Spain Inheritance & Gift Tax: 2025 Comprehensive Guide for Investors

Introduction

Transferring assets in Spain, whether through inheritance or as a gift, requires careful consideration of the Inheritance and Gift Tax (Impuesto sobre Sucesiones y Donaciones – ISD). This tax, though complex and highly variable across different regions, remains an essential fiscal step when transferring property within Spanish territory.

Understanding this tax is crucial for any investor or property owner, whether resident or non-resident. Poor planning can lead to significant tax costs, while strategic anticipation allows for optimized asset transfer. This 2025 guide details who must pay, how the tax is calculated, and strategies to mitigate its impact.

1. Who is Affected by the Inheritance and Gift Tax (ISD)?

The obligation to pay ISD in Spain depends on the tax residency of the heir (or donee) and the location of the assets being transferred.

- ➡️ Spanish Residents: They are liable for tax on all assets received, whether located in Spain or abroad (unlimited tax liability).

- ➡️ Non-Residents in Spain: They are liable for tax only on assets and rights located within Spanish territory (real tax liability).

Typical Case for Non-Residents

Even if you reside in France, Belgium, or Switzerland, if you inherit a property (house, apartment) located in Spain, you will mandatorily need to file a declaration and pay ISD in Spain.

2. How ISD is Calculated: The Key Role of Autonomous Communities

The calculation of ISD is a shared competence between the central State and the 17 Autonomous Communities. This is what makes this tax so complex: the amount payable can vary enormously depending on the region where the asset is located.

The National Tax Rates (State Scale)

In the absence of regional regulations (or for certain non-resident cases), the national progressive scale applies. It ranges from 7.65% to 34%.

| Taxable Base (up to) | Amount Payable | Remaining Taxable Base | Applicable Rate (%) |

|---|---|---|---|

| 0,00 € | 0,00 € | 7 993,46 € | 7,65% |

| 7 993,46 € | 611,50 € | 7 987,45 € | 8,50% |

| 15 980,91 € | 1 290,43 € | 7 987,45 € | 9,35% |

| ... | ... | ... | ... |

| 797 555,08 € | 230 468,69 € | Above | 34,00% |

The Crucial Importance of Autonomous Communities

Almost all Autonomous Communities have legislated to offer reductions (reducciones) and allowances (bonificaciones) that are much more advantageous than those offered by the State. These benefits apply preferentially.

"The region where the asset is located is the most determining factor in calculating inheritance tax in Spain. An inheritance in Madrid is fiscally very different from an inheritance in Valencia or Catalonia."

3. Main Regional Exemptions and Reductions

Reductions vary enormously but generally target close family ties (Group I and II: children, spouses, parents).

Here are the most common allowances:

- ✅ Family Relationship: Very high allowances for spouses and children (e.g., 99% in Madrid, 99.9% in the Canary Islands, 100% in Andalusia up to €1 million).

- ✅ Main Residence: A reduction on the value of the deceased's main residence (often 95%), provided that the heirs retain it for a certain number of years (generally 5 to 10 years).

- ✅ Disability: Specific allowances depending on the heir's degree of disability.

- ✅ Family Business: Significant reductions (often 95%) to ensure business continuity.

| Autonomous Community | Notable Allowance / Bonification |

|---|---|

| Madrid | 99% bonification on the tax amount. |

| Andalusia | Exemption for taxable bases below €1,000,000. |

| Valencian Community | €100,000 reduction (children & spouses). Variable bonifications (e.g., 50%). |

| Catalonia | 99% bonification for the spouse. Variable reductions for children. |

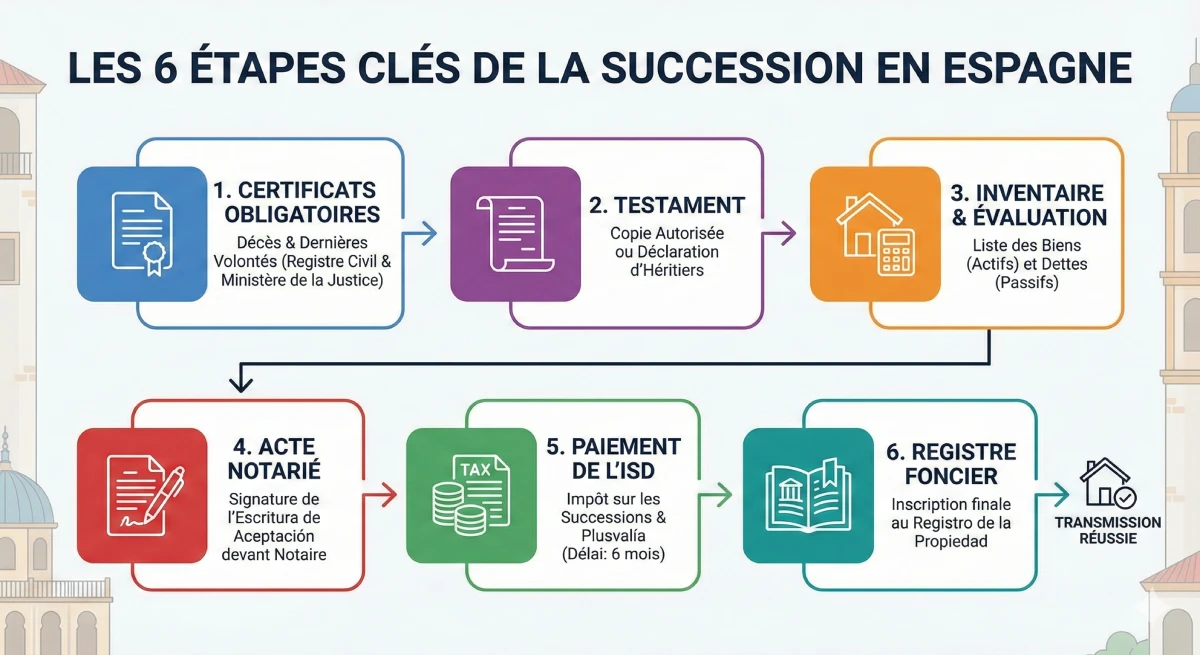

4. Key Steps in the Spanish Inheritance Process

The inheritance process in Spain involves several mandatory administrative and fiscal steps. From obtaining the death certificate to the final registration of the property in the Land Registry, each step must be completed.

5. Gifts (Donations), Procedures, and Practical Examples

The Case of Gifts (Lifetime Transfers)

A gift (donation) is subject to the same tax rules as inheritance (ISD), but it is declared and paid by the donee (the recipient) at the time of transfer. Real estate gifts absolutely require a notarial deed and registration in the Land Registry (Registro de la Propiedad).

Note: A gift can also trigger for the donor (the giver) the payment of capital gains tax (IRPF for residents) and municipal capital gains tax (plusvalía municipal).

Procedures and Deadlines to Observe

Adhering to deadlines is fundamental to avoid penalties:

- ⏱️ For an inheritance: The heir has 6 months from the date of death to file the declaration (Form 650 or 651) and pay the ISD. An extension of an additional 6 months can be requested (before the end of the 5th month).

- ⏱️ For a gift: The declaration must be made within 30 working days following the signing of the gift deed.

Practical Example: Inheriting an Apartment

Let's take the example of a French resident who inherits (direct line, child) an apartment in Spain valued at €300,000:

- ➡️ If the property is located in Catalonia: After allowances and reductions, the heir may pay approximately €10,000.

- ➡️ If the property is located in Madrid: The direct heir benefits from a 99% bonification, reducing the tax to only a few hundred euros.

6. Risks, Advice, and Double Taxation

Consequences of Non-Payment

A delay in payment leads to interest and late payment penalties (recargos) from the Spanish tax administration (Agencia Tributaria).

More seriously, no property transfer can be registered in the Land Registry without proof of ISD payment (or exemption). Therefore, the heir cannot sell or mortgage the property until the tax is settled.

Practical Advice to Optimize Asset Transfer

To effectively prepare an asset transfer in Spain, anticipation is key:

- Consult a notary and a tax advisor (asesor fiscal) specialized in international law and familiar with the specifics of the Autonomous Community concerned.

- Consider a lifetime gift (donation) if the tax regime in the region is more favorable for gifts than for inheritances.

- Take into account tax treaties between Spain and your country of residence (such as France or Belgium) to avoid double taxation.

- Anticipate the necessary liquidity for paying the duties, as they must be paid "in advance" to unblock the inheritance funds.

- Consult official tax administration resources, such as the Practical Handbook on Inheritance Tax (in Spanish).

Conclusion

Inheritance and gift tax in Spain is a complex taxation system because it strongly depends on the autonomous communities. The amount payable depends less on the value of the asset and more on its location (Madrid, Andalusia, Valencia, etc.) and the relationship to the deceased/donor.

Good preparation, accompanied by specialized advice, is essential. It allows for a considerable reduction in the amount payable and ensures a smooth transfer of your real estate assets in Spain.

Need to Optimize Your Estate Planning?

Take advantage of market opportunities. Let's discuss your project.

Article Summary

- Introduction

- 1. Who is Affected by the Inheritance and Gift Tax (ISD)?

- 2. How ISD is Calculated: The Key Role of Autonomous Communities

- The National Tax Rates (State Scale)

- The Crucial Importance of Autonomous Communities

- 3. Main Regional Exemptions and Reductions

- 4. Key Steps in the Spanish Inheritance Process

- 5. Gifts (Donations), Procedures, and Practical Examples

- The Case of Gifts (Lifetime Transfers)

- Procedures and Deadlines to Observe

- Practical Example: Inheriting an Apartment

- 6. Risks, Advice, and Double Taxation

- Consequences of Non-Payment

- Practical Advice to Optimize Asset Transfer

- Conclusion

FAQ: Spanish Inheritance and Gift Tax (ISD)

All your questions answered about Spanish Inheritance and Gift Tax

The ISD (Impuesto sobre Sucesiones y Donaciones) is the Spanish Inheritance and Gift Tax. It applies to any transfer of assets by inheritance (succession) or during one's lifetime (gift/donation).

Yes. If you are a non-resident (for example, a UK/US investor or international buyer) and you inherit a property located in Spain (such as an apartment or a house), you have a legal obligation to file a declaration and pay the ISD in Spain on that asset.

No, absolutely not. This is the most crucial point. Although there is a national scale (from 7.65% to 34%), the tax is managed by the 17 Autonomous Communities (regions). The final amount payable varies enormously depending on whether the property is located in Madrid, Andalusia, Valencia, or Catalonia.

Yes. Most regions offer significant reductions (reducciones) and allowances/reliefs (bonificaciones) for direct line heirs (Group I and II). For example, in Madrid, the allowance is 99% of the tax, and in Andalusia, there is an exemption up to 1 million euros.

For the same apartment valued at €300,000 inherited by a child:

-

In Madrid: Thanks to the 99% allowance, the tax would only be a few hundred euros.

-

In Catalonia: After applying regional allowances, the tax could amount to approximately €10,000.

You have a period of 6 months from the date of death to file the declaration (Form 650 or 651) and pay the tax.

Yes, it is possible to request an extension of an additional 6 months. Please note: this request must be made strictly before the end of the fifth month following the death.

This depends entirely on the region. The tax is the same (ISD), but regional allowances may differ. A gift must be declared immediately (within 30 days) and requires a public deed before a notary. It is essential to carry out a simulation with a tax advisor.

Yes. This is a crucial point. The donee (the recipient) pays the ISD (Gift Tax). But you, the donor (the giver), may be liable for two other taxes: Capital Gains Tax (IRPF) and the plusvalía municipal (municipal capital gains tax).

Besides penalties and late payment interest, the most serious consequence is that the Land Registry (Registro de la Propiedad) will block the property. You will not be able to register the property in your name and therefore you will not be able to sell or mortgage it until the tax is settled.

Yes, most regions provide for a significant reduction (often 95%) on the value of the deceased's main residence. This reduction is usually conditioned on the heirs' obligation to retain the property for a certain number of years (5 to 10 years depending on the region).

To avoid double taxation, Spain has signed double taxation treaties with several countries, including the UK and the US. These treaties allocate the right to tax or allow for the deduction of tax paid abroad. The application is complex and requires expert advice.

The 6 main steps are:

- Obtain the death certificate.

- Obtain the Certificate of Last Wills (testament/will).

- Inventory assets and debts.

- Pay the Inheritance Tax (ISD).

- Sign the deed of acceptance of inheritance before a notary.

- Register the property in your name at the Land Registry.

Plan ahead and seek professional assistance. Do not try to manage this alone. Consult a tax advisor (asesor fiscal) or a solicitor/notary specialized in international inheritance law who is thoroughly familiar with the specific laws of the Autonomous Community where the assets are located.

Unlike an inheritance (6-month period), a gift/donation must be declared and the tax paid much more quickly: within 30 working days following the signing of the public deed of gift before a notary.