Spain Real Estate Price Forecast 2026: In-depth Analysis (Euribor, Supply & Demand)

Introduction

After the euphoria of 2021-2022 and the sharp cooldown of 2024-2025 due to the Euribor hike, all investor eyes are now turning to the future. The question on everyone's lips is: should one buy now or wait? Is a Spain property price forecast for 2026 even possible? This is a highly financial subject where expert insight is paramount.

As experts in the Spanish real estate market, we must be clear: the era of double-digit increases is over. While 2026 will not be a year of explosive growth, it is also unlikely to be a year of collapse. We are entering a normalization phase, where prices will be dictated by three key factors: the anticipated decrease in Euribor, the shortage of new-build properties, and the resilience of foreign demand.

2024-2025 Review: The Great Slowdown After the Euphoria

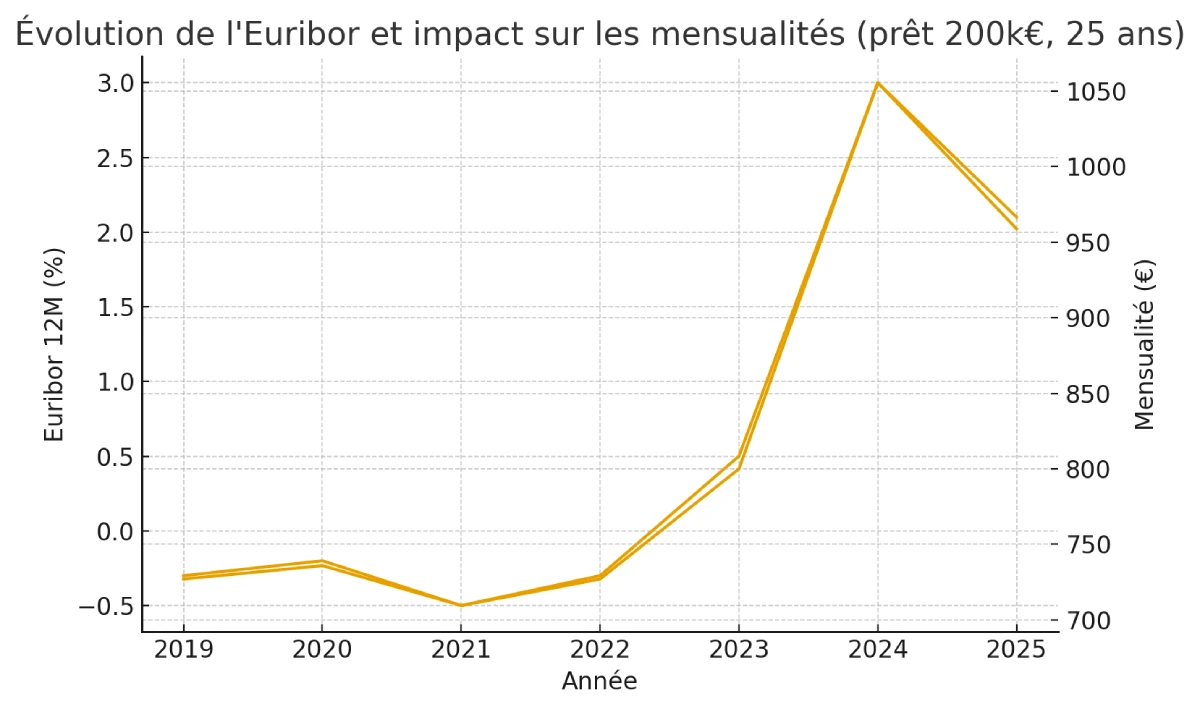

To forecast 2026, understanding the current context is essential. The dramatic rise in interest rates by the European Central Bank (ECB) propelled the Euribor from 0% to over 3.5% in record time. This benchmark, which sets the rate for most mortgages in Spain, had an immediate effect:

- Drop in Transactions: Local buyers, relying on credit, saw their borrowing capacity shrink, putting their projects on hold.

- Price Stagnation: After years of increases, prices have stabilized, or even slightly corrected in less dynamic areas.

We have thus transitioned from a "seller's" market to a "buyer's" market in 2024-2025, characterized by longer selling times and greater negotiation margins.

3 Key Factors Driving Prices in 2026

Our 2026 forecast is based on the interaction of three major forces. Real estate prices will be the result of their equilibrium.

1. ECB Policy and the Anticipated Euribor Decrease

This is the number one factor. As Eurozone inflation moderates, the ECB has begun to ease its policy. Analysts agree on a trend towards a decrease in Euribor throughout 2025. An Euribor that durably falls below the 3% threshold in 2025 will 'reawaken' local demand in 2026, restoring purchasing power to Spanish households and rekindling competition in the mortgage market.

2. Structural Shortage of New-Build Properties (Obra Nueva)

Spain is not building enough. New-build housing production (obra nueva) is significantly lower than the net creation of households. This supply shortage, particularly in high-demand areas, creates a 'floor' that prevents prices from collapsing. As long as supply remains limited, even moderate demand will be sufficient to sustain prices, especially for new or recent properties with high energy efficiency standards.

3. The Resilience of International Demand

This is the 'wildcard' of the Spanish market. Foreign buyers (French, Belgian, German, British, etc.) show remarkable resilience. A large portion of them purchase with little or no credit (cash buyers), making them insensitive to Euribor fluctuations. This solvent demand, driven by lifestyle quality, maintains upward pressure on coastal and luxury markets.

2026 Forecast: Our 2 Scenarios

As experts, we do not offer a crystal ball, but rather scenarios based on facts. The hypothesis of a real estate crash in 2026 is extremely unlikely due to the lack of supply. Here are the two most plausible scenarios.

| Scenario (Probability) | Euribor Assumption (End 2025) | Price Forecast (National 2026) |

|---|---|---|

| 1. Stabilization and Normalized Market (70%) | Euribor stabilizes between 2.75% and 3.25% | Stability (+0.5% to +2%) |

| 2. Slight Rebound (30%) | ECB rapidly cuts rates; Euribor drops below 2.5% | Moderate Increase (+2% to +4%) |

Our Expert Analysis

The most probable scenario for 2026 is one of normalization. We will not witness a boom, but rather a healthy return to market equilibrium. Buyers will have slightly more negotiating power than in 2022, but sellers of quality properties will have no reason to undersell. Foreign demand and the shortage of new builds will support the entire market.

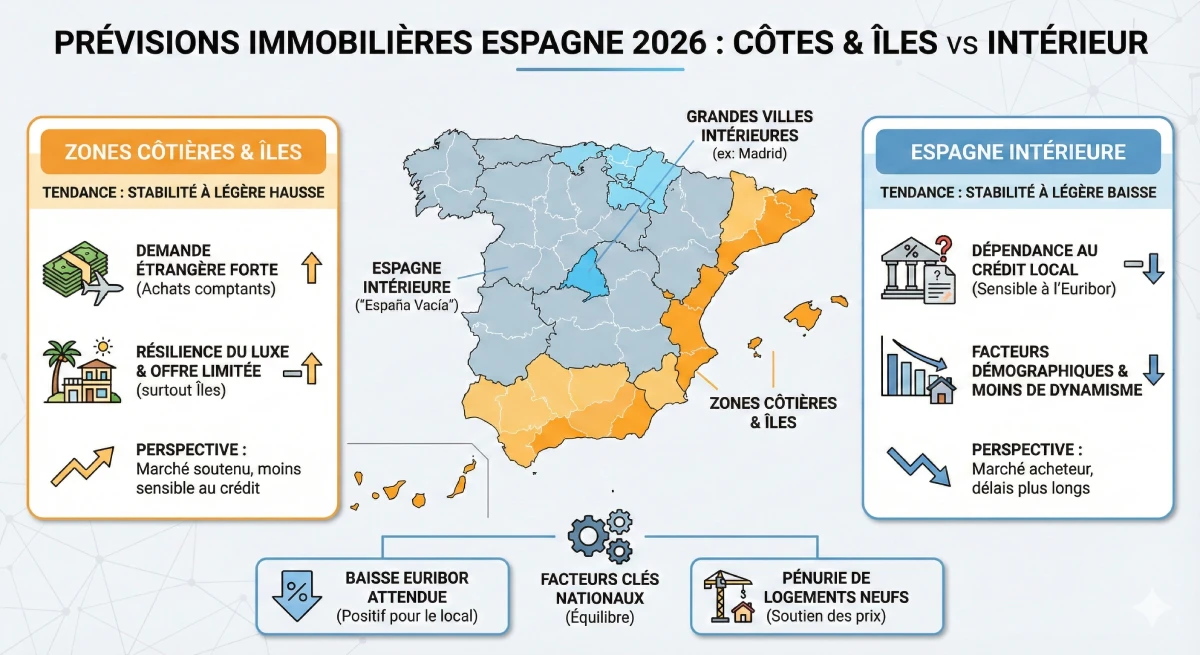

A Multi-Speed Market: Regional Forecasts

There isn't ONE real estate market in Spain, but dozens. The 2026 forecast must be geographically nuanced. Areas dependent on local demand and credit (small inland towns) will face more challenges than dynamic coastal regions.

| Geographic Zone | 2026 Trend Forecast | Key Factor |

|---|---|---|

| Coasts (Costa del Sol, Costa Blanca) | Stability to Slight Increase | Strong foreign demand (cash purchases), luxury segment resilience. |

| Balearic and Canary Islands | Strong Stability | Ultra-luxury market, extremely limited supply. |

| Major Cities (Madrid, Barcelona) | Stability | Strong rental demand, but purchase demand depends on credit recovery. |

| Inland Spain ("España Vacía") | Stability to Slight Decrease | Market 100% dependent on local credit and demographics. |

Official Resource

To monitor official price evolution data, the most reliable source in Spain is the National Institute of Statistics (INE) and its Housing Price Index (IPV). These official figures help contextualize trends.

Conclusion

Our real estate price forecast for 2026 in Spain points to a healthy stabilization. The main driver of this normalization will be the anticipated decrease in Euribor, which will ease pressure on local demand. However, the structural shortage of new-build properties and strong demand from foreign buyers (often cash purchasers) will prevent any major price corrections in attractive areas.

For buyers with available capital, the 2025-2026 period represents a window of opportunity: the market is calmer, allowing for price negotiation before the demand recovery that falling interest rates will inevitably trigger. Waiting for a price crash appears to be a risky strategy that could lead you to miss the opportune moment.

Need Expert Advice?

Take advantage of market opportunities. Let's discuss your project.

Table of Contents

- Introduction

- 2024-2025 Review: The Great Slowdown After the Euphoria

- 3 Key Factors Driving Prices in 2026

- 1. ECB Policy and the Anticipated Euribor Decrease

- 2. Structural Shortage of New-Build Properties (Obra Nueva)

- 3. The Resilience of International Demand

- 2026 Forecast: Our 2 Scenarios

- A Multi-Speed Market: Regional Forecasts

- Conclusion

FAQ: Spanish Property Price Forecast 2026

Our experts answer your key questions on price trends and purchasing opportunities for UK/US investors.

The general forecast points to a healthy normalization and stabilization. The era of double-digit increases is over. The most likely scenario (estimated at 70%) anticipates stability or a slight nationwide price increase, in the range of +0.5% to +2%.

No. According to analysis, the hypothesis of a crash is extremely unlikely. The market is protected by two main factors: the structural shortage of new-build homes and strong demand from international buyers who often purchase with cash.

The market experienced a "significant slowdown" due to the dramatic rise in Euribor (the benchmark index for mortgages). As credit became more expensive, the borrowing capacity of local buyers diminished, leading to a drop in transactions and price stagnation.

Euribor sets the interest rate for the majority of mortgages in Spain. It is crucial because analysts agree on its expected decline throughout 2025. A lower Euribor will restore purchasing power to Spanish households and "reawaken" local demand in 2026.

Three major factors will determine the market balance:

-

The decline in Euribor (reigniting local demand).

-

The shortage of new-build properties (limiting available supply).

-

The resilience of international demand (supporting prices in coastal areas).

Much less so. The article highlights the "remarkable resilience" of international buyers (including those from the UK, US, and other countries). A large proportion of them purchase with little or no mortgage (cash purchase), making them unaffected by variations in Spanish interest rates.

No. Spain faces a "structural deficit" of new-build homes. Production is significantly lower than the creation of new households. This supply shortage creates a "floor" that prevents prices from collapsing, especially for recent properties with high energy efficiency standards.

For buyers with available capital, the article suggests that 2025-2026 represents a window of opportunity. The market is calmer than in 2022, offering greater room for negotiation before the rebound in demand that falling interest rates are sure to trigger.

According to this analysis, waiting for a price drop is a risky strategy. The anticipated decline in Euribor is expected to revive demand. By waiting, buyers might miss the "right moment" and face higher prices in attractive areas.

Absolutely not. There isn't ONE Spanish market, but dozens. The article predicts a "multi-speed market":

-

Coastal areas (Costa del Sol, Costa Blanca) and Islands (Balearic Islands, Canary Islands): Strong stability or slight increase.

-

Inland Spain ("España Vacía"): Stability or slight decrease.

The Coasts (Costa del Sol, Costa Blanca) and the Balearic/Canary Islands. These markets are driven by strong, solvent international demand (cash purchases) and very limited supply, particularly in the luxury segment.

Inland Spain (small towns, "España Vacía"). This market is almost 100% dependent on local credit and demographics. This is where prices could stagnate or correct slightly.

After the euphoria of 2021-2022 (a "seller's market"), the cooling off in 2024-2025 has led us into a "buyer's market". This means that sales times are longer, and buyers have more room for negotiation.

There is an alternative "Slight Rebound" scenario (30% probability). If the ECB rapidly cuts its rates and Euribor drops below 2.5%, demand could be stronger than anticipated, leading to a moderate price increase of +2% to +4%.

The article recommends consulting the most reliable source: the National Institute of Statistics (INE) and its Housing Price Index (IPV).