Is This Guide for You?

This guide is designed for **international citizens** (UK, US, Canada, Europe) considering Spain as a destination for an ambitious and well-planned property project.

Specifically, we have tailored it for three main profiles:

Future Retirees & Lifestyle Seekers

You want to prepare for or enjoy a sunny retirement in an exceptional setting. You are looking not just for a property, but for a lifestyle project combining safety, comfort, and well-being.

Savvy Investors

You seek to diversify your portfolio with a tangible, high-performance asset. Attracted by Spain's strong rental yields, you want to optimize your investment, whether for holiday lets or long-term capital appreciation.

Families & Relocation Projects

Whether for career opportunities or a lifestyle change, you are planning to move your family to Spain. You need a secure environment and a clear understanding of the relocation process (schools, healthcare).

Your Roadmap to a Successful Purchase

Now that you know this guide is for you, let's explain our mission. Buying property abroad raises legitimate questions, especially regarding the language and local legal system. How do you avoid pitfalls?

This guide answers those questions. We help you:

- Demystify red tape and legal procedures (NIE, Notary, Land Registry).

- Understand the specificities of the Spanish market to negotiate better.

- Secure your transaction by avoiding common mistakes made by non-residents.

- Save time, money, and above all, gain peace of mind.

Why Spain is the Strategic Choice in 2026

Spain's appeal goes beyond lifestyle: The country has established itself as a solid ground for real estate investment, supported by robust economic fundamentals. Investing in Spain today is a smart wealth strategy.

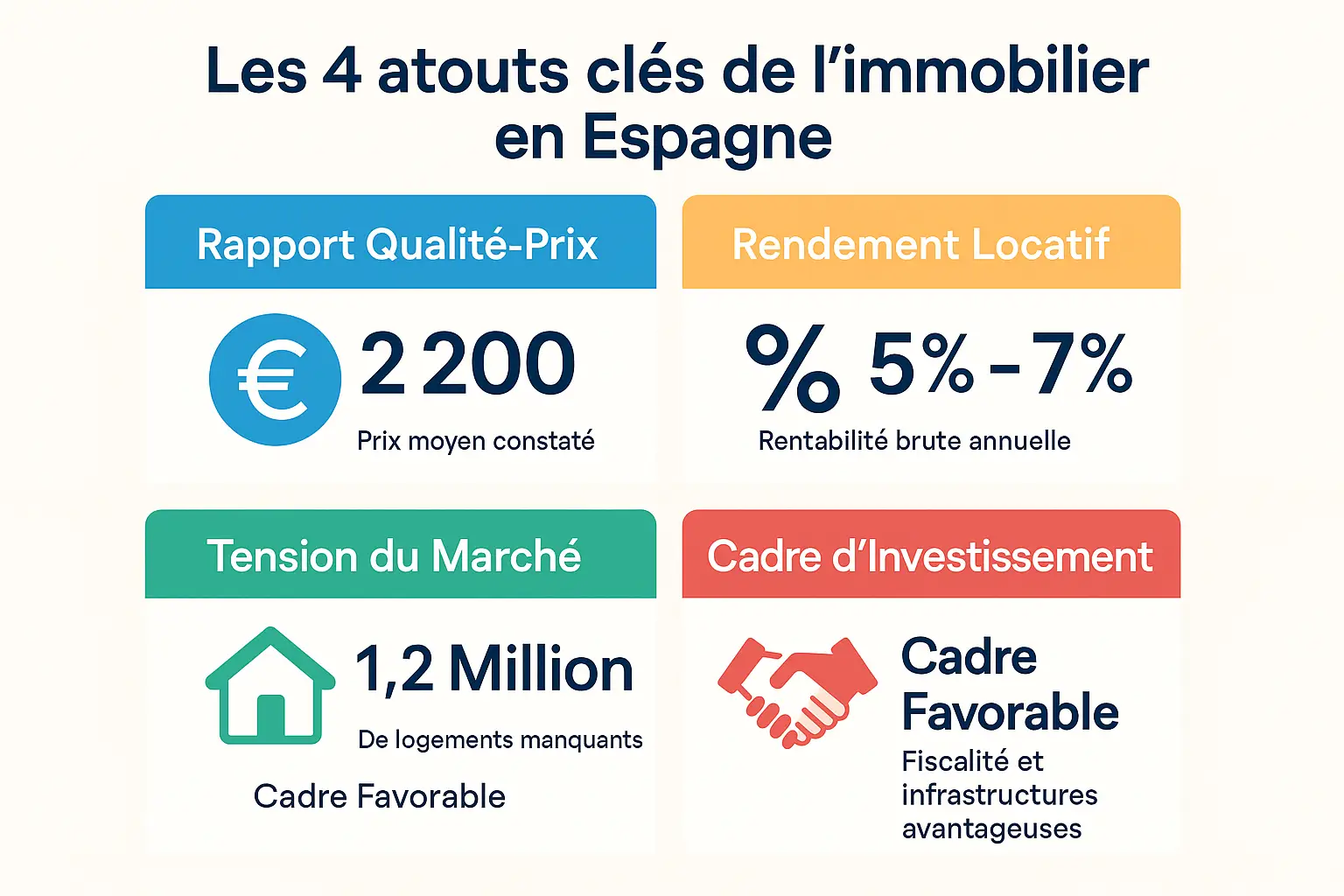

4 Pillars of a Secure Investment

- Attractive Value: With an average price of €2,200/sqm, Spain offers affordability that is rare in Western Europe for this standard of living.

- Exceptional Rental Yield: Driven by high demand, gross yields often range between 5% and 7%, some of the best in Europe.

- Structural Housing Shortage: An estimated deficit of 1.2 million homes keeps the market under tension, ensuring long-term value retention.

- Favorable Framework: Spain offers advantageous tax conditions for non-residents and easier access to mortgages for solvent international buyers.

The Numbers Speak for Themselves

This appeal is validated by experts. CBRE ranks Spain as the #2 preferred European destination for property investment.

Record Tourism Drives Rental Demand

The property market is fueled by a powerful tourism sector. With record figures in 2025, Spain confirms its status as the 2nd most visited country in the world. For landlords, this guarantees high occupancy rates.

All Systems Go!

You now know that this guide is for you and that the Spanish market in 2026 represents an exceptional opportunity.

However, seizing the opportunity requires method. The question is no longer why invest, but how to do it intelligently and safely.

Your Action Plan: Method, Tools, and Services

Success in Spain is not about luck, it's about method. Here is your essential roadmap, broken down into 4 logical steps.

-

1. Admin & Financial Preparation

Rigorous preparation is essential to be reactive and credible to sellers.

- Get your NIE: The Foreigner Identification Number is mandatory for any transaction.

- Validate your Budget: Account for the necessary funds to cover all closing costs.

- Secure Financing: Open a bank account and explore your mortgage options early.

Our Tools

Our Services

-

2. Legal Security (Due Diligence)

The Spanish legal system is different. Having the right experts on your side is a necessity, not an option.

- Hire an Independent Lawyer: Unlike in the UK/US, the Notary does not check everything. A lawyer checks debts and legality for YOU.

- Understand Contracts: Master the 3 stages: Reserva, Arras (Deposit Contract), and Escritura (Title Deed).

Essential Guide

Our Services - 2. Legal Security (Due Diligence)

-

3. Market Analysis & Property Search

Your investment must match your goals and current market dynamics.

- Identify 2025 Trends: High demand, limited supply, and rising prices in coastal areas.

- New Build vs Resale: Understand the tax implications (VAT vs Transfer Tax).

Our Tools

Our Services

-

4. Taxes & Ownership

Owning property in Spain comes with obligations you must know to avoid surprises.

- Annual Taxes: Learn about Council Tax (IBI) and Non-Resident Income Tax (IRNR).

- Rental Regulations: Check tourist license rules before investing.

Our Services

7 Traps to Avoid When Buying

Being well-informed is your best protection. Here are the most common mistakes to avoid at all costs.

Underestimating the Lawyer's Role

The Spanish Notary does not perform the same checks as a UK Solicitor. Only an independent lawyer will check for debts and planning permission to protect YOUR interests.

Ignoring Illegal Builds

A pool or terrace built without a license can lead to fines, demolition orders, or resale problems.

Signing 'Arras' Too Quickly

This deposit contract is binding. Without exit clauses (e.g., subject to mortgage) drafted by your lawyer, you risk losing your deposit.

Forgetting Hidden Debts

In Spain, debts (Community fees, IBI tax) are attached to the property, not the owner. If not cleared before sale, you inherit them.

Neglecting Rental Laws

If you aim for holiday rentals, rules are strict. A Tourist License is often mandatory and sometimes impossible to get in certain zones.

Master Your Budget: Purchase Costs Detail

On top of the property price, budget an additional 13% to 15% to cover all taxes and mandatory fees.

| Cost Type | Percentage / Amount | Specific Notes |

|---|---|---|

| Transfer Tax (ITP) | 6 – 10% | For Resale properties. Varies by region. |

| VAT (IVA) | 10% | Only for New Build properties (First sale). |

| Stamp Duty (AJD) | 0,5 – 1,5% | Added to VAT for New Builds. |

| Notary Fees | 0,5 – 1% | Fee for signing the Title Deed. |

| Land Registry | 0,5 – 1% | Registering the property in your name. |

| Legal Fees | 1 – 2% | Essential for due diligence and safety. |

| Total Closing Costs | 13 – 15% | To be added to the purchase price. |

Which Region Suits You Best?

Where to Buy? Popular Regions Compared

Each region has its own charm and specifics. Here is an overview to help you decide.

| Region / City | Avg Price (€/sqm) | Key Strengths |

|---|---|---|

| Costa del Sol (Andalusia) | 2 500 – 4 000 € | Exceptional climate Luxury rental market High prices in prime areas |

| Valencia | 1 500 – 2 500 € | Excellent value for money Quality of life and city beaches Rising prices (high competition) |

| Alicante (Costa Blanca) | 1 400 – 2 200 € | Affordable & great flight connections Large international community Very touristy in summer |

| Barcelona | 4 000 – 6 000 € | Cultural and economic hub Strong rental demand Expensive & strict regulations |