Buying Property in Spain: Individual or Company? (The French SCI Trap vs. the Spanish SL Solution)

Introduction

Buying property in Spain is a major project. A crucial question arises: should you buy as an individual (persona física) or via a company (persona jurídica)? For French investors, there's a strong temptation to use an existing structure like a French *Société Civile Immobilière* (SCI) or a *Société par Actions Simplifiée* (SAS). This is a financial and tax decision with significant consequences, and the answer might not be what you expect.

As experts in the Spanish market, we must be clear: using a French SCI to buy in Spain is a tax trap. Spain does not recognise the "fiscal transparency" of the SCI, which leads to double taxation nightmares. This guide compares the two valid methods: purchasing in your own name (the simplest) and purchasing via the *correct* company structure, a Spanish *Sociedad Limitada* (SL).

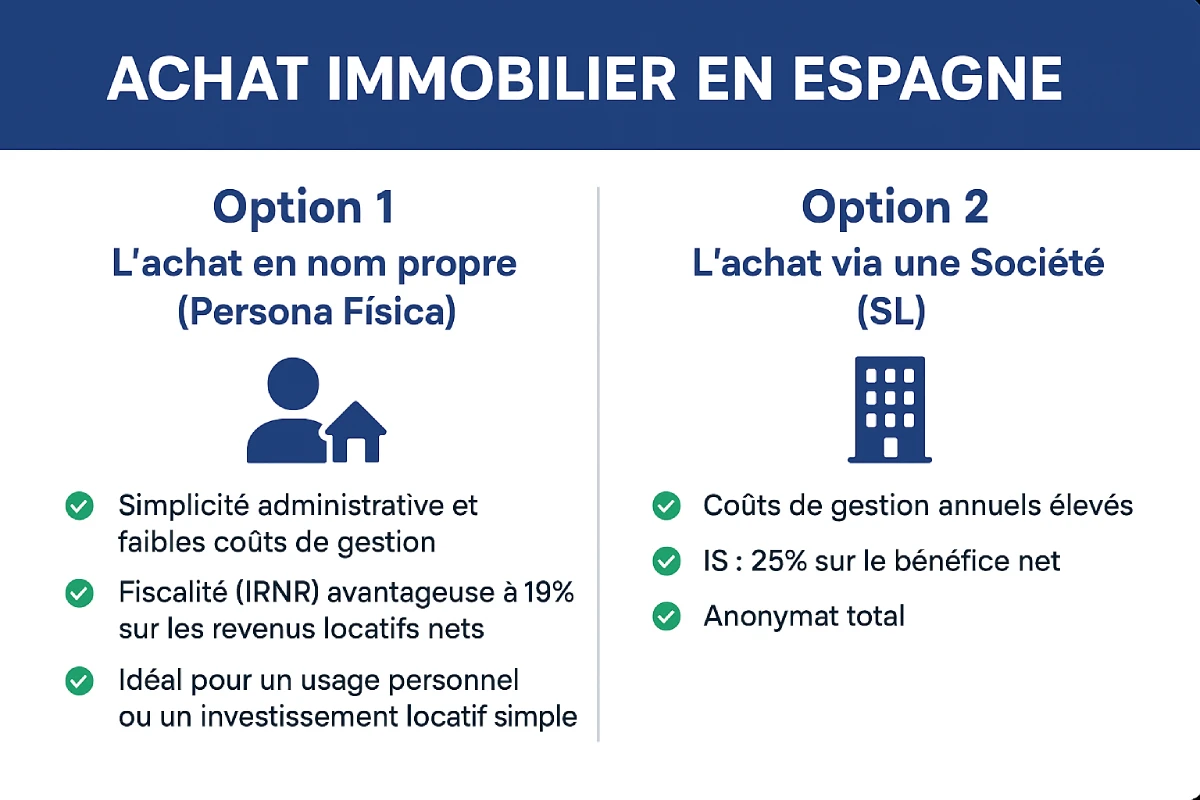

Option 1: Individual Purchase (Persona Física)

This is the most simple and common method for a non-resident buying a second home or a single rental property. The process is straightforward: you purchase as an individual.

Key steps include:

- Obtaining your NIE (Número de Identificación de Extranjero - Foreigner's Identification Number), which is your mandatory tax ID.

- Opening a Spanish bank account.

- Appointing a lawyer (abogado) to verify the legality of the property (via the Nota Simple - property registry extract).

- Signing the title deed (escritura) at the notary.

Taxation for Individual Purchase (Non-Resident)

Taxation is predictable:

- ✅ Upon purchase: You pay the ITP (Impuesto sobre Transmisiones Patrimoniales - Property Transfer Tax) for a resale property (7% to 10% depending on the region) or IVA (VAT) at 10% for a new build.

- ✅ Annually: You pay the IBI (Impuesto sobre Bienes Inmuebles - Property Tax) and the IRNR (Impuesto sobre la Renta de No Residentes - Non-Resident Income Tax).

- ✅ IRNR (Rental): If you rent out the property, you are taxed at 19% (as an EU resident) on the *net* rental income.

- ✅ IRNR (Personal Use): If you do not rent it out, Spain considers that you benefit from a "deemed rental income". You pay 19% on a basis of 1.1% to 2% of the cadastral value.

| Advantages (Individual Purchase) | Disadvantages (Individual Purchase) |

|---|---|

| Administrative simplicity and low management costs. | Lack of anonymity (your name is public in the Registry). |

| Favourable IRNR taxation at 19% on net rental income. | Transfer / Inheritance subject to Spanish law (high taxes in some regions). |

| Ideal for personal use or a simple rental investment. | Difficulty deducting certain expenses (outside of rental). |

Option 2: Corporate Purchase (The SCI Trap and the SL Solution)

This is where the most costly mistake is made. You think, "I have an SCI in France, I'll buy with that."

The Fatal Trap: Buying with a French SCI or SAS

DO NOT DO THIS. Spain does not recognise the "fiscal transparency" regime of French SCIs. For the Spanish tax authorities, your SCI is not "transparent"; it is an opaque foreign entity.

Conséquences:

- ❌ Double Taxation: Your SCI will be taxed in Spain on its profits (at the Spanish corporate tax rate or IRNR). Then, when you distribute dividends in France, you (the shareholders) will be *again* taxed on the same income in France.

- ❌ Inappropriate Taxation: You lose the benefit of the 19% IRNR rate for individuals.

- ❌ GEBI: In some cases, the SCI could be subject to the GEBI (Gravamen Especial sobre Bienes Inmuebles de Entidades No Residentes - Special Tax on Real Estate of Non-Resident Entities) of 3% on the cadastral value, although the France-Spain tax treaty may mitigate this.

The Professional Solution: Creating a Spanish *Sociedad Limitada* (SL)

If you wish to buy via a company (for anonymity, managing multiple properties, or inheritance optimisation), the only viable solution is to create a company under Spanish law. The most common is the Sociedad Limitada (SL), the equivalent of a Limited Liability Company (LLC) in many English-speaking countries.

In this case, the Spanish SL becomes the owner of the property. You, as an individual, are the partner (socio) of this SL.

Comparison: Individual Purchase vs. Company (SL)

So, when should an SL be favoured? This structure is not suitable for a simple second home due to its management costs. It becomes relevant for a large-scale rental investment.

| Criterion | Individual Purchase (Private Investor) | Purchase via a Spanish SL (Company) |

|---|---|---|

| Annual Management Costs | Low (IBI + IRNR) | High (Mandatory accountant/gestor: ~€1,000 - €2,500/year) |

| Tax on Rental Income | IRNR: 19% (for EU residents) on net income. | Corporate Income Tax (IS): 25% on net profit. |

| Depreciation & Expenses | Depreciation and deductible expenses (if rented). | All expenses (insurance, accountant, IBI, etc.) are deductible from profit. |

| Anonymity | None (Name public in the Registry). | Total (The Registry shows the SL's name, not yours). |

| Transfer / Inheritance | Inheritance taxes (regional). | Easier: Company shares are transferred (often less taxed). |

| Personal Use | Yes (by paying the "deemed rental" IRNR). | Not recommended. Making the property available to the shareholder for free is a taxable benefit in kind. |

Expert Advice: When is an SL advisable?

We recommend an SL only if you meet these conditions:

- It is a pure rental investment (no personal use).

- You plan to buy several properties (3 or more).

- The asset value is very high and inheritance optimisation (transfer of shares) is a major objective.

Official Resource

Non-resident taxation is a complex subject. The only official source is the Spanish tax authority, the Agencia Tributaria.

Conclusion: Individual or Professional, Choose the Right Path

For 90% of international buyers, individual purchase (as a private investor) is the simplest, least expensive, and safest route for a second home or a single rental investment.

The absolute trap to avoid is using your French SCI or SAS. If your project is a large-scale rental investment, the only viable professional structure is the creation of a Spanish *Sociedad Limitada* (SL), but its management costs must be justified. In all cases, the assistance of a specialised lawyer (abogado) and tax advisor (gestor) is essential.

Individual or Company: Still Unsure?

Take advantage of market opportunities. Let's discuss your project.

Table of Contents

- Introduction

- Option 1: Individual Purchase (Persona Física)

- Taxation for Individual Purchase (Non-Resident)

- Option 2: Corporate Purchase (The SCI Trap and the SL Solution)

- The Fatal Trap: Buying with a French SCI or SAS

- The Professional Solution: Creating a Spanish Sociedad Limitada (SL)

- Comparison: Individual Purchase vs. Company (SL)

- Conclusion: Individual or Professional, Choose the Right Path

FAQ : Buying Property in Spain: As an Individual or Through a Company?

Our experts answer key questions on purchasing property as an individual, the pitfalls of using a French SCI (Société Civile Immobilière), and the option of a Spanish SL (Sociedad Limitada) for international buyers.

No, it is strongly advised against. Using a French SCI (Société Civile Immobilière) to buy property in Spain is considered a "tax trap." Spain does not recognise the fiscal transparency of the SCI, which leads to severe tax and legal complications for international investors.

The problem is that Spain does not consider the SCI to be 'fiscally transparent'. For the Spanish tax authorities, it is an opaque foreign entity. This means that income (rental profits) will be taxed once in Spain at the SCI level, and then potentially a second time in your home country (e.g., UK or US) when you (the partners/shareholders) receive dividends or distributions. This leads to the nightmare of double taxation.

The simplest and most common method for international buyers is to purchase in your own name (as a persona física, or individual). The process is straightforward, and the taxation is predictable, which is ideal for personal use or a single rental investment.

The fundamental steps are:

-

Obtain your NIE (Número de Identificación de Extranjero), which is your essential Spanish tax identification number.

-

Open a Spanish bank account.

-

Appoint a solicitor (abogado) to conduct legal due diligence, including obtaining the Nota Simple (property registry extract).

-

Sign the title deed (escritura pública) before a public notary.

Yes, the NIE (Número de Identificación de Extranjero) is absolutely mandatory for any property purchase in Spain, whether in your own name or through a company. It serves as your unique tax identification number in Spain.

You will pay one of the following two taxes (they are not cumulative):

-

For a resale property: The ITP (Impuesto sobre Transmisiones Patrimoniales), which is the Property Transfer Tax. The rate varies from 7% to 10% depending on the autonomous region where the property is located.

-

For a new-build property: The IVA (Spanish VAT) at 10%.

As an international non-resident, you will be taxed on rental income via the IRNR (Impuesto sobre la Renta de No Residentes – Non-Resident Income Tax). The rate is 19% on net rental income (after deduction of eligible expenses) for residents of EU/EEA countries. For non-EU/EEA residents (including UK and US investors), the rate is 24% on gross income (fewer deductions allowed). It is crucial to consult a Spanish tax advisor regarding your specific situation and any applicable double taxation treaties.

Yes. Even if you do not rent out the property, Spain considers that you benefit from a 'deemed rental income'. You must pay the IRNR (Non-Resident Income Tax) based on an imputed income, calculated by applying a percentage (1.1% or 2%) to the cadastral value (valor catastral) of the property. The tax rate on this imputed income is 19% for EU/EEA residents and 24% for non-EU/EEA residents (including UK and US investors).

The only viable solution to purchase through a professional structure is to create a Spanish company. The most common is the Sociedad Limitada (SL), which is broadly equivalent to a UK Private Limited Company or a US LLC (Limited Liability Company).

Creating a Spanish SL is not recommended for a simple holiday home or single property purchase. It only becomes relevant for a significant investment strategy if you meet these conditions:

-

It is a purely rental investment (with no personal use of the property).

-

You plan to acquire multiple properties (generally three or more).

-

Optimisation of inheritance/succession planning (transfer of company shares) is a major objective.

The main disadvantage is the annual management costs. You will be obliged to maintain comprehensive accounting records and engage a gestor (a professional administrator/accountant), which incurs significant fixed fees (estimated between €1,000 and €2,500 per year), regardless of whether the property is rented out.

This is not recommended. If you (as the shareholder or director) use the property free of charge, the Spanish tax authorities will consider this a benefit in kind, which must be declared and taxed. An SL is structured for professional rental or business activity, not for personal use.

The difference in taxation is significant:

-

Individual Ownership: Imposed via IRNR (Non-Resident Income Tax) at 19% on net income for EU/EEA residents, or 24% on gross income for non-EU/EEA residents (including UK and US investors).

-

Spanish SL: Imposed via IS (Impuesto de Sociedades - Spanish Corporate Tax) at a rate of 25% on the company's net profit (this rate can be 15% for newly established companies for the first two years of profit).

If anonymity is an essential criterion for your investment, the Spanish SL is generally the only viable solution. In the Property Register (Registro de la Propiedad), the name of the SL will appear as the owner, not your personal name. Conversely, when purchasing in your own name, your personal details are publicly recorded.

For the vast majority of international buyers looking to acquire a holiday home or a single rental property, purchasing in their own name (as an individual - persona física) is the simplest, most cost-effective, and most fiscally secure option.