanish lending standard is just as prudent as those in many other developed nations, typically ranging between 30% and 35%.

The Golden Rule in Spain: The 30-35% "Tasa de Esfuerzo"

Forget the 50% myth. The critical figure for any Spanish retail bank (such as Sabadell, CaixaBank, BBVA, or Santander) is your "Tasa de Esfuerzo" (effort rate), which is the Spanish equivalent of a debt-to-income (DTI) ratio.

What is the "Tasa de Esfuerzo"?

This represents the percentage of your net monthly income allocated to servicing all your debts. To safeguard both the financial system and borrowers, the Bank of Spain (Banco de España), as the primary regulatory authority, strongly advises banks not to exceed a threshold of 30% to 35%. This prudent approach is a direct consequence of the lessons learned from the 2008 financial crisis, which significantly impacted Spain.

How Do Spanish Banks Calculate This Ratio?

The calculation is straightforward yet stringent. The bank aggregates all your existing liabilities and divides them by your total stable income.

- Income Considered: Net salaries (from permanent employment, civil servants), retirement pensions (a highly favored profile due to their stability), rental income (typically weighted, where the bank usually accounts for only 70% to 80% of the collected rent).

- Debts Considered: Absolutely ALL your existing global debts. This encompasses any mortgages you hold in other countries (e.g., France or Belgium), car loans, consumer loans, alimony payments, and, critically, the new monthly payment for your prospective Spanish mortgage.

| Borrower Profile | Net Monthly Income | Existing Debts (e.g., in France) | Max Monthly Payment Available for Spain |

|---|---|---|---|

| Couple A | 4 000 € | 500 € (Car Loan) | (4000 € x 0.35) - 500 € = 900 € / month |

| Couple B | 6 000 € | 1 000 € (FR Mortgage Loan) | (6000 € x 0.35) - 1000 € = 1 100 € / month |

Why 50% Is a (Very) Rare Exception, Not the Rule

So, where did this 50% myth originate? It primarily stems from a common confusion between "Retail Banking" and "Private Banking." For the vast majority (99%) of prospective buyers, the 35% rule is consistently applied. The rare 50% exception is reserved exclusively for very high-net-worth individuals, and it’s based on a fundamentally different calculation methodology.

The Bank's True Calculation: "Disposable Income" (El "Sobrante")

More than just a simple debt-to-income percentage, banks are primarily concerned with your "disposable income" (known as "sobrante" or "remanente" in Spanish): specifically, how much capital you have remaining in euros after all your monthly obligations and expenses are met.

Key Expert Insight

A 50% DTI on an income of €3,000 leaves only €1,500 for living expenses. This presents an unacceptably high default risk for the bank.

Conversely, a 50% DTI on an income of €20,000 leaves €10,000 for living expenses. In this scenario, the risk of default is negligible. This is the only situation where a higher debt-to-income ratio might be considered.

The Exception: The "Banca Privada" (Private Banking) Client

If you possess a substantial financial net worth (typically exceeding €500,000 or €1,000,000 in assets), you are no longer considered a retail client but rather a "Banca Privada" (Private Banking) client. The lending criteria for this segment differ significantly. A private bank may be willing to accept a 50% DTI ratio because the credit risk is mitigated not solely by your income, but also by your significant asset base (which can be pledged, or "pignorado," as collateral).

| Client Profile | Net Income / month | Target DTI Ratio | "Disposable Income" | Bank Decision |

|---|---|---|---|---|

| Standard Buyer | 3 500 € | 35% (1 225 €) | 2 275 € | Accepted (if > threshold) |

| Standard Buyer | 3 500 € | 50% (1 750 €) | 1 750 € | Rejected (Disposable income too low) |

| "Banca Privada" Client | 15 000 € | 50% (7 500 €) | 7 500 € | Accepted (High disposable income) |

3 Solutions If Your Debt-to-Income Ratio Exceeds 35%

If your property project necessitates a DTI exceeding the "standard" 35% threshold, there's no need to abandon your plans. Here are three effective solutions we routinely employ with our clients to secure favorable financing.

- Increase Your Down Payment (Aportación): This is often the most straightforward and impactful solution. As a non-resident, it's important to remember that a minimum down payment of 30% of the property price is typically required (as banks usually finance only up to 70%), in addition to approximately 12-14% for associated fees. By increasing your down payment to 40% or 50%, you significantly reduce the amount to be borrowed, thereby lowering your monthly mortgage payment and bringing it comfortably within the 35% DTI threshold.

- Settle Existing Debts: If you have existing loans, such as a car loan or consumer credit in your home country (e.g., France), scheduled to conclude within 1 or 2 years, consider settling them prematurely. This action immediately liberates your borrowing capacity, making more room for your Spanish property project.

- Add a Co-Borrower (Cotitular): If you are purchasing alone and your income is somewhat restrictive, introducing a co-borrower (such as your spouse or an adult child) enables the bank to factor in both incomes. This effectively broadens the income base for the 35% DTI calculation, making your application stronger.

Official Resource

For a comprehensive understanding of official recommendations regarding Spanish mortgages and borrower rights, the most authoritative source is the Bank of Spain's customer portal.

Conclusion

The notion of a 50% debt-to-income (DTI) ratio for a Spanish mortgage is a prevalent myth for the typical property buyer. Attempting to structure your investment project based on this misconception is the quickest route to jeopardizing your 10% deposit. The only dependable rule for securing a mortgage in Spain is adherence to the 30-35% "Tasa de Esfuerzo".

Our extensive experience unequivocally shows that any property purchase project in Spain must commence with a realistic financing simulation. Never commit a deposit before securing a bank pre-approval based on the stringent 30-35% DTI rule. Your investment project must align with your actual repayment capacity, not the other way around.

Is Your Spanish Mortgage Financing Secured?

Take advantage of market opportunities. Let's discuss your project.

Article Summary

- Introduction

- The Golden Rule in Spain: The 30-35% "Tasa de Esfuerzo"

- What is the "Tasa de Esfuerzo"?

- How Do Spanish Banks Calculate This Ratio?

- Why 50% Is a (Very) Rare Exception, Not the Rule

- The Bank's True Calculation: "Disposable Income" (El "Sobrante")

- The Exception: The "Banca Privada" (Private Banking) Client

- 3 Solutions If Your Debt-to-Income Ratio Exceeds 35%

- Conclusion

FAQ: Debt-to-Income Ratio Myths and Realities for UK/US Investors in Spain

Understanding the True 35% Debt-to-Income Rule Before Signing a 'Contrato de Arras'.

No. This is a dangerous myth for 99% of international buyers. Basing your financial project on this false belief is the quickest way to have your loan refused and lose your deposit.

The golden rule is the "Tasa de Esfuerzo" (effort rate/debt-to-income ratio). To protect borrowers, the Bank of Spain (Banco de España) strongly recommends that retail banks do not exceed a threshold of 30% to 35%.

This is the Spanish equivalent of what's commonly known as the debt-to-income (DTI) ratio. It represents the percentage of your net monthly income that you dedicate to repaying all your debts (existing debts + future Spanish mortgage payment).

The danger is signing a "Contrato de Arras" (equivalent to a preliminary sales agreement or deposit contract) and paying the 10% deposit, believing that the financing will be approved. If the bank refuses the loan (because you exceed 35%), you risk losing the entire deposit.

They add up all your monthly financial commitments (including the future Spanish mortgage payment) and divide them by your stable net monthly income.

Yes, absolutely. Banks analyze ALL your global debts: mortgages in the UK, US, or elsewhere, car loans, consumer loans, alimony/maintenance payments, etc.

The bank considers stable income: net salaries (from permanent employment contracts) and retirement pensions. Rental income is generally weighted: the bank will only consider 70% to 80% of the rent you receive.

It stems from a confusion between retail banking (available to all) and "Banca Privada" (private banking). The latter may, in very rare cases, accept a 50% ratio for clients with very high incomes and significant assets.

These are individuals with very high financial net worth, typically over €500,000 or €1,000,000 in financial assets. The bank then uses these assets as collateral, in addition to their income.

This is the most important criterion for the bank, even more so than the percentage. It's the amount in euros you have left after all your monthly expenses are paid. A 50% ratio on an income of €3,000 (leaving €1,500) will likely be refused, whereas a 50% ratio on €20,000 (leaving €10,000) might be accepted.

This article identifies three main solutions:

-

Increase your personal down payment (Aportación) to reduce the borrowed amount.

-

Pay off existing loans (e.g., car loan, consumer credit) to free up borrowing capacity.

-

Add a co-borrower (Cotitular) to increase the combined income considered.

A non-resident must provide a minimum of 30% of the purchase price (as banks typically finance a maximum of 70%) plus approximately 12% to 14% to cover legal fees, taxes (including Stamp Duty where applicable), and processing fees.

Yes, the article states that retirement pensions are considered a "very stable and appreciated profile" by Spanish banks when calculating income.

This is the Spanish equivalent of a preliminary sales agreement or an earnest money contract. It's a private agreement between the buyer and seller where the buyer pays a deposit (often 10%) to 'reserve' the property. It is very difficult to recover this deposit if you withdraw from the purchase.

Expert experience is clear: you should never commit to a deposit (sign a "Contrato de Arras") before you have obtained a realistic pre-approval for financing from a bank, based on the 35% debt-to-income rule.