Buying Property in Spain: Individual or Company? (The Pitfall of the French SCI vs. the Spanish SL Solution)

Introduction

Purchasing property in Spain is a significant undertaking. A crucial question arises: should you buy as an individual (natural person) or through a company (legal entity)? For many foreign investors, there's a strong temptation to use an existing structure like a French SCI (Société Civile Immobilière) or a SAS. This is a financial and tax decision with serious consequences, and the answer is not what you might expect.

As experts in the Spanish market, we must be clear: using a French SCI to purchase property in Spain is a tax trap. Spain does not recognize the "tax transparency" of the SCI, which leads to double taxation nightmares. This guide compares the two valid methods: purchasing in your own name (the simplest) and purchasing via the *correct* company structure, a **Spanish Sociedad Limitada (SL)**.

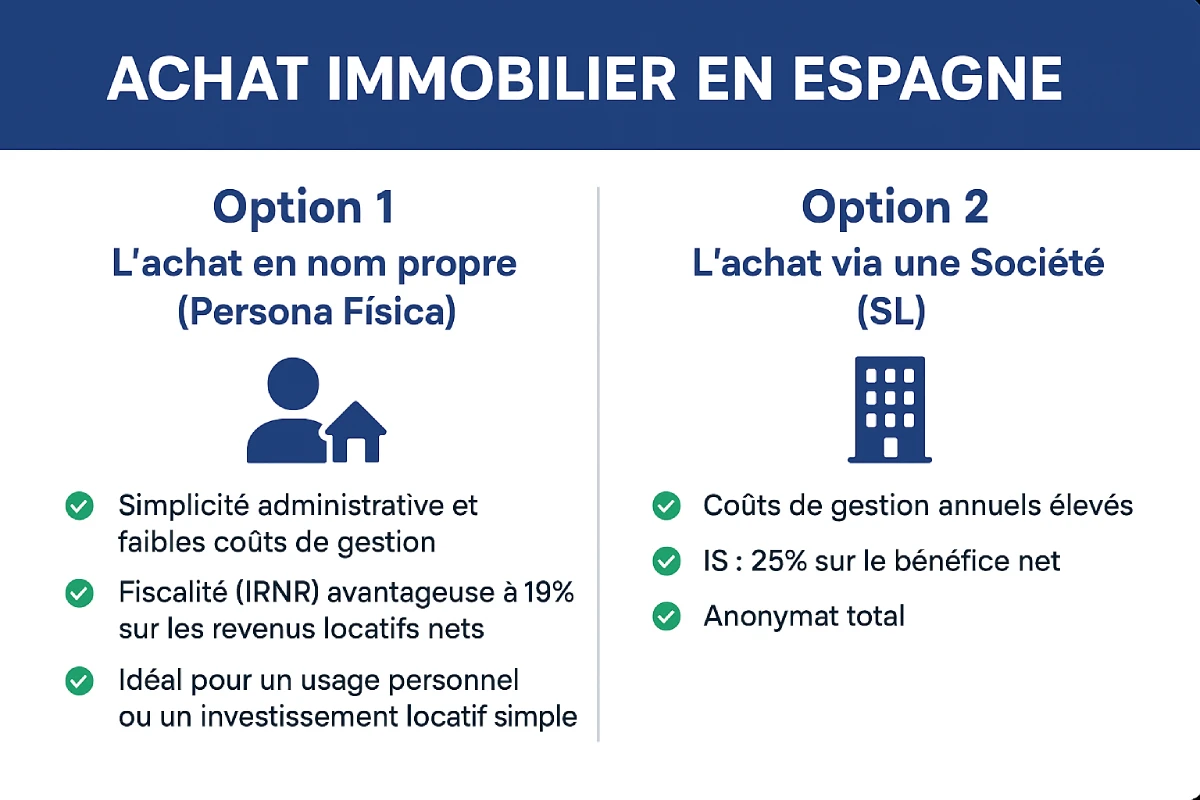

Option 1: Purchasing in Your Own Name (Persona Física)

This is the most straightforward and common method for a non-resident buying a second home or a single rental property. The process is direct: you purchase as an individual.

Key steps include:

- Obtaining your NIE (Número de Identificación de Extranjero), which is your mandatory tax identification number.

- Opening a Spanish bank account.

- Engaging a lawyer (abogado) to verify the legality of the property (via the Nota Simple).

- Signing the deed of sale (escritura) at the notary's office.

Taxation of Individual Purchase (Non-Resident)

Taxation is predictable:

- ✅ Upon Purchase: You pay ITP (Impuesto sobre Transmisiones Patrimoniales - Property Transfer Tax) for a resale property (7% to 10% depending on the region) or IVA (VAT) at 10% for a new build property.

- ✅ Annually: You pay IBI (Impuesto sobre Bienes Inmuebles - Municipal Property Tax) and IRNR (Impuesto sobre la Renta de No Residentes - Non-Resident Income Tax).

- ✅ IRNR (Rental Income): If you rent out the property, you are taxed at 19% (as an EU resident) on the *net* rental income.

- ✅ IRNR (Personal Use): If you do not rent out the property, Spain considers you benefit from a "deemed rental income." You pay 19% on a base of 1.1% to 2% of the cadastral value.

| Advantages (Individual Purchase) | Disadvantages (Individual Purchase) |

|---|---|

| Administrative simplicity and low management costs. | Lack of anonymity (your name is public in the Land Registry). |

| Favorable IRNR taxation at 19% on net rental income. | Transfer / Inheritance subject to Spanish law (high taxes in some regions). |

| Ideal for personal use or a straightforward rental investment. | Difficulty deducting certain expenses (outside of rental). |

Option 2: Purchasing via a Company (The SCI Trap and the SL Solution)

This is where the most costly mistake is made. You might think, "I have an SCI in France, I'll use it to buy."

The Fatal Trap: Buying with a French SCI or SAS

DO NOT DO THIS. Spain does not recognize the "tax transparency" regime of French SCIs. For the Spanish tax authorities, your SCI is not "transparent"; it is an opaque foreign entity.

Consequences:

- ❌ Double Taxation: Your SCI will be taxed in Spain on profits (at the Spanish corporate tax rate or IRNR). Then, when you distribute dividends in your home country, you (the shareholders) will be *again* taxed on the same income.

- ❌ Unsuitable Taxation: You lose the benefit of the 19% IRNR rate for individuals.

- ❌ GEBI: In some cases, a foreign property-holding company could be subject to a Special Tax on Real Estate of Non-Resident Entities (often referred to as GEBI) of 3% on the cadastral value, although international tax treaties might mitigate this.

The Professional Solution: Creating a Spanish Sociedad Limitada (SL)

If you wish to purchase via a company (for anonymity, managing multiple properties, or inheritance optimization), the only viable solution is to create a Spanish legal entity. The most common is the Sociedad Limitada (SL), equivalent to a French SARL/SASU or a UK Limited Company/US LLC.

In this case, the Spanish SL becomes the property owner. You, as an individual, are the shareholder (socio) of this SL.

Comparison: Individual Purchase vs. Company (SL)

So, when should an SL be preferred? This structure is not suitable for a simple second home due to its management costs. It becomes relevant for a large-scale rental investment.

| Criterion | Individual Purchase | Purchase via a Spanish SL (Company) |

|---|---|---|

| Annual Management Costs | Low (IBI + IRNR) | High (Mandatory Accountant/Gestor: ~€1,000 - €2,500/year) |

| Rental Income Tax | IRNR: 19% (for EU residents) on net income. | IS: 25% (Corporate Tax) on net profit. |

| Depreciation & Expenses | Depreciation and deductible expenses (if rented). | All expenses (insurance, accountant, IBI, etc.) are deductible from profit. |

| Anonymity | None (Name public in the Registry). | Complete (The Registry shows the SL's name, not yours). |

| Transfer / Inheritance | Inheritance taxes (regional). | Easier: Shares are transferred (often less taxed). |

| Personal Use | Yes (by paying the "deemed" IRNR). | Not recommended. Making the property available to the shareholder for free is a taxable benefit-in-kind. |

Expert Advice: When is an SL a sensible choice?

We recommend an SL only if you meet these conditions:

- It is a purely rental investment (no personal use).

- You plan to purchase multiple properties (3 or more).

- The asset value is very high and inheritance optimization (transfer of shares) is a major objective.

Official Resource

Non-resident taxation is a complex subject. The only official source is the Spanish tax authority, the Agencia Tributaria.

Conclusion: Individual or Professional, Choose the Right Path

For 90% of international buyers, purchasing in your own name (as an individual) is the simplest, most cost-effective, and safest route for a second home or a single rental investment.

The absolute trap to avoid is using your French SCI or SAS. If your project is a large-scale rental investment, the only viable professional structure is the creation of a Spanish Sociedad Limitada (SL), but its management costs must be justified. In all cases, the assistance of a specialized lawyer (abogado) and tax advisor (gestor) is essential.

Individual or Company: Unsure?

Take advantage of market opportunities. Let's discuss your project.

Article Summary

- Introduction

- Option 1: Purchasing in Your Own Name (Persona Física)

- Taxation of Individual Purchase (Non-Resident)

- Option 2: Purchasing via a Company (The SCI Trap and the SL Solution)

- The Fatal Trap: Buying with a French SCI or SAS

- The Professional Solution: Creating a Spanish Sociedad Limitada (SL)

- Comparison: Individual Purchase vs. Company (SL)

- Conclusion: Individual or Professional, Choose the Right Path

FAQ : Buying Property in Spain: As an Individual or Through a Company?

Our experts answer key questions on purchasing property as an individual, the pitfalls of using a French SCI (Société Civile Immobilière), and the option of a Spanish SL (Sociedad Limitada) for international buyers.

No, it is strongly advised against. Using a French SCI (Société Civile Immobilière) to buy property in Spain is considered a "tax trap." Spain does not recognise the fiscal transparency of the SCI, which leads to severe tax and legal complications for international investors.

The problem is that Spain does not consider the SCI to be 'fiscally transparent'. For the Spanish tax authorities, it is an opaque foreign entity. This means that income (rental profits) will be taxed once in Spain at the SCI level, and then potentially a second time in your home country (e.g., UK or US) when you (the partners/shareholders) receive dividends or distributions. This leads to the nightmare of double taxation.

The simplest and most common method for international buyers is to purchase in your own name (as a persona física, or individual). The process is straightforward, and the taxation is predictable, which is ideal for personal use or a single rental investment.

The fundamental steps are:

-

Obtain your NIE (Número de Identificación de Extranjero), which is your essential Spanish tax identification number.

-

Open a Spanish bank account.

-

Appoint a solicitor (abogado) to conduct legal due diligence, including obtaining the Nota Simple (property registry extract).

-

Sign the title deed (escritura pública) before a public notary.

Yes, the NIE (Número de Identificación de Extranjero) is absolutely mandatory for any property purchase in Spain, whether in your own name or through a company. It serves as your unique tax identification number in Spain.

You will pay one of the following two taxes (they are not cumulative):

-

For a resale property: The ITP (Impuesto sobre Transmisiones Patrimoniales), which is the Property Transfer Tax. The rate varies from 7% to 10% depending on the autonomous region where the property is located.

-

For a new-build property: The IVA (Spanish VAT) at 10%.

As an international non-resident, you will be taxed on rental income via the IRNR (Impuesto sobre la Renta de No Residentes – Non-Resident Income Tax). The rate is 19% on net rental income (after deduction of eligible expenses) for residents of EU/EEA countries. For non-EU/EEA residents (including UK and US investors), the rate is 24% on gross income (fewer deductions allowed). It is crucial to consult a Spanish tax advisor regarding your specific situation and any applicable double taxation treaties.

Yes. Even if you do not rent out the property, Spain considers that you benefit from a 'deemed rental income'. You must pay the IRNR (Non-Resident Income Tax) based on an imputed income, calculated by applying a percentage (1.1% or 2%) to the cadastral value (valor catastral) of the property. The tax rate on this imputed income is 19% for EU/EEA residents and 24% for non-EU/EEA residents (including UK and US investors).

The only viable solution to purchase through a professional structure is to create a Spanish company. The most common is the Sociedad Limitada (SL), which is broadly equivalent to a UK Private Limited Company or a US LLC (Limited Liability Company).

Creating a Spanish SL is not recommended for a simple holiday home or single property purchase. It only becomes relevant for a significant investment strategy if you meet these conditions:

-

It is a purely rental investment (with no personal use of the property).

-

You plan to acquire multiple properties (generally three or more).

-

Optimisation of inheritance/succession planning (transfer of company shares) is a major objective.

The main disadvantage is the annual management costs. You will be obliged to maintain comprehensive accounting records and engage a gestor (a professional administrator/accountant), which incurs significant fixed fees (estimated between €1,000 and €2,500 per year), regardless of whether the property is rented out.

This is not recommended. If you (as the shareholder or director) use the property free of charge, the Spanish tax authorities will consider this a benefit in kind, which must be declared and taxed. An SL is structured for professional rental or business activity, not for personal use.

The difference in taxation is significant:

-

Individual Ownership: Imposed via IRNR (Non-Resident Income Tax) at 19% on net income for EU/EEA residents, or 24% on gross income for non-EU/EEA residents (including UK and US investors).

-

Spanish SL: Imposed via IS (Impuesto de Sociedades - Spanish Corporate Tax) at a rate of 25% on the company's net profit (this rate can be 15% for newly established companies for the first two years of profit).

If anonymity is an essential criterion for your investment, the Spanish SL is generally the only viable solution. In the Property Register (Registro de la Propiedad), the name of the SL will appear as the owner, not your personal name. Conversely, when purchasing in your own name, your personal details are publicly recorded.

For the vast majority of international buyers looking to acquire a holiday home or a single rental property, purchasing in their own name (as an individual - persona física) is the simplest, most cost-effective, and most fiscally secure option.