Property Tax in Spain (IBI): How it Works, Calculation, and Expert Advice

Introduction

When you buy property in Spain, you become liable for a local tax known as IBI (Impuesto sobre Bienes Inmuebles). This equivalent of property tax in many other countries is collected annually by the local town hall (Ayuntamiento) where the property is located. It is an unavoidable expense for all owners, whether resident or non-resident.

Understanding this tax is a critical step for accurately budgeting your investment. As experts in the Spanish market, we often see buyers underestimate this annual cost. This guide details how it works, its calculation method, and common pitfalls to avoid for smooth property management.

1. What is IBI and Who Must Pay It?

IBI is a municipal tax paid by all owners of a property in Spain (houses, apartments, garages, land, commercial premises). The funds collected finance local public services (roads, lighting, parks, etc.).

Payment is incumbent upon the person or entity who is the official owner of the property as of January 1st of the fiscal year, as recorded in the Property Register (Registro de la Propiedad).

Expert Tip: The January 1st Pitfall

The law states that the owner on January 1st pays the IBI. If you purchase on January 10th, the seller is legally liable for the entire year! In practice, custom (and case law) dictates that the IBI is apportioned pro rata temporis (proportional to time) between the buyer and the seller at the time of signing before the notary. Ensure your lawyer (abogado) negotiates and includes this in the deed of sale (escritura).

2. How is Property Tax (IBI) Calculated?

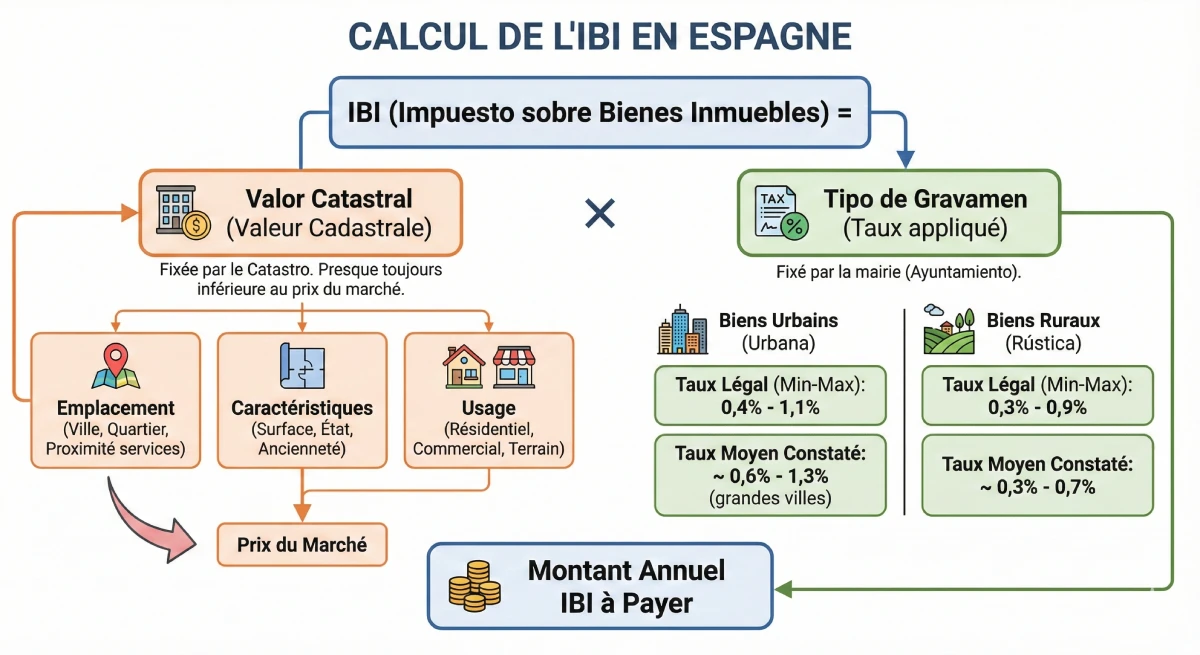

The IBI is calculated by applying a rate (tipo de gravamen) set by the town hall to the property's cadastral value (valor catastral). This value, determined by the Cadastre (Catastro), is almost always lower than the market price. It depends on:

- The property's location (city, neighborhood, proximity to services).

- The property's characteristics (area, condition, age).

- The property's use (residential, commercial, undeveloped land).

| Property Type | Minimum Legal Rate | Maximum Legal Rate | Observed Average Rate |

|---|---|---|---|

| Urban Properties (Urbana) | 0.4% | 1.1% | ~ 0.6% to 1.3% (major cities) |

| Rural Properties (Rústica) | 0.3% | 0.9% | ~ 0.3% to 0.7% |

IBI Calculation Example

Let's take an apartment in Valencia with a cadastral value of €120,000. If the Valencia City Council (Ayuntamiento) applies a rate of 0.9%:

- Taxable Base (Valor Catastral): €120,000

- Rate (Tipo): 0.9 %

- IBI Amount: €120,000 x 0.009 = €1,080 per year

3. When and How to Pay IBI?

The IBI is paid once a year, but the voluntary payment period (periodo voluntario) varies greatly from one town hall to another (often between June and November). The tax notice is sent to the tax address. For non-residents, it is crucial to be proactive.

Payment methods include:

- By direct debit (domiciliación bancaria) from a Spanish bank account. This is the highly recommended solution.

- Directly at the town hall counter or at a partner bank.

- Online via the town hall's tax portal (often requires digital identification).

4. Differences with Other Countries and Pitfalls to Avoid

IBI vs. Property Tax in Other Countries

While similar, the IBI is often considered lower than property tax in many other countries. However, the waste collection tax (Tasa de Basuras) is generally charged separately in Spain, whereas it is often included in property tax elsewhere (e.g., TEOM in France, or as part of Council Tax in the UK). Therefore, you should add both to make an accurate comparison.

| Characteristic | Other Countries (e.g., UK Council Tax, US Property Tax) | Spain (IBI) |

|---|---|---|

| Main Tax | Property Tax / Council Tax | IBI (Impuesto sobre Bienes Inmuebles) |

| Calculation Basis | Cadastral rental value (often outdated) | Valor Catastral (regularly updated, closer to reality) |

| Waste Collection Tax | Generally included (e.g., TEOM in France, part of Council Tax in UK) | Charged separately (Tasa de Basuras) |

Penalties for Non-Payment

Failing to pay IBI is a serious mistake. The town hall (Ayuntamiento) will apply surcharges (recargos) ranging from 5% to 20% and late payment interest (intereses de demora). If the debt persists, the administration can initiate a seizure procedure (embargo) on your Spanish bank account, and as a last resort, on the property itself.

Official Resource

IBI management falls under the responsibility of the Cadastre (Catastro). You can consult public information (excluding personal data) for any parcel via the official portal.

Consult the Electronic Cadastre Headquarters (Sede Catastro)

Conclusion

Property tax in Spain (IBI) is an essential annual obligation for all property owners. While its amount is generally reasonable, it is crucial to budget for it and pay it on time to avoid heavy penalties.

Our experience shows that the best strategy is to set up a direct debit (domiciliación) immediately upon acquisition. This ensures smooth management of your property investment in Spain.

Master Your Local Taxation

Take advantage of market opportunities. Let's discuss your project.

FAQ : Your Guide to IBI and Spanish Local Property Taxes

Find answers to the 15 most frequent questions asked by UK/US property owners about Spanish property tax (IBI).

Yes, many municipalities offer discounts. The most common cases are for large families (familia numerosa) or, increasingly, for the installation of solar panels (up to 50% reduction for several years, depending on the municipality).

Legally, the owner is liable to the authorities for the payment. However, the Spanish Urban Leases Act (LAU) allows this cost to be passed on to the tenant if it is explicitly stated in the rental agreement.

This is a common confusion. IBI is a local property tax, similar to Council Tax or Property Tax. IRNR (Impuesto sobre la Renta de No Residentes - Non-Resident Income Tax) is a state tax on 'income' (actual if the property is rented out, or imputed/fictitious if it is vacant). You are required to pay both.

You must absolutely ask the seller for the latest IBI receipt (último recibo del IBI) before signing. This allows you to verify the exact amount and ensure all payments are up to date.

Not necessarily. It varies if the municipality changes the tax rate or if the State revises the cadastral value. These revisions are not systematic every year but follow administrative cycles (ponencia de valores - a comprehensive cadastral valuation review).

Yes, most municipalities offer an instalment payment plan (for example, quarterly). You need to make an express request to the local tax authority (such as SUMA in Alicante or ORGT in Barcelona).

Yes. If the garage or storage unit has its own cadastral reference (independent of the main dwelling), you will receive a separate tax bill. If they are annexed to the dwelling on the same title deed, their value is included in the overall IBI calculation.

Not receiving the notice does not exempt you from payment. In Spain, it is the taxpayer's responsibility to stay informed. This is why setting up a bank direct debit is vital to avoid penalties for 'missed payments'.

If you rent out your property and declare your rental income (in Spain or your home country), the IBI amount is a deductible expense, proportionate to the rental period.

This is a recent possibility. The new Housing Law allows municipalities to apply a surcharge (recargo) of up to 150% of the IBI for permanently unoccupied properties without justification, in order to combat housing vacancy.

Normally, the notary public informs the Cadastral Office. However, it is prudent for UK/US investors to visit the town hall or the tax management body (such as the Diputación - Provincial Council) with your title deed (Copia Simple - a simple copy of the public deed of sale) to confirm the change and set up the direct debit.

Yes, but they are limited to properties such as State buildings, churches, Red Cross properties, or certain buildings classified as historical heritage. Private individuals are rarely eligible for a full exemption.

This is the unique identifier for your property (a 20-character alphanumeric code). It is essential for paying your IBI, declaring your taxes (IRNR), and performing any administrative procedures related to the property.

Yes, you can initiate a procedure (subsanación de discrepancias - rectification of discrepancies) with the Cadastral Office if you believe there is a technical error (e.g., incorrect surface area, wrong usage). This is a lengthy procedure that often requires the assistance of an architect or surveyor.

As long as the property has not been delivered and individually registered with the Cadastral Office, it is generally the developer who pays the IBI on the land/building under construction. You will begin paying in the year following the handover of the apartment.