How to Open a Bank Account in Spain?

Introduction

Opening a bank account in Spain is an essential and often the first concrete step for expatriates, investors, or retirees settling in the country. This process is crucial, impacting many other actions, particularly the signing of a reservation contract (arras) or obtaining a mortgage.

The main distinction is between a non-resident account (cuenta de no residente) and a resident account. As real estate experts (Expertise), we guide you through this critical process to secure your property purchase.

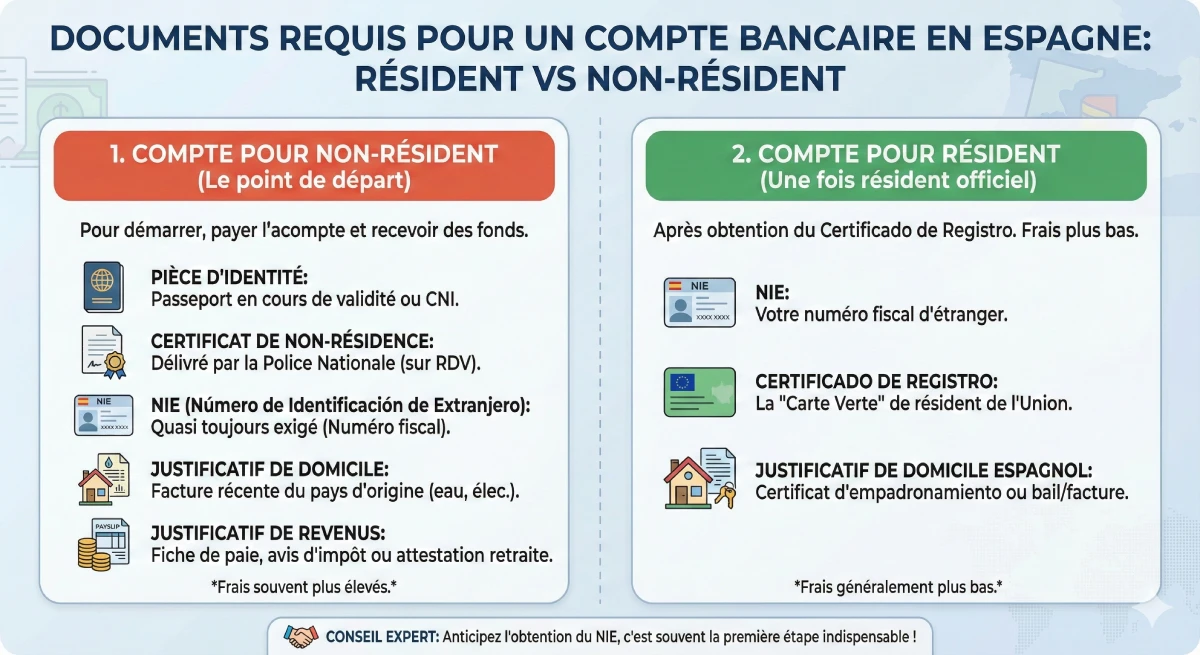

Required Documents: The Key Distinction

The list of documents varies drastically depending on whether you already have Spanish residency (the "green card" or Certificado de Registro) or not. Most property buyers start with a non-resident account.

1. Non-Resident Account (The Starting Point)

This is the account you will open first, essential for paying the deposit on your property and receiving funds from your home country. The required documents are:

- 📄 Proof of Identity: Valid passport (preferred) or national identity card.

- 📄 Non-Resident Certificate: A key document obtained from a National Police station in Spain (by appointment).

- 📄 NIE (Número de Identificación de Extranjero): Although this is a "non-resident" account, 99% of banks require it. This is your foreign tax identification number, essential for property purchases.

- 📄 Proof of Address: A recent utility bill (electricity, phone) from your country of origin.

- 📄 Proof of Income/Activity: Pay slips, tax returns, or a retirement certificate (for anti-money laundering purposes).

- 📄 For non-residents or foreigners without conventional proof of address, the "empadronamiento" can be a recognised way to prove your address in Spain.

2. Resident Account (The Next Step)

Once you have obtained official residency (the Certificado de Registro de la Unión), you must convert your account to a resident account. Fees are generally lower. You will need:

- 📄 Your NIE.

- 📄 Your Certificado de Registro de la Unión (the "green card").

- 📄 Spanish proof of address (your empadronamiento certificate, or a rental contract/utility bill).

How to Choose the Right Bank?

The choice of bank (Trustworthiness) will depend on your profile: do you need a physical branch, a contact in your preferred language, or do you prioritize the low fees of online banks?

| Bank | Advantages (Expat / Buyer Focus) | Key Languages |

|---|---|---|

| Santander | Very extensive national network, robust. | 🇪🇸 🇬🇧 (sometimes 🇫🇷) |

| CaixaBank | "HolaBank" services dedicated to expatriates. | 🇪🇸 🇬🇧 🇫🇷 🇩🇪 |

| BBVA | Excellent mobile application, very modern. | 🇪🇸 🇬🇧 |

| Sabadell | Very accustomed to foreign clients, good bilingual advisors. | 🇪🇸 🇬🇧 🇫🇷 |

| N26 / Revolut | 100% online, easy opening, but not ideal for a property purchase (no bank cheque). | 🇪🇸 🇫🇷 🇬🇧 |

| Type of Fee | What to Check (Experience) |

|---|---|

| Account Maintenance Fees (Resident Account) | Often free if you direct deposit your salary ('nómina') or subscribe to other products (insurance, etc.). |

| Account Fees (Non-Resident) | Crucial Point: These fees are often high (e.g., €30 to €50 per quarter). Negotiate them! |

| SEPA Transfers (in Euros) | Should be free, including within the SEPA zone. |

| Bank Cheque ('Cheque Bancario') | Essential for signing at the notary. Check the cost (sometimes 0.5% of the amount!). |

| Debit/Credit Card | Check annual fees ('mantenimiento de tarjeta'). The debit card is standard. |

Opening Process and Expert Advice

Once the documents are gathered, opening an account at a physical branch is often the simplest for non-residents. Once the file is validated by the compliance department, opening is quick (24 to 72 hours).

Expert Tips for a Property Buyer

- 💡 Anticipate the NIE: Don't wait until you've found a property. Obtaining your NIE is the first step. Without it, no bank will open an account.

- 💡 Contact Person: Choose a bank with customer service in English or other preferred languages (Sabadell, CaixaBank/HolaBank are known for this).

- 💡 Non-Resident Fees: Explicitly ask about the 'comisiones cuenta no residente'. These are often hidden and negotiable.

- 💡 Bank Cheque: Confirm that the bank can issue a certified bank cheque ('cheque bancario') for the signing at the notary and what the associated fees are.

- 💡 Transfers: Check transfer limits, which are essential for transferring your funds for the property purchase.

Good to know: Some Spanish banks refuse remote account opening without a NIE. It's best to visit in person with an appointment ('cita previa') or contact an advisor to validate your application beforehand.

Conclusion

Opening a bank account in Spain is a straightforward process if well-prepared. For a property buyer, it's the cornerstone of all future transactions, demonstrating your commitment and streamlining the entire purchase process.

Ensure you have your NIE before anything else, compare non-resident fees, and choose a bank accustomed to international clients. This will save you a lot of stress during the final signing at the notary. To go further:

Need Help with Your Bank Account in Spain?

Take advantage of market opportunities. Let's discuss your project.

FAQ: Opening a Bank Account in Spain

Our real estate experts answer frequently asked questions about opening a bank account for your property purchase in Spain.

Theoretically, yes, but it is highly inadvisable and complex. You will need a Spanish account to issue the certified bank cheque ('cheque bancario') required by the notary for the final signing. Furthermore, this account will be essential for paying taxes (such as Property Transfer Tax - ITP), notary fees, and setting up direct debits for utilities (water, electricity) and community fees ('comunidad').

Obtaining your NIE is the imperative first step. As mentioned in the article, 99% of banks will refuse to open an account (even a non-resident one) without this tax identification number. The NIE is the cornerstone of all your administrative procedures in Spain.

This is a common confusion:

- The NIE is your tax identification number (a unique number that never changes).

- The Certificate of Non-Residency is an attestation that proves you are not a tax resident in Spain at a given time.

You apply for both at the National Police's Foreigners' Office (Extranjería), and they are often issued at the same time.

This is becoming increasingly difficult due to anti-money laundering (AML) regulations. Some banks (such as Sabadell or CaixaBank/HolaBank) offer this service through specialised branches, but the process is often lengthy. The most simple and quickest option remains to book a prior appointment ('cita previa') and visit a branch in Spain with all your documents (especially your NIE).

These banks are excellent for daily transactions but are completely unsuitable for a property purchase. The main reason is that they cannot issue the 'cheque bancario' (certified bank cheque or banker's draft) which is essential for the final payment at the notary's office. You would find yourself stuck on the day of signing.

This is a major point to be aware of. These fees are often high because you do not have your salary ('nómina') or regular income paid into it. Expect to pay between €30 and €60 per quarter (i.e., €120 to €240 per year) just for account maintenance. This is why you should negotiate and compare them before signing.

No, you do not need to close it. You must inform your bank of your change of status. You will present your 'Certificado de Registro' (the green card) and your empadronamiento certificate (local registration). The bank will convert your 'cuenta de no residente' (non-resident account) into a 'cuenta de residente' (resident account), which will significantly reduce your banking fees.

In Spain, the final payment is made on the day of signing the public deed ('escritura'). The notary requires a certified bank cheque (issued by your Spanish bank) because it is the only way to guarantee the seller that the funds are available and secure. An instant bank transfer is generally not accepted as it does not offer the same immediate legal security.

Yes, systematically. This is a legal obligation (anti-money laundering - AML). You will need to prove the source of the funds for your purchase (tax returns, sale deed of another property, gift certificate, savings statements, etc.). Prepare these documents in advance to avoid delays.

Generally, for simple proofs like tax returns, payslips, or pension statements, banks accustomed to international clients (CaixaBank, Sabadell) will accept them in English. However, for more complex documents (company statutes, notary deeds), a sworn translation ('traducción jurada') may be required.

Yes, it's even recommended. Opening an account first and transferring your down payment to it demonstrates seriousness, which will facilitate the assessment of your loan application. Spanish banks finance non-residents, generally up to 60-70% of the purchase price. This is a complex process for which specialised assistance is very useful.

Generally, no. Most banks do not require a minimum initial deposit for opening an account. However, they will charge you account maintenance fees from the first quarter.

It's a 'salary account'. This is the standard resident account where you have your regular income (salary or pension) paid into it. In Spain, direct debiting ('domiciliación') of your income and bills ('recibos') is key to avoiding account maintenance fees.

Some international banks have partnerships. For example, your UK/US bank might have agreements with Spanish banks for fee-free withdrawals. However, this does not exempt you from opening a 100% Spanish account. A partnership does not provide you with a local account, which is essential for direct debits and transactions with the notary.

A 'gestor' (or 'gestoría') is an administrative and tax advisor, very common in Spain. You do not need one to open a bank account, but they can be very useful for obtaining your NIE or your certificate of non-residency quickly, especially if you do not speak Spanish.