Spanish Mortgage: Banks, 2025 Rates, and Pitfalls to Avoid

Introduction

For many international buyers, securing a mortgage in Spain is the most critical and complex step in their property purchase journey. The dream of a villa on the Costa Blanca or an apartment in Barcelona often encounters a banking reality very different from what they might be used to in their home country.

The rules are not the same, and Spanish banks have specific criteria, especially for non-residents.

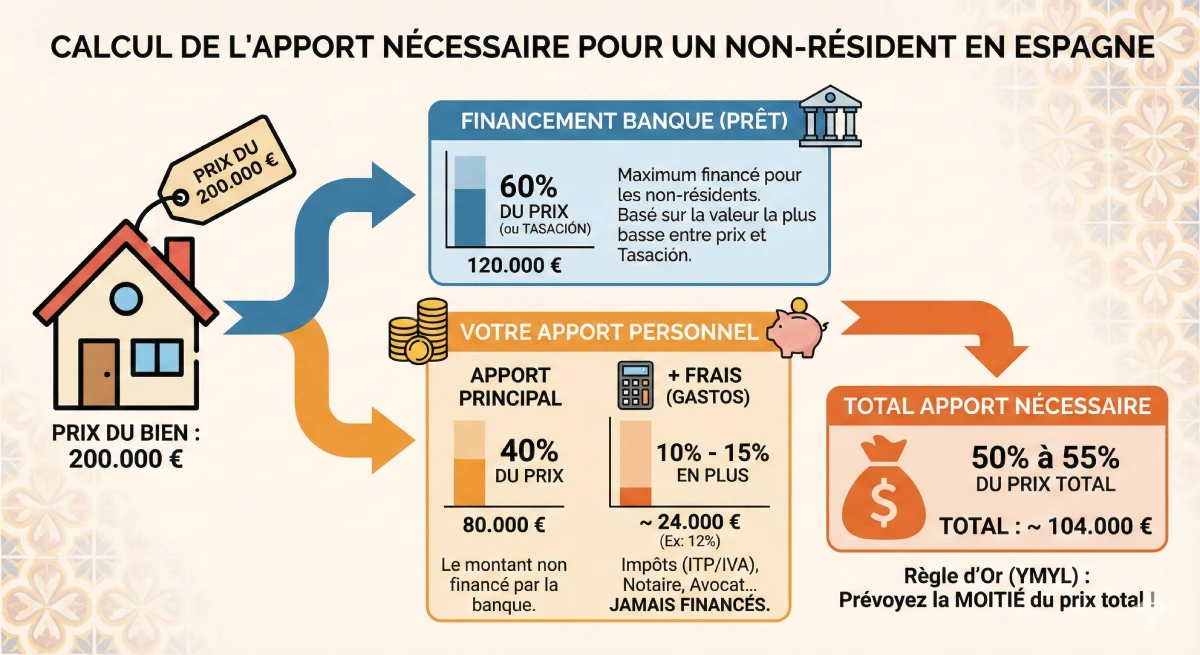

The golden rule to understand is this: Spanish banks (such as Santander, BBVA, CaixaBank, or Sabadell) finance tax residents and non-residents differently. For non-residents, the bank will only finance a maximum of 60% to 70% of the property's appraised value (the *tasación*). You therefore need a personal down payment of at least 30% to 40%, plus approximately 10-15% for associated costs (notary fees, taxes). This expert guide demystifies the process, 2025 rates, and the pitfalls to avoid.

Resident vs. Non-Resident Mortgage: The Key Distinction

Your tax status in Spain is the primary factor the bank will analyze. A tax resident (who pays taxes in Spain and lives there more than 183 days/year) obtains more favorable conditions. A non-resident (secondary home buyer) presents a higher risk for the bank, which translates into lower financing.

| Characteristic | Non-Resident Mortgage (Your Case) | Spanish Tax Resident Mortgage |

|---|---|---|

| Financing (LTV) | 60% to 70% of purchase price (or the *tasación* / appraised value) | 80% (sometimes 90%) of purchase price |

| Required Down Payment | 30% to 40% of purchase price + 10-15% in fees | 20% of purchase price + 10-15% in fees |

| Maximum Loan Term | 20 years (sometimes 25 years) | 30 years (sometimes 40 years) |

| Interest Rates | Often slightly higher | Standard rates |

Fixed or Variable Rate (Euribor): What to Choose in 2025?

In Spain, you will have the choice between two types of interest rates. Unlike some other countries where fixed rates dominate, the variable rate (`tipo variable`) has long been the norm in Spain.

- Fixed Rate (`Tipo Fijo`): The rate is fixed for the entire loan term. This is the secure option. With rising rates in 2023-2024, fixed rates offered in 2025 are higher than before, but they provide complete predictability.

- Variable Rate (`Tipo Variable`): The rate consists of a fixed bank margin (e.g., +0.7%) added to a reference index: the Euribor (12 months). If Euribor rises, your monthly payment increases. If it falls, it decreases. It's a gamble on the future.

Expert Advice

Historically, Spanish banks have favored variable rates. In 2025, many banks are offering "mixed" mortgages: a fixed rate for the first 5 or 10 years, then a switch to variable. Carefully analyze the offer: the "security" of the initial years often hides a switch to a potentially risky variable rate in the long run.

Process and Required Documents

Obtaining a mortgage in Spain is an administrative marathon. Preparation is key. You cannot apply for a mortgage if you do not already have your NIE (Número de Identificación de Extranjero - Foreigner's Identification Number). This is the first essential step.

The 6 Steps of Your Mortgage Application

- Simulation & Pre-approval: Contact several banks (Santander, CaixaBank, Sabadell, BBVA...) to obtain simulations.

- Obtaining your NIE: Essential for any administrative process.

- Signing the "Contrato de Arras" (Deposit Contract): This is the preliminary sales agreement. You pay a deposit (usually 10%).

- The "Tasación" (Property Appraisal): The bank commissions an independent expert to appraise the property's value. It is this value (the *tasación*) that serves as the basis for calculating your mortgage, not the purchase price.

- Mortgage Offer (FEIN): The bank provides you with the official offer (initially called FIPRE, then FEIN). You have a legal cooling-off period of 10 days.

- Signing at the Notary: You sign the deed of sale (*escritura*) and the mortgage deed (*hipoteca*) simultaneously.

Non-Resident Document Checklist

The bank will analyze your repayment capacity in your home country.

| Required Document | Why? |

|---|---|

| NIE (Original and copy) | Essential for signing with the notary and paying taxes. |

| Tax Returns (Last 2 years) | To prove your declared income in your country of residence. |

| Employment Contract and Last 3 Payslips | To prove income stability (permanent contract required). |

| Bank Statements (Last 6 months) | To verify your savings, down payment, and financial management. |

| Proof of Down Payment Funds | To prove the origin of funds (anti-money laundering). |

| Credit Report (e.g., from your national credit bureau) | To prove you have no outstanding debts or payment defaults. |

| Contrato de Arras (Deposit Contract) | The preliminary sales agreement for the property you wish to purchase. |

The 3 Pitfalls to Avoid (Based on Our Experience)

As experts assisting buyers, we too often see these mistakes that can be costly or jeopardize a project.

Pitfall #1: Forgetting the "Gastos" (Associated Costs)

Don't just calculate your down payment based on the property price. You must add 10% to 15% for associated costs (the *gastos*) which are **never financed by the bank**.

Example: For a €200,000 property, the bank lends 60% (€120,000).

- Your down payment for the property: €80,000

- Your associated costs (e.g., 12%): €24,000

- Total required down payment: €104,000 (which is over 50% of the purchase price!)

Pitfall #2: The Appraisal (Tasación) is Lower Than the Sales Price

The bank lends based on the lower amount between the sales price and the *tasación* (appraised value). If you buy a property for €200,000, but the expert appraises it (*tasación*) at €180,000, the bank will only lend you 60% of €180,000 (i.e., €108,000), not €120,000. Your personal down payment will need to increase by €12,000!

Pitfall #3: The "Bonificaciones" (Linked Products)

To obtain an attractive rate, the bank will often require you to subscribe to ancillary products (`productos vinculados` or `bonificaciones`). Most commonly: life insurance (`seguro de vida`) and home insurance (`seguro de hogar`) with them. The cost of these insurances, often high, must be included in your profitability calculation, as it can sometimes negate the benefit of the reduced rate.

Official Resource

Taxation and property mortgages are complex subjects. For official information on your rights as a borrower, consult the client portal of the Bank of Spain (Banco de España).

Consult the official guide on mortgage loans (Banco de España).

Conclusion

Obtaining a mortgage in Spain in 2025 is entirely possible for a non-resident, provided you are thoroughly prepared. The Spanish market operates differently: the variable rate (Euribor) is common, and the required personal down payment is the most critical point.

Remember this rule: plan for a minimum of 40% to 50% of the sales price as a personal down payment (to cover the 30-40% unfunded portion + the 10-15% in fees). By preparing your documents (NIE, tax returns) in advance and comparing offers (CaixaBank, BBVA, Santander...), you will secure your financing and avoid common pitfalls.

Need to Validate Your Financing?

Take advantage of market opportunities. Let's discuss your project.

Article Summary

- Introduction

- Resident vs. Non-Resident Mortgage: The Key Distinction

- Fixed or Variable Rate (Euribor): What to Choose in 2025?

- Process and Required Documents

- The 6 Steps of Your Mortgage Application

- Non-Resident Document Checklist

- The 3 Pitfalls to Avoid (Based on Our Experience)

- Pitfall #1: Forgetting the "Gastos" (Associated Costs)

- Pitfall #2: The Appraisal (Tasación) is Lower Than the Sales Price

- Pitfall #3: The "Bonificaciones" (Linked Products)

- Conclusion

FAQ: Spanish Mortgages for Non-Residents

Addressing Your Key Questions on Down Payments, Interest Rates (Euribor, Fixed-Rate), Banks, and Potential Financing Pitfalls in 2025.

Important YMYL (E-E-A-T) Notice

The information in this FAQ is provided for informational purposes and as expert guidance, based on our experience (E-E-A-T). Property financing is a complex YMYL (Your Money Your Life) topic. Loan conditions, interest rates, and bank policies can change. We recommend consulting a qualified financial advisor or mortgage broker for personalised advice before making any financial decisions.

This is the most important YMYL rule. Spanish banks typically only lend 60% to 70% of the property's purchase price (this is the LTV, or Loan-to-Value). Therefore, you must provide the remaining 30% to 40% as a down payment. Additionally, you need to cover the purchase costs (Stamp Duty, notary fees, legal fees, etc.) which represent an additional 10% to 15%. These costs are never financed by the bank.

(30% down payment + 10% costs) = 40% minimum.

No. The distinction is not based on nationality (EU vs non-EU) but on tax residency. If you pay your taxes in your home country (e.g., UK or US), you are considered a "non-resident" by Spanish banks, and financing will be capped at 60-70%, even if you are an EU citizen.

This is very risky. Spanish banks require proof of the origin of funds (*justificante del origen de los fondos*). If they see that your down payment is itself a debt, they may reject the application. They want to see genuine savings. Furthermore, this would increase your overall debt-to-income ratio, which is a key criterion.

Once your complete application is submitted (with your NIE number, property valuation (*tasación*), and employment contract), expect it to take between 4 and 8 weeks. The *tasación* (valuation) takes approximately one week, and the bank's legal and financial analysis takes the rest. Never sign an *arras contract* (deposit agreement) with a deadline of less than 60 days if you are reliant on a mortgage.

You can obtain simulations and non-binding pre-approvals. However, you cannot receive an official mortgage offer (the FEIN) or sign the mortgage deed before a notary without a valid NIE number. This is the number one administrative priority.

The Euribor (Euro Interbank Offered Rate) is the average interest rate at which European banks lend money to one another. It is the benchmark index for all variable-rate mortgages in Spain. Choosing a variable rate is a gamble: if Euribor falls, your monthly payments decrease. If it rises (as was the case in 2023-2024), your monthly payments can increase significantly. A fixed rate offers security.

This is a very common product in Spain. It combines both: you have a fixed interest rate for the first few years (typically 5, 10, or 15 years) to provide initial security, and then the loan automatically switches to a variable rate (Euribor + the bank's margin) for the remainder of the term.

Yes. While there's no official law, banks' risk policies are clear: the mortgage must be fully repaid before the borrower reaches 75 years of age (sometimes 80 in rare cases). If you are 60 years old, the bank will only offer you a maximum 15-year mortgage.

Spanish banks are strict. Your "tasa de esfuerzo" (debt-to-income ratio) must not exceed 30% to 35% of your net monthly income, including the new Spanish mortgage AND all your existing loans (car loans, mortgages in your home country...).

It is the buyer (borrower) who pays the valuation company (*tasadora*), even if it is mandated by the bank. The cost varies between €300 and €600 depending on the property. If the loan is refused, or if the *tasación* is too low, these fees are lost.

Legally, no. Spanish law prohibits compulsory tie-in sales of life insurance (*seguro de vida*). The only mandatory insurance is home insurance (*seguro de hogar*) against fire. However, if you refuse the bank's additional products (the *bonificaciones* or incentives), the bank has the right to penalize your interest rate by increasing it. Therefore, you need to calculate what is most cost-effective.

Spanish banks need to assess your overall indebtedness. They will typically ask for a credit report or credit history statement from your home country's credit bureaus (e.g., Experian, Equifax, TransUnion for UK/US residents). This is an official document listing all your outstanding loans. In Spain, the equivalent is called the CIRBE (Central de Información de Riesgos del Banco de España – Central Credit Register of the Bank of Spain).

For a non-resident, it is almost always preferable to go through a mortgage broker (*bróker hipotecario*) based in Spain. Traditional banks (like CaixaBank, Santander) often have local branches that rarely deal with non-residents and may not be familiar with the specific procedures. A specialised broker knows the right contacts, the banks that lend to foreign buyers (such as Sabadell or Bankinter), and will prepare your application to maximise your chances of approval.

This is very difficult as a non-resident. The bank typically finances 60-70% of the purchase value. Renovation mortgages (*hipoteca para reforma*) are different products and are more complex to obtain for non-residents. It is generally more prudent to finance your renovation work with your personal savings.

This is the most important document. It is the bank's official and binding mortgage offer, valid for a determined period. It summarises all the conditions: the interest rate, total cost, insurances, and penalties. Once you receive it, you have a legal 10-day cooling-off period before you can sign it before the notary.

On the same topic:

Our clients talk about us

Reviews from Peter Z.

"Investor for rent, Murcia"

Satisfied with my investment. Greg top. Duplex flat is good for renting, good return. Service team professional, helps a lot despite my French not perfect. Would recommend.

Reviews from Inès L.

"Happy buyer, Antequera region"

I'm a delighted buyer in Antequera! Thanks to the agency's professionalism and their invaluable advice, my purchase went off without a hitch. The beauty of the region and the quality of the support provided more than merit my 5/5 rating.

Reviews from Julien G.

"Satisfied buyer, Albarracín region"

As Belgians, we are delighted buyers in the magnificent Albarracín region. Grégory's guidance was exceptional. His in-depth knowledge of the region and its leisure activities, including the golf courses, was a real asset in confirming our choice.

Reviews from Maxence G.

Satisfied buyer, Jávea region

Reviews from Fabien D.

"Retired expatriate in Segovia"

For our retirement project in Segovia, Grégory's guidance was simply perfect. As a keen golfer, he immediately understood our expectations and found us the rare gem just a stone's throw from a magnificent course. Many thanks for his attentiveness and professionalism!

Reviews from Sarah D.

Retired expatriate in Baza

Reviews from Sébastien G.

Owner of a superb flat in Olvera.

Reviews from Mathis R.

Happy owner at Oropesa del Mar

Reviews from Constance B.

Retired expatriate in Baza

Reviews from Gilles B.

Owner of a superb flat in Formentera.

Reviews from Lucie G.

"A delighted investor in La Coruña"

As an investor, I'm absolutely delighted with my project in La Coruña. I was impressed by the quality of the advice and the in-depth knowledge of the local market. The process was extremely smooth and carried out with exemplary professionalism, which is very reassuring for an investment.

Reviews from Jules-Antoine B.

"A delighted investor in Sitges"

As a Belgian investor, I'm delighted with my project in Sitges. The agency's in-depth knowledge of the local market was a major asset in identifying the right investment. The whole process was carried out with great professionalism and efficiency, and I highly recommend it.

Reviews from Quentin P.

Owner of a superb flat in Seville.

Reviews from Édith R.

Owner of a villa in Benalmádena.

Reviews from Emma B.

"Retired expatriate in Vejer de la Frontera"

As a retired expatriate in Vejer de la Frontera, I was delighted with Loreta's support. Her expertise in administrative and legal services gave me invaluable peace of mind. Everything was handled with professionalism and warmth, thank you Loreta!

Reviews from Françoise D.

"Buyer, Guardamar del Segura"

I was very apprehensive at the start of the project, but the young lady was able to reassure me and understood my needs perfectly. The purchase was stress-free.

Reviews from Aurore L.

Happy buyer, Huéscar region

Reviews from Clovis B.

"Satisfied buyer, Carchuna region"

We're delighted buyers at Carchuna! Grégory's support was remarkable. In addition to his great professionalism, his knowledge of local golf courses was a real plus for us. We're delighted to have found the ideal property in which to enjoy our two passions.

Reviews from Jean-Pierre L.

"Owner of a villa, Costa Blanca"

Thanks to their help, I found my villa by the sea. Grégory is very friendly and always available.

Reviews from Yohan C.

"Retired expatriate in Grazalema"

Jérôme gave us excellent advice on our retirement project in Grazalema. His expertise in the upmarket market and his mastery of the financial aspects were a real asset in securing our investment. We're delighted to be starting this new life with complete peace of mind.

Reviews from Inès B.

Owner of a superb flat in Orihuela.

Reviews from Valérie V.

"Happy owner in Malaga"

We're finally homeowners in Malaga and we couldn't have hoped for better support. Jérôme's financial expertise and knowledge of the upmarket market enabled us to make our investment with complete peace of mind. Many thanks to him for his professionalism and invaluable advice.

Reviews from Cassandra R.

Owner of a superb flat in Ripoll.

Reviews from Anaëlle N.

Owner of a villa in Archidona.

Reviews from Marie D.

"Happy homeowner in Alicante"

Very happy, an impeccable experience! Grégory was attentive and very professional from start to finish. I would highly recommend him.

Reviews from Lola D.

"Happy owner in Huéscar"

We're finally homeowners in Huéscar and the experience has been perfect. Jérôme's support was essential; his financial expertise enabled us to secure our project with complete confidence and peace of mind. His professionalism and knowledge of the upmarket market are invaluable assets.

Reviews from Sandrine B.

"A delighted investor in Marchena"

As an investor, I am absolutely delighted with my project in Marchena. Grégory's support was exceptional; his knowledge of the region's assets, including the magnificent golf courses, was a real plus for my investment. His professionalism and sound advice are invaluable.

Reviews from Julia P.

"Owner, Santa Pola"

My husband and I are extremely satisfied with the service. We were able to buy our Atico in record time! Many thanks to Jérôme

Reviews from Charlotte C.

"Happy buyer, Cartagena region"

As Belgians, we are delighted buyers in the magnificent Cartagena region. For this first project in Spain, we particularly appreciated the quality of the agency's advice and professionalism. The process was smooth and reassuring from start to finish - a real pleasure!

Reviews from Marie L.

A delighted investor in Barcelona

Reviews from Marion R.

"Owner of a villa in Sayalonga."

We finally own our villa in Sayalonga! A huge thank you to Loreta, whose expertise was invaluable. Her rigorous management of all the administrative and legal aspects enabled us to complete our project with complete peace of mind. It's a real pleasure to have been so well looked after.

Reviews from Myriam M.

"Retired Belgian expatriate, Benidorm"

During my first visit, I had very precise expectations, but I realised that I hadn't communicated my criteria properly. After clarification, Freddy was able to better target my wishes and guide me effectively.

Reviews from Anouk D.

Owner of a superb flat in Torrox.

Reviews from Jérémy B.

Owner of a superb flat in Cadaqués.

Reviews from David G.

Owner of a villa in Santa Pola.

Reviews from Hélène R.

Retired expatriate in Salamanca

Reviews from Aurore B.

Owner of a villa in San Fernando.

Reviews from Sébastien D.

"Owner of a villa in Ibiza."

I'm a DJ and it's really a dream come true thanks to Jérome... thank you my Bro