Moving to Spain for Retirement from France: Administrative Steps

Introduction

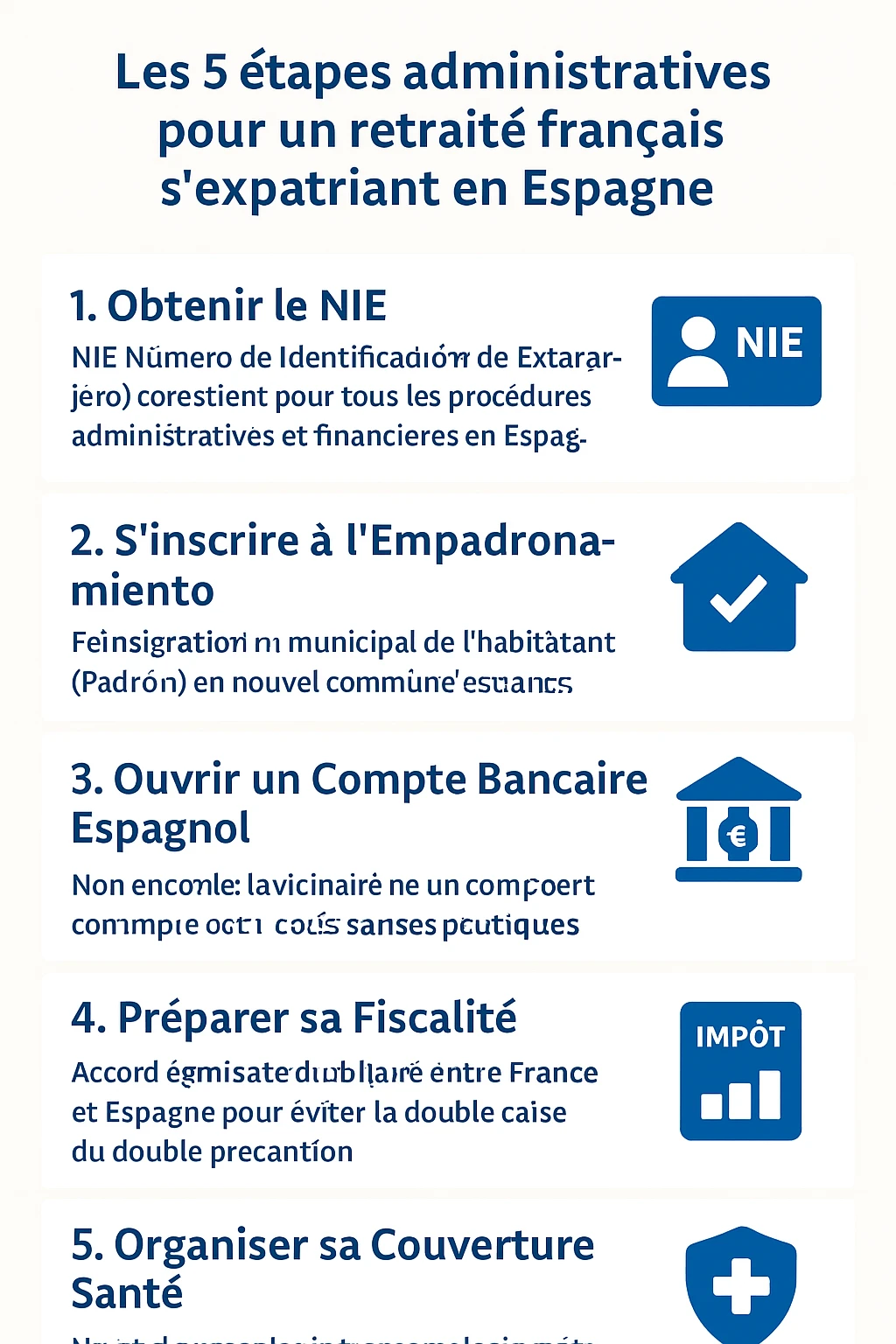

Have you recently retired in France and the Spanish dream is calling your name? ☀️ You're not alone. Enjoying an exceptional climate, an attractive cost of living, and a rich culture is a wonderful project. However, as real estate and expatriation experts, we know that this transition involves significant financial and personal decisions. A successful relocation depends entirely on rigorous administrative preparation.

From the taxation of your pensions to your health coverage, and including the essential documents for your property purchase, leaving nothing to chance is key. This comprehensive guide details the crucial administrative steps to calmly prepare your expatriation as a French retiree to Spain.

The 3 Administrative Pillars for Moving to Spain

Before even thinking about decorating your future apartment in Valencia or Alicante, three administrative documents form the foundation of your new Spanish life.

1. Obtaining the NIE (Número de Identificación de Extranjero)

The NIE is your Foreigner Identification Number. It is absolutely essential for ALL administrative and financial procedures in Spain. Without a NIE, you cannot:

- 🏠 Purchase a property (signing with the notary)

- 🏦 Open a resident bank account

- ✍️ Subscribe to contracts (phone, electricity, water)

- 💶 Pay your taxes

Our expert advice: Apply for it as early as possible, either at a Spanish consulate in France before your departure, or directly in Spain (by appointment, "cita previa") upon your arrival.

2. Registering for the Empadronamiento

The empadronamiento is your registration in the municipal registry of residents (the "Padrón") of your new town of residence. This step is mandatory if you reside in Spain for more than 6 months per year.

This document is crucial as it certifies your status as an effective resident and will be required for:

- ✅ Registering your vehicle (Spanish license plates)

- 🏥 Accessing local health services

- 🗳️ Benefiting from social services or voting in local elections

- 💰 Paying certain local taxes (such as refuse collection tax)

3. Opening a Spanish Bank Account

Although not mandatory, a local bank account greatly simplifies daily management: payment of bills (electricity, water, internet), receipt of certain pensions, and management of property-related taxes. Banks generally require your NIE and proof of address (your empadronamiento certificate or your property's deed of sale).

Taxation for French Retirees in Spain

This is the most complex and crucial aspect of your expatriation. France and Spain have signed a bilateral tax convention to prevent double taxation. The general rule is that your pensions are taxed in your country of residence (Spain), but there is a major exception.

| Pension Type | Place of Taxation (according to the convention) | Comment |

|---|---|---|

| Private Sector Pension (CARSAT, AGIRC-ARRCO) | Spain (Country of Residence) | You must declare these pensions in Spain via income tax (IRPF). |

| Public Sector Pension (Civil Servants, Military) | France (Paying Country) | These pensions remain taxed in France, at the source. You do not re-declare them in Spain. |

You will therefore need to inform the French and Spanish tax authorities of your change of residence to comply with regulations. In Spain, you become a tax resident if you spend more than 183 days a year there.

Healthcare: Social Security and Supplementary Insurance

As a French retiree, you have the right to transfer your health insurance rights to Spain and benefit from the excellent Spanish public healthcare system (Seguridad Social).

The process is simple but must be completed before your departure:

- Request Form S1 (formerly E121) from your French pension fund (CARSAT).

- Once in Spain, present this S1 form to the local Seguridad Social agency (INSS) to obtain your Spanish health card (the "tarjeta sanitaria").

This S1 form certifies that France will cover your healthcare costs, giving you access to medical care in Spain under the same conditions as a local resident.

Expert Tip: The Spanish public system is highly efficient, but subscribing to private supplementary health insurance (mutua) is strongly recommended (cost: 50-100€/month). It allows for faster access to specialists, examinations (MRI, CT scans), and guarantees a private room in case of hospitalization.

Checklist of Other Practical Steps

Once the pillars (NIE, Taxes, Health) are in place, consider the practical details of your move.

| Step | Key Consideration |

|---|---|

| Driving License | Your French pink (cardboard) or card format license is valid. You must register it with the DGT (Dirección General de Tráfico) or exchange it for a Spanish license after 2 years of residence. |

| Vehicle and Registration | If you import your French car, you have 6 months to register it in Spain (Spanish plates). This is a complex process (homologation, ITV/Technical inspection, import tax). |

| Inform French Organizations | Notify your French pension fund, French social security (for the S1 form), your bank, and your mutual health insurance of your change of address. |

| Local Taxes (Property) | As a property owner, you will be liable for IBI (property tax) and non-resident income tax (IRNR) if you are not a tax resident. |

Conclusion

Expatriating to Spain for retirement is a fantastic life project, offering a perfect balance between quality of life and sunshine. The success of this transition relies on meticulous administrative preparation, particularly concerning fiscal aspects (pension taxation) and social aspects (S1 form). By anticipating these steps, you ensure a serene and secure installation to fully enjoy your new life.

Are you planning your retirement in the sun?

Take advantage of market opportunities. Let's discuss your project.

Table of Contents

- Introduction

- The 3 Administrative Pillars for Moving to Spain

- 1. Obtaining the NIE (Número de Identificación de Extranjero)

- 2. Registering for the Empadronamiento

- 3. Opening a Spanish Bank Account

- Taxation for French Retirees in Spain

- Healthcare: Social Security and Supplementary Insurance

- Checklist of Other Practical Steps

- Conclusion

FAQ: Administrative Procedures for UK/US Retirees in Spain

Our experts answer your practical questions for a successful administrative relocation to Spain for UK/US retirees.

This is a common confusion.

- The NIE is simply a tax identification number for foreigners. It is permanent and you need it first.

- The Certificado de Registro de la Unión (green certificate) is your residency certificate in Spain, required if you stay for more than 3 months. For EU citizens, this is the document issued. However, for non-EU citizens (such as most new UK and US arrivals), your official residency document will typically be the Tarjeta de Identidad de Extranjero (TIE card). To obtain either, you must first have a NIE and prove sufficient resources (your pensions) and health insurance (your S1 form or private insurance).

Yes, you can sign a reservation contract (contrato de arras) with just your passport. However, you will imperatively need the NIE for the signing of the final deed of sale (escritura) before a Notary Public. This is why we advise starting the NIE application process as soon as you begin your property purchase project.

Absolutely. The Empadronamiento is the registration in the municipal register of inhabitants, whether you are an owner or a tenant. You will simply need to provide the local town hall (Ayuntamiento) with proof of your domicile, which will most often be your rental agreement (contrato de alquiler) in your name.

Your registration in the register ("Padrón") is permanent as long as you live at that address. However, the paper certificate (volante de empadronamiento) that is issued to you has a validity date, often 3 months, for administrative procedures (such as vehicle registration). You can simply request an updated copy from your town hall (often online) when you need it.

Yes, absolutely. This is a crucial point (YMYL). As a Spanish tax resident, you must declare all your worldwide income to the Spanish tax authorities (Hacienda). Your public pension from the UK/US must be declared. However, under the specific Double Taxation Treaty between Spain and the UK/US, public service pensions are generally taxable only in the country from which they are paid (i.e., the UK or US), not in Spain. While it must be declared, it will typically be exempt from Spanish taxation to avoid double imposition and is usually not taken into account for the calculation of the overall tax rate (IRPF) on your other income. It is essential to consult with a 'gestor' or tax advisor to understand the specifics of your pension and tax situation, as DTTs can be complex.

As a Spanish tax resident, you must declare everything in Spain.

- Rental income from the UK/US: This is generally taxable in the UK/US, but must be declared in Spain (with a tax credit to avoid double taxation).

- Life assurance policies, dividends, capital gains: These are declared and taxed in Spain according to Spanish savings income ("rentas del ahorro") rules.

A consultation with a 'gestor' or tax advisor is essential in your first year.

Yes. If your spouse or civil partner is dependent on you and does not have their own healthcare entitlement (for example, they are not yet retired and not working), they can be registered as your beneficiary ("beneficiario") on your S1. The INSS (Spanish social security) will also issue them a "tarjeta sanitaria" (health card).

The Spanish public system is excellent but, like in the UK/US, it has its limitations. A private 'mutua' gives you access:

- Quickly: Direct access to specialists without needing a GP referral and virtually non-existent waiting lists for examinations (MRI, CT scans).

- Comfort: Guaranteed private room in case of hospitalisation.

- Uncovered care: Excellent coverage for dental and optical care, which are often poorly reimbursed by the public system.

Yes, generally. The rules differ slightly for UK and US citizens:

- For UK Citizens: Your UK driving licence is valid for the first 6 months of your residency in Spain. After this period, you are generally required to exchange it for a Spanish licence. You should contact the DGT (Dirección General de Tráfico) for specific requirements and deadlines, especially considering post-Brexit rules.

- For US Citizens: There is currently no reciprocal agreement for exchanging driving licences between Spain and the United States. This means that after 6 months of residency in Spain, you will generally be required to take a Spanish driving test to obtain a Spanish licence.

We advise starting this process early, as appointments with the DGT can have long waiting times.

Financially, it depends on the age and value of your vehicle. Registration (homologation, specific technical inspection (ITV), and registration tax based on CO2 emissions) can be expensive, sometimes more than 1000€. For a car over 10 years old, it is often simpler and more economical to sell it in the UK/US and buy a used one in Spain.

The IBI (Impuesto sobre Bienes Inmuebles) is the equivalent of the local property tax in the UK/US. It is paid once a year by the owner of the property (as of January 1st). Its amount is set by the local town hall (Ayuntamiento) and depends on the "valeur cadastrale" (valor catastral) of your property.

No. This is one of Spain's significant tax advantages: there is no equivalent to a residential or council tax on your primary residence. You will only pay the IBI (property tax) and the rubbish collection fee (tasa de basuras).

It is strongly advised to keep a bank account in the UK/US, at least for the first year. It will be useful for receiving your pensions (before setting up the transfer to Spain), paying your UK/US taxes (if you have a public pension), and managing any subscriptions. Simply inform your UK/US bank of your "non-resident tax" status.

You will not be immediately covered by the Spanish public health system. While awaiting your S1 (which can take several weeks), it is wise to:

- For UK citizens: Apply for a Global Health Insurance Card (GHIC) from the NHS. This will cover your urgent medical care in Spain.

- For US citizens: Ensure you have comprehensive private travel or health insurance that covers you during this interim period.

For most procedures (NIE, Empadronamiento, bank account), standard documents (passport, rental agreement) are sufficient. However, for more official procedures (recognition of rights, marriage, sometimes vehicle registration), you might need a sworn translation ("traducción jurada") of certain documents (such as a marriage certificate or birth certificate).