Tax Resident vs. Non-Resident: IRNR Guide 2025

Introduction

\r\nPurchasing property in Spain is a dream for many, but it comes with a complex administrative reality. The most important and critical question is your tax status. Are you considered a \"tax resident\" or a \"non-resident\"? This distinction is not a choice; it is a legal status determined by precise rules.

\r\nUnderstanding this difference is fundamental because it determines not only the type of tax you will pay but also the extent of your obligations to the Hacienda (the Spanish tax authority). A non-resident will pay the IRNR (Impuesto sobre la Renta de No Residentes), while a resident will pay IRPF. As experts assisting buyers, we demystify this subject to secure your investment.

\r\nHow Does Spain Determine Your Tax Residency?

\r\nThe Spanish tax administration (Agencia Tributaria) relies on clear criteria to determine if you are a tax resident in Spain. Simply holding a \"green card\" (CRUE) or a TIE does not automatically make you a *tax* resident. Your de facto situation is paramount.

\r\nThe 183-Day Rule (Primary Criterion)

\r\nThis is the most well-known and simplest criterion to verify. You are considered a tax resident in Spain if you spend more than 183 days in Spanish territory during a calendar year (from January 1st to December 31st). Temporary or \"sporadic\" absences are not deducted, unless you can prove your tax residency in another country.

\r\nCentre of Economic or Vital Interests (Secondary Criteria)

\r\nEven if you spend less than 183 days in Spain, you may be considered a tax resident if:

\r\n- \r\n

- ✅ The main nucleus of your economic activities (your job, your business) is located in Spain. \r\n

- ✅ Your unseparated spouse and minor children habitually reside in Spain (this is the presumption of \"centre of vital interests\"). \r\n

| Status | \r\nPrimary Criterion | \r\nSecondary Criterion | \r\n

|---|---|---|

| Tax Resident | \r\nSpends +183 days in Spain (per year) | \r\nOR the centre of their economic/vital interests is in Spain. | \r\n

| Non-Tax Resident | \r\nSpends -183 days in Spain (per year) | \r\nAND the centre of their economic/vital interests is not in Spain. | \r\n

IRPF vs. IRNR: The Fundamental Impact on Your Taxes

\r\nOnce your status is determined, your tax obligations change radically. This is the difference between being taxed on your Spanish income only or on your worldwide income.

\r\n

| Characteristic | \r\nTax Resident (IRPF) | \r\nNon-Tax Resident (IRNR) | \r\n

|---|---|---|

| Tax Payable | \r\nIRPF (Income Tax for Individuals) | \r\nIRNR (Non-Resident Income Tax) | \r\n

| Taxable Base | \r\nWORLDWIDE Income (salaries, pensions, rents, dividends... regardless of country) | \r\nSPANISH-SOURCE Income ONLY (e.g., rent from a property in Spain) | \r\n

| Rate Type | \r\nProgressive scale (by brackets, similar to UK/US) | \r\nFixed rate (generally 19% for EU/EEA residents, 24% for others) | \r\n

| Declaration | \r\nAnnual declaration (Declaración de la Renta) | \r\nDeclaration via Modelo 210 (occasional or annual) | \r\n

Focus: What is IRNR for a Non-Resident Property Owner?

\r\nThis is where the main challenge lies for a non-resident property buyer. As a non-resident owner of a property in Spain, you must pay IRNR, and this is true **even if you do not rent out your property**.

\r\n

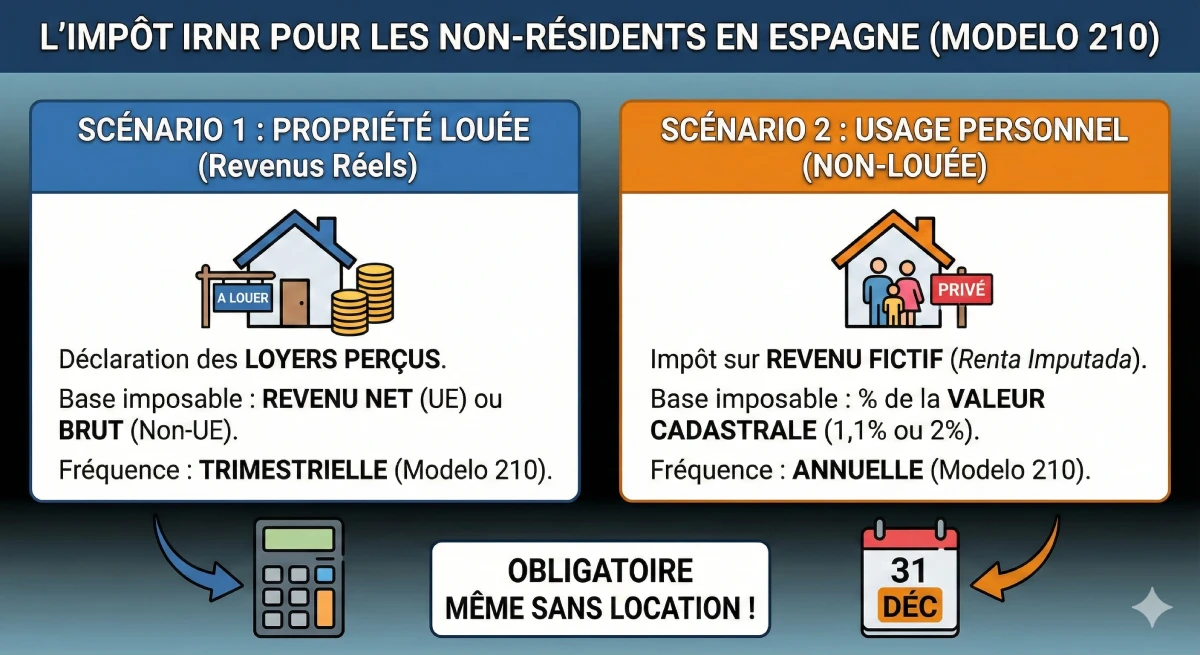

Scenario 1: You Rent Out Your Property

\r\nIf you rent out your property (short-term or long-term rental), you must declare the rents received. You will be taxed on the net income (if an EU resident) or gross income (non-EU resident). This declaration is made via Modelo 210 on a quarterly basis.

\r\nScenario 2: You Do Not Rent Out Your Property (Personal Use)

\r\nThis is often the most challenging concept for a foreign national to grasp. The Hacienda considers that merely owning a property provides you with a \"benefit\" or \"deemed income\" (renta imputada). Therefore, you must pay tax on this deemed income.

\r\n- \r\n

- Calculation Base: The tax is calculated on a percentage of the \"valor catastral\" (cadastral value) of your property, which you will find on your property tax notice (IBI). \r\n

- Rate: The deemed income is generally 1.1% or 2% of the cadastral value. \r\n

- Payment: You pay IRNR on this deemed income (at the fixed rate of 19% or 24%). This declaration is made via Modelo 210 on an annual basis (before December 31st of the following year). \r\n

\r\n\r\nExpert Tip: The Mistake to Avoid

\r\nMany non-resident owners \"forget\" to pay IRNR (especially the deemed income tax, as the Hacienda does not actively demand it every year). This is a serious error. The day you want to sell your property, the notary will verify if your payments are up to date. You will have to pay the last 4 years of outstanding IRNR, plus interest and late payment penalties, directly from your sale price.

\r\n

Official Resource & Disclaimer

\r\nTaxation is a complex subject that depends on your personal situation and the double taxation agreements between Spain and your country of origin. This article provides general expertise but does not replace personalized advice.

\r\nWe strongly recommend engaging an \"asesor fiscal\" (tax advisor) or a \"gestoría\" to manage your declarations. For official information, consult the portal of the Agencia Tributaria (Hacienda): Official IRNR Portal.

\r\nConclusion

\r\nThe difference between being a tax resident and a non-resident in Spain boils down to a simple rule: do you spend more or less than 183 days per year in the country? The answer to this question has major tax implications. If you are a resident, you declare your worldwide income via IRPF. If you are a non-resident, you only declare your Spanish-source income (including the deemed income from your property) via IRNR (Modelo 210).

\r\nFailing to declare and pay IRNR is a common mistake that can be very costly when reselling your property. Proper tax planning with an expert is as important as choosing your property for a successful investment in Spain.

Unsure About Your Tax Status?

Take advantage of market opportunities. Let's discuss your project.

Article Summary

- Introduction

- How Does Spain Determine Your Tax Residency?

- The 183-Day Rule (Primary Criterion)

- Centre of Economic or Vital Interests (Secondary Criteria)

- IRPF vs. IRNR: The Fundamental Impact on Your Taxes

- Focus: What is IRNR for a Non-Resident Property Owner?

- Scenario 1: You Rent Out Your Property

- Scenario 2: You Do Not Rent Out Your Property (Personal Use)

- Conclusion

FAQ: Tax Residency and Non-Resident Income Tax (IRNR) in Spain

Additional questions regarding the distinction between tax residents and non-residents, and IRNR obligations for property owners.

YMYL (Your Money Your Life) & E-E-A-T Disclaimer

The information provided in this FAQ is for general informational purposes only. Taxation is a complex subject (YMYL) that depends on your personal situation and international double taxation treaties. This article does not constitute tax advice and should not replace consultation with a qualified professional (tax lawyer or *asesor fiscal*).

A tax resident (who pays IRPF, Spanish Personal Income Tax) is taxed in Spain on their worldwide income (salaries, pensions, rental income from all countries). A non-resident (who pays IRNR, Non-Resident Income Tax) is taxed in Spain only on their Spanish-sourced income (e.g., rental income generated in Spain).

Not automatically. The CRUE (Certificado de Registro de Ciudadano de la Unión) or TIE (Tarjeta de Identidad de Extranjero) proves your administrative residency. Hacienda (the Spanish tax authority) bases its assessment on facts: if you spend more than 183 days in Spain, you are a tax resident, regardless of whether you hold the card. However, applying for a CRUE or TIE indicates to the administration your intention to live in Spain, which is a significant indicator of your tax residency.

Hacienda can cross-reference numerous data points: your electricity and water consumption, bank withdrawals, flight tickets, your registration on the *padrón* (Empadronamiento - municipal register), social security affiliation, your children's school enrollment, etc. The burden of proof lies with you: it's up to you to prove that you spent *less* than 183 days in Spain if the tax authorities request it.

IRPF (Impuesto sobre la Renta de las Personas Físicas) is the Spanish Personal Income Tax for tax residents. It is a progressive tax (the rate increases in brackets, similar to income tax systems in many countries) that applies to all your worldwide income (salaries, pensions, rental income, capital gains, etc.).

IRNR (Impuesto sobre la Renta de No Residentes) is the Non-Resident Income Tax. It applies solely to income generated in Spain. For a property owner, this includes rental income received (scenario 1) or an imputed income tax on the property if it is not rented out (scenario 2).

No. You must declare your pension in Spain, but thanks to the Double Taxation Treaties signed between Spain and your home country, you will not be taxed twice. Depending on the nature of the pension (private or public), it will either be taxed solely in your country of origin or taxed in Spain with a tax credit equivalent to what you have already paid at source. This is a complex matter that should be discussed with an *asesor fiscal* (tax advisor).

For citizens of the EU/EEA (Iceland, Norway, Liechtenstein) and Switzerland, the fixed IRNR rate is 19%. For citizens of other countries (e.g., UK post-Brexit, Canada, USA), the fixed rate is 24%.

A major advantage for EU/EEA residents is that you pay 19% on your net income. You can deduct expenses proportional to the rental (e.g., mortgage interest, IBI, community fees, insurance, utility bills...). Non-EU/EEA residents (e.g., UK citizens, Americans) are taxed at 24% on the gross income, without deduction of expenses.

This is the concept of "renta imputada" (imputed income). Hacienda considers that simply owning a second home at your disposal (which you *could* rent out) constitutes a "benefit in kind" or "notional income". You are therefore taxed on this "imputed rental income" that you 'pay' to yourself. It is a legal obligation.

The Modelo 210 is the official tax form you must use to declare and pay the IRNR (Non-Resident Income Tax). You use it quarterly if you rent out your property, or once a year (by December 31st) if you are paying the imputed income tax (for personal use).

The "Valor Catastral" is the administrative value of your property, registered with the Spanish Cadastre (*Catastro*). It is significantly lower than the market price. You will find it on your annual property tax notice, the IBI (Impuesto sobre Bienes Inmuebles - Council Tax/Local Property Tax). This value serves as the basis for calculating the imputed income tax (IRNR) for non-residents.

Generally, the imputed income is 1.1% of the cadastral value (if it has been recently revised) or 2% (otherwise). You then pay 19% (if EU/EEA citizen) or 24% (if non-EU/EEA citizen) on this amount.

Example: Cadastral value of €100,000. Imputed income (1.1%) = €1,100. IRNR tax to pay: If EU/EEA citizen, 19% of €1,100 = €209 per year. If non-EU/EEA citizen (e.g., UK/US investor), 24% of €1,100 = €264 per year.

Hacienda can claim for the last 4 years. If you are audited, you will have to pay the last 4 outstanding declarations, plus a penalty (*sanción*) and late payment interest (*recargo*).

Yes. This is a critical point. When selling, the Spanish notary public will require proof of IRNR payments for the last 4 years. If you do not have them, the sale may be blocked, or the notary public will withhold the amount due (with penalties) from your sale price to pay it directly to Hacienda. You will lose money.

As experts (E-E-A-T), we strongly advise against it. Spanish taxation is complex. We recommend all our clients to appoint an "asesor fiscal" (tax advisor) or a "gestoría" (administrative agency). For a modest annual fee, they will manage your declarations (Modelo 210, etc.), ensure you are compliant, and optimize your situation, providing complete peace of mind.

On the same topic:

Our clients talk about us

Reviews from Peter Z.

"Investor for rent, Murcia"

Satisfied with my investment. Greg top. Duplex flat is good for renting, good return. Service team professional, helps a lot despite my French not perfect. Would recommend.

Reviews from Inès L.

"Happy buyer, Antequera region"

I'm a delighted buyer in Antequera! Thanks to the agency's professionalism and their invaluable advice, my purchase went off without a hitch. The beauty of the region and the quality of the support provided more than merit my 5/5 rating.

Reviews from Julien G.

"Satisfied buyer, Albarracín region"

As Belgians, we are delighted buyers in the magnificent Albarracín region. Grégory's guidance was exceptional. His in-depth knowledge of the region and its leisure activities, including the golf courses, was a real asset in confirming our choice.

Reviews from Maxence G.

Satisfied buyer, Jávea region

Reviews from Fabien D.

"Retired expatriate in Segovia"

For our retirement project in Segovia, Grégory's guidance was simply perfect. As a keen golfer, he immediately understood our expectations and found us the rare gem just a stone's throw from a magnificent course. Many thanks for his attentiveness and professionalism!

Reviews from Sarah D.

Retired expatriate in Baza

Reviews from Sébastien G.

Owner of a superb flat in Olvera.

Reviews from Mathis R.

Happy owner at Oropesa del Mar

Reviews from Constance B.

Retired expatriate in Baza

Reviews from Gilles B.

Owner of a superb flat in Formentera.

Reviews from Lucie G.

"A delighted investor in La Coruña"

As an investor, I'm absolutely delighted with my project in La Coruña. I was impressed by the quality of the advice and the in-depth knowledge of the local market. The process was extremely smooth and carried out with exemplary professionalism, which is very reassuring for an investment.

Reviews from Jules-Antoine B.

"A delighted investor in Sitges"

As a Belgian investor, I'm delighted with my project in Sitges. The agency's in-depth knowledge of the local market was a major asset in identifying the right investment. The whole process was carried out with great professionalism and efficiency, and I highly recommend it.

Reviews from Quentin P.

Owner of a superb flat in Seville.

Reviews from Édith R.

Owner of a villa in Benalmádena.

Reviews from Emma B.

"Retired expatriate in Vejer de la Frontera"

As a retired expatriate in Vejer de la Frontera, I was delighted with Loreta's support. Her expertise in administrative and legal services gave me invaluable peace of mind. Everything was handled with professionalism and warmth, thank you Loreta!

Reviews from Françoise D.

"Buyer, Guardamar del Segura"

I was very apprehensive at the start of the project, but the young lady was able to reassure me and understood my needs perfectly. The purchase was stress-free.

Reviews from Aurore L.

Happy buyer, Huéscar region

Reviews from Clovis B.

"Satisfied buyer, Carchuna region"

We're delighted buyers at Carchuna! Grégory's support was remarkable. In addition to his great professionalism, his knowledge of local golf courses was a real plus for us. We're delighted to have found the ideal property in which to enjoy our two passions.

Reviews from Jean-Pierre L.

"Owner of a villa, Costa Blanca"

Thanks to their help, I found my villa by the sea. Grégory is very friendly and always available.

Reviews from Yohan C.

"Retired expatriate in Grazalema"

Jérôme gave us excellent advice on our retirement project in Grazalema. His expertise in the upmarket market and his mastery of the financial aspects were a real asset in securing our investment. We're delighted to be starting this new life with complete peace of mind.

Reviews from Inès B.

Owner of a superb flat in Orihuela.

Reviews from Valérie V.

"Happy owner in Malaga"

We're finally homeowners in Malaga and we couldn't have hoped for better support. Jérôme's financial expertise and knowledge of the upmarket market enabled us to make our investment with complete peace of mind. Many thanks to him for his professionalism and invaluable advice.

Reviews from Cassandra R.

Owner of a superb flat in Ripoll.

Reviews from Anaëlle N.

Owner of a villa in Archidona.

Reviews from Marie D.

"Happy homeowner in Alicante"

Very happy, an impeccable experience! Grégory was attentive and very professional from start to finish. I would highly recommend him.

Reviews from Lola D.

"Happy owner in Huéscar"

We're finally homeowners in Huéscar and the experience has been perfect. Jérôme's support was essential; his financial expertise enabled us to secure our project with complete confidence and peace of mind. His professionalism and knowledge of the upmarket market are invaluable assets.

Reviews from Sandrine B.

"A delighted investor in Marchena"

As an investor, I am absolutely delighted with my project in Marchena. Grégory's support was exceptional; his knowledge of the region's assets, including the magnificent golf courses, was a real plus for my investment. His professionalism and sound advice are invaluable.

Reviews from Julia P.

"Owner, Santa Pola"

My husband and I are extremely satisfied with the service. We were able to buy our Atico in record time! Many thanks to Jérôme

Reviews from Charlotte C.

"Happy buyer, Cartagena region"

As Belgians, we are delighted buyers in the magnificent Cartagena region. For this first project in Spain, we particularly appreciated the quality of the agency's advice and professionalism. The process was smooth and reassuring from start to finish - a real pleasure!

Reviews from Marie L.

A delighted investor in Barcelona

Reviews from Marion R.

"Owner of a villa in Sayalonga."

We finally own our villa in Sayalonga! A huge thank you to Loreta, whose expertise was invaluable. Her rigorous management of all the administrative and legal aspects enabled us to complete our project with complete peace of mind. It's a real pleasure to have been so well looked after.

Reviews from Myriam M.

"Retired Belgian expatriate, Benidorm"

During my first visit, I had very precise expectations, but I realised that I hadn't communicated my criteria properly. After clarification, Freddy was able to better target my wishes and guide me effectively.

Reviews from Anouk D.

Owner of a superb flat in Torrox.

Reviews from Jérémy B.

Owner of a superb flat in Cadaqués.

Reviews from David G.

Owner of a villa in Santa Pola.

Reviews from Hélène R.

Retired expatriate in Salamanca

Reviews from Aurore B.

Owner of a villa in San Fernando.

Reviews from Sébastien D.

"Owner of a villa in Ibiza."

I'm a DJ and it's really a dream come true thanks to Jérome... thank you my Bro

Estimated Annual Taxes

Calculating...