NIE complete guide 2025: the key to everything in Spain

⚠️ Penalties for not having an NIE

Find out about the real consequences and concrete examples of what happens without an NIE when taking steps in Spain

🏠 Property penalties

Transaction cancelled by the notary

Legal basis: Article 17 of the Spanish Mortgage Law. The notary cannot authenticate a deed without full tax identification of all parties.

📋 Specific examples

Case 1: Purchase of a Costa Blanca flat

Situation: Mr Dupont signs a promise to purchase a flat for €180,000 in Torrevieja without a NIE.

❌ Consequences:

- Notary signature impossible

- Deposit of €18,000 blocked for 3 months

- Lawyer's fees: €1,500

- Late payment penalties to seller: €2,000

Case 2: Sale of Alicante villa

Situation : Mrs Martin wants to sell her inherited villa worth €320,000 without having updated her NIE.

❌ Consequences:

- Sale cancelled 2 times

- Negotiated price reduction: -15 000€

- Resale costs: €3,200

- Time lost: 8 months

Case 3: Rental investment

Situation : Mr Leblanc buys 3 flats in Benidorm for seasonal rental (total €450,000).

❌ Consequences:

- Total blocking of the 3 transactions.

- Failed summer season (loss: €25,000).

- Cancellation of tourist licences

- Additional bank charges: €2,800

Case 4: Family inheritance

Situation : Rodriguez family inherits a house in Alicante (€280,000) with no NIE from the heirs.

❌ Consequences:

- Inheritance blocked for 6 months

- Inheritance tax increased: +€4,200

- Notary fees doubled

- Family conflicts and stress

💡 What the notary says

"Without a NIE, we cannot legally proceed with any deed of sale or purchase. It's an absolute legal requirement, not a mere formality."

📋 Administrative penalties

Fines of up to €10,000

Legal basis: Article 53.1 of Organic Law 4/2000 on the rights and freedoms of foreigners in Spain.

| Offence | Amount of fine | Time limit for regularisation | Example |

|---|---|---|---|

| Lack of NIE for economic activity | 500€ - 10 000€ | 30 days | Work without an NIE detected during an inspection |

| Expired NIE not renewed | 300€ - 3 000€ | 15 days | Roadside check with expired documents |

| Transaction > €10,000 without NIE | 1 000€ - 10 000€ | Immediate | Purchase of luxury vehicle without identification |

| Fraudulent opening of bank account | 2 000€ - 10 000€ | 7 days | Account opened with false documents |

of penalties can be avoided with an up-to-date NIE

average time taken to obtain NIE

official cost of the NIE (model fee 790)

🏦 Banking sanctions

Account frozen or closed

Regulations: European anti-money laundering directive and Law 10/2010 on the prevention of money laundering in Spain.

Bank freezing procedure

Automatic check NIE missing/expired

Email/mail of formal notice

Blocking of transfers > €3,000

Permanent closure of account

Customer testimonial

"My Santander account was frozen overnight. I had €25,000 frozen for 6 weeks while I got my NIE. I missed my property deposit and almost lost my dream home in Altea."

💡 Quick solution

As soon as the NIE is received, presentation in the bank branch + release within 48-72 working hours.

✅ Avoid all these penalties

Anticipate your NIE application before taking any important steps in Spain. Our team will help you to obtain it quickly. To speed up the process, we have developed an automated bot dedicated to making appointments.

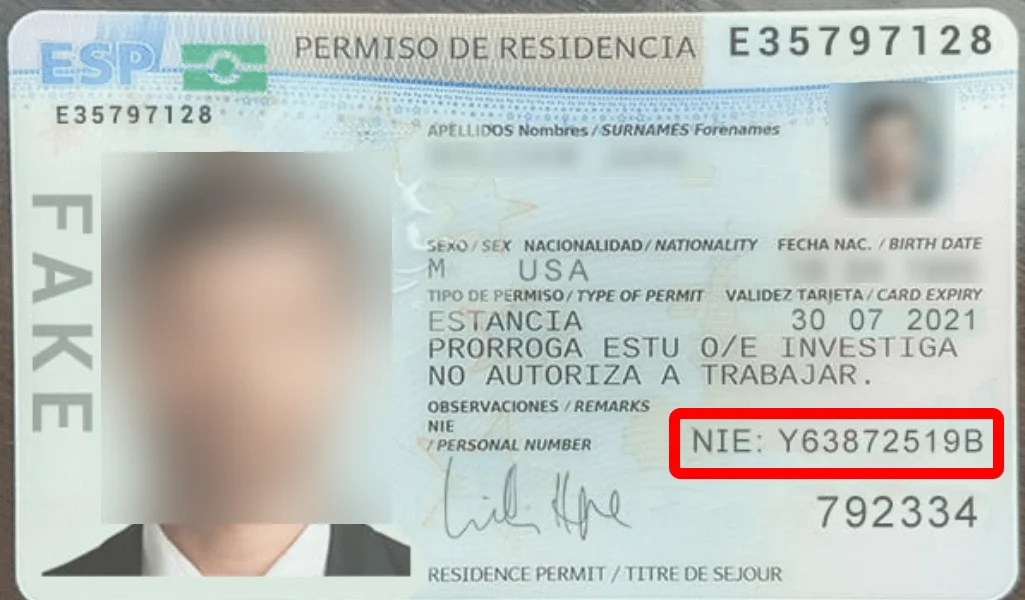

What is the NIE?

NIE stands for Número de Identificación de Extranjero. It is a personal, unique and compulsory number assigned to foreigners who have economic, professional or social interests in Spain.

It is much more than just an identification number: it is the central administrative management tool for all foreign nationals in Spain.

What is the NIE used for in Spain?

Property transactions

Buying, selling or renting property

Banking services

Opening bank accounts

Employment and work

Signing employment contracts

Tax obligations

Payment of taxes and contributions

Why is the EIN compulsory?

The NIE enables the Spanish State to :

- 🏛️ Tax traceability: Link any economic activity to taxes (IRPF, VAT, capital gains)

- 🔍 Anti-money laundering: Any transaction over €10,000 must mention the NIE

- 📊 Demographic statistics: Data for public policies

The NIE verifies eligibility for :

- 🏥 Health services and social security

- 🎓 S panish education system

- 💼 Social security contributions and tax returns

- 🚗 Driving licences and registration

Who needs to obtain an NIE?

✅ Persons concerned

| 🏠 Property buyers | Notary signature, ITP taxes, Register entry |

| 💼 Workers | Employment contracts, social security contributions |

| 🏢 Entrepreneurs | Setting up a business, business accounts |

| 🎓 Students | Courses > 3 months, student accommodation |

| 🏡 Residents | Utilities, utility contracts |

❌ Who does NOT need a NIE?

- 🧳 Tourists: Stays < 90 days (except property purchase).

- 🏛️ Diplomats on official business

⚠️ Sanctions

- Real estate: Transaction cancelled

- Administrative: Fines of up to €10,000

- Banking: Account frozen or closed

How do I obtain an NIE?

🇪🇸 From Spain

Apply to an Oficina de Extranjeros

🇫🇷 From abroad

Via the Spanish consulate in your country

📋 Documents required

Completed and signed

Passport or EU card

Promise to buy, contract, etc.

Frequently asked questions about the NIE

Everything you need to know about the Identification Number for Foreigners in Spain.

NIE stands for Número de Identificación de Extranjero. It is a personal, unique and compulsory number issued to foreign nationals who have economic, professional or social interests in Spain. It is the central administrative management tool for all foreign nationals in Spain.

Yes, for any transaction - purchase, rental or professional activity - the NIE is essential. If you are resident in Spain for more than three months, you must also apply for the Certificado de registro (often called the "permanent NIE"). This certificate attests to your status as a resident of the European Union and must be applied for at an Oficina de Extranjeros or a Spanish police station.

The NIE is essential for a number of procedures in Spain, including

- Property transactions: Buying, selling or renting property.

- Banking services: Opening bank accounts.

- Employment and work: signing employment contracts.

- Tax obligations: Payment of taxes and contributions.

- Access to public services: health, education, driving licence, etc.

The NIE is compulsory for several key reasons:

- Fiscal control and transparency: It enables the Spanish State to ensure the fiscal traceability of all economic activity and to combat money laundering.

- Management of rights and duties: It verifies eligibility for health services, the Spanish education system, social security contributions and other administrative rights and duties.

The following people must obtain an NIE:

- Property buyers, sellers or tenants.

- Workers and entrepreneurs.

- Students (for stays of more than 3 months).

- Residents who need to access public services and sign utility contracts.

Tourists staying for less than 90 days (except for property purchases) and diplomats on official business generally do not need an NIE.

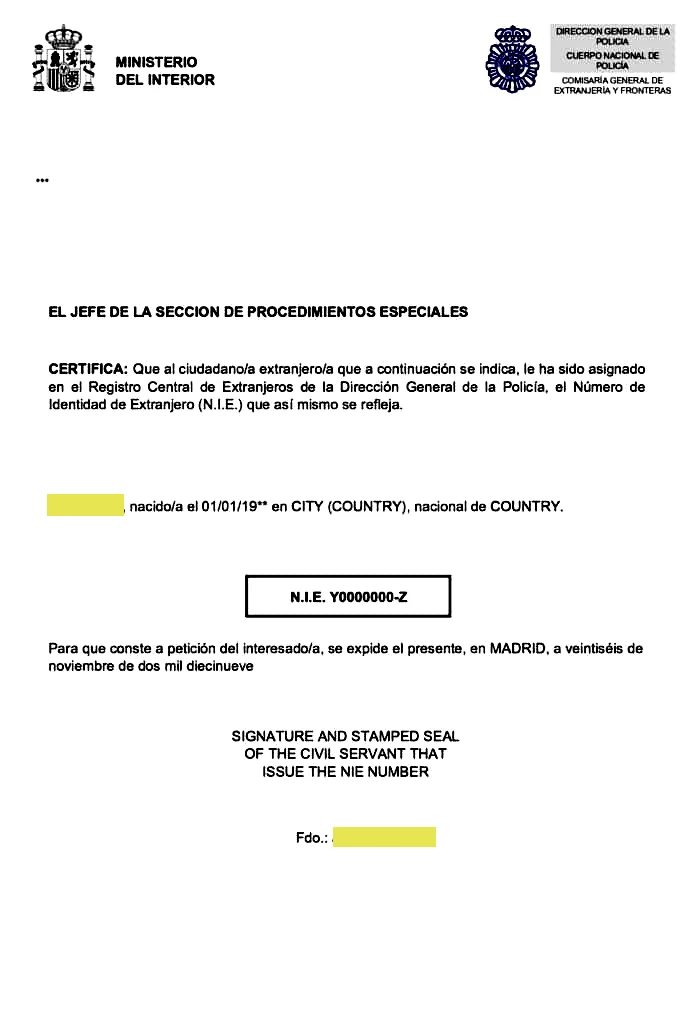

There are two main ways of obtaining an NIE:

- From Spain: By applying to an Oficina de Extranjeros.

- From abroad: Via the Spanish consulate in your country of residence.

It is advisable to apply for your NIE before taking any important steps in Spain to avoid penalties.

To obtain an NIE from France, you must apply to the nearest Spanish consulate. You need to fill in form EX-15, provide your passport or identity document, and justify the reason for your application (property purchase, work contract, etc.). An appointment is often necessary.

🏠 Need help with your property project?

Are you looking for personalised assistance with your property project in Spain? We are an estate agency in Alicante dedicated to French speakers, offering tailor-made services that are perfectly suited to your needs.

From obtaining the NIE to signing at the notary's office, we can help you with all the steps you need to take to make your project a reality with complete peace of mind.