Guide: How to Renegotiate Your Spanish Mortgage Rate (Novación vs Subrogación)

Introduction

Do you have an active mortgage with a Spanish bank (Santander, CaixaBank, BBVA...) and notice that current rates are significantly lower than what you signed for? This is a frustrating financial situation that could cost you tens of thousands of euros over the life of your loan. In some countries, this is known as "refinancing"; in Spain, the procedure is different and based on two key concepts: Novación (negotiating with your current bank) and Subrogación (switching banks).

The bad news is that, in 90% of cases, your current bank will refuse to renegotiate: this is "novación." They are under no obligation to do so and prefer to keep your rate high. The good news is that Spanish law greatly facilitates the second option: "subrogación," or the transfer of your mortgage to a competing bank offering you a better rate. This guide explains how to analyze your situation and which method to use to save on your monthly payments.

When Should You Renegotiate Your Mortgage in Spain?

Renegotiating a mortgage is not always profitable. It involves costs (fees, penalties). As experts, we recommend considering it only if you meet these conditions:

- ✅ The rate difference is significant: The general rule is that there should be a difference of at least 0.75% to 1.0% between your current rate and current fixed or variable rates (Euribor + margin).

- ✅ You are early in your loan term: Renegotiation is most profitable during the first third of the loan's life. This is when you pay the most interest.

- ✅ Your financial profile is strong: You must have an excellent payment history, stable income (permanent employment, pensions...), and a healthy debt-to-income ratio.

The Dilemma: Fixed Rate vs. Variable Rate (Euribor)

Most renegotiation requests concern two profiles:

- You have a high fixed rate: You purchased in 2023-2024 with a fixed rate of 4.0%, and current fixed rates are at 3.0%. You want to switch to a lower fixed rate.

- You have an expensive variable rate: You have an older variable-rate mortgage with a high margin (diferencial) (e.g., Euribor + 1.5%). You want to transfer it for a cheaper variable rate (e.g., Euribor + 0.5%) or, conversely, secure it with a fixed rate.

Method 1: Novación (Negotiating with Your Current Bank)

"Novación" (novation) involves asking your own bank to modify the terms of your current mortgage. It is the simplest, quickest, and cheapest solution.

You arrange an appointment with your advisor (gestor) and request a reduction in your interest rate (`tipo de interés`), leveraging your strong financial profile and competitor offers. Unfortunately, it is also the least effective method. The bank has no legal obligation to accept and, in most cases, will refuse or offer only a minimal reduction.

| Advantages of Novación | Disadvantages of Novación |

|---|---|

| ✅ Very few fees (no new appraisal, no notary fees if a simple agreement). | ❌ The bank has the absolute power to refuse. |

| ✅ Speed (if the bank accepts). | ❌ The bank may demand additional commitments (e.g., subscribing to life insurance, an alarm system...). |

Method 2: Subrogación (Switching Banks)

This is the most powerful tool for borrowers in Spain. "Subrogación de acreedor" (subrogation) involves transferring your existing mortgage to a new bank. The new bank "buys out" your debt from the old bank and applies its own conditions (a better rate).

This process is highly regulated by Spanish law to protect consumers. Your previous bank cannot refuse the transfer. It is your right.

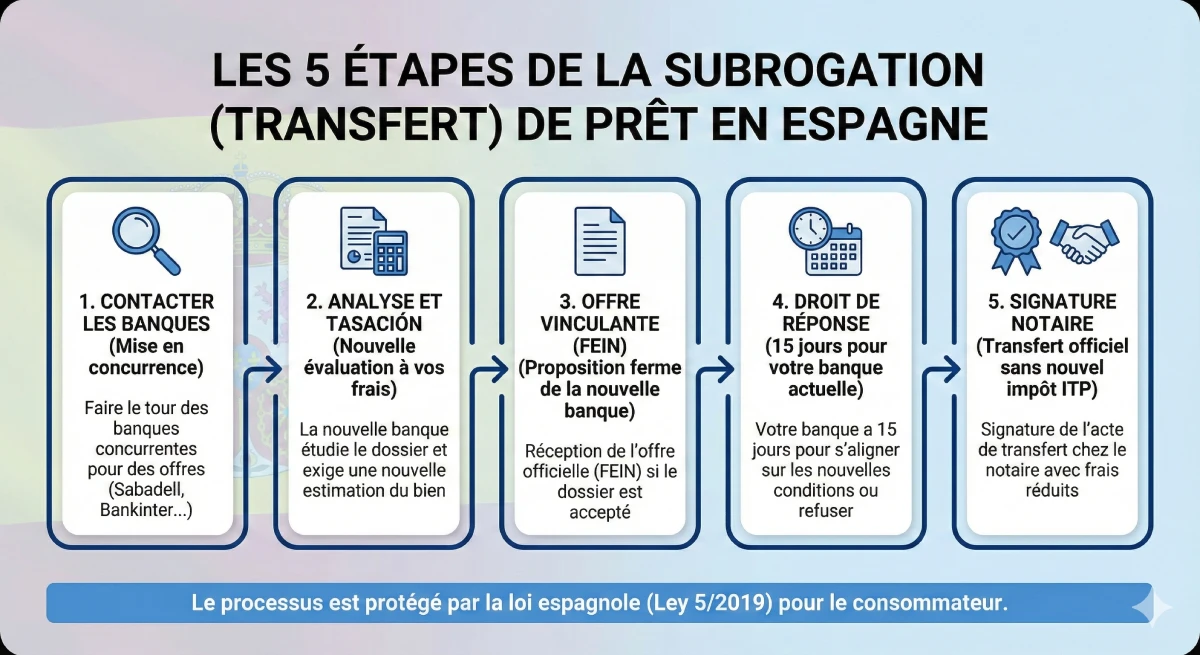

The Subrogación Process Step-by-Step

Here's how a mortgage transfer unfolds in Spain:

- Contact competing banks: You approach other banks (Sabadell, Bankinter, ING...) to obtain subrogation offers.

- File analysis: The new bank will review your profile (income, debt, credit report (CIRBE)) just as for a new loan. They will require a new "tasación" (appraisal) of the property at your expense.

- The Binding Offer (FEIN): If the bank accepts, it will send you a firm offer (the FEIN).

- The "Right of Reply" (15 days): The new bank officially notifies your current bank. Your current bank then has 15 calendar days to make you a counter-offer and match the new conditions.

- The Final Decision:

- If your bank matches (which is rare), you stay with them at the new rate (this is a forced *novación*).

- If they do not respond or refuse, you are free to leave.

- Signing at the Notary: You sign the transfer with the notary. You do not have to pay the ITP tax a second time; the fees are significantly reduced.

Costs and Risks of Renegotiation

Before you start, you must calculate the profitability. Renegotiation is not free. Your primary cost will be the early repayment penalty on your old loan.

| Anticipated Fees | Novación (Same Bank) | Subrogación (Switching Banks) |

|---|---|---|

| Appraisal (Tasación) | Not required | Yes (Mandatory) (Cost: €300 - €500) |

| Early Repayment Penalty | No (unless stipulated) | Yes (The main cost). Capped by law, but check your contract. |

| Notary / Gestoría Fees | Reduced fees | Reduced fees (largely paid by the new bank) |

| Arrangement Fee (Comisión de Apertura) | No | Sometimes (negotiable, often €0) |

Expert Advice: Beware of the Early Repayment Penalty

The most important point in your calculation is the "comisión por cancelación anticipada" (early repayment penalty) on your current loan. Spanish law caps it, but for recent fixed-rate mortgages, it can reach 2% of the outstanding capital during the first 10 years. Calculate whether the rate savings over 2-3 years cover this initial cost.

Official Resource

The mortgage transfer process is a right protected by Spanish mortgage credit law (*Ley 5/2019*). For official and neutral information on your rights, consult the customer portal of the Bank of Spain (Banco de España).

Consult your rights to change your mortgage (Banco de España).

Conclusion

Renegotiating your mortgage rate in Spain is not only possible but it is a right. Do not expect much from a simple negotiation with your current bank (Novación). The real solution is to leverage competition and initiate a Subrogación (switching banks) procedure.

This is an administrative process that requires preparation. You must have an excellent financial profile and accurately calculate the profitability by comparing future savings with immediate costs (especially the early repayment penalty). If the rate difference is 1% or more, and you have many years left to pay, the effort is almost always worthwhile.

Is your current rate too high?

Take advantage of market opportunities. Let's discuss your project.

Article Summary

FAQ: Renegotiating Your Mortgage in Spain

Additional (YMYL) questions on "Novación," "Subrogación," fees, and the process to change banks.

YMYL (Your Money Your Life) Disclaimer (E-E-A-T)

This information is based on our expertise (E-E-A-T) in the Spanish mortgage market. Mortgage renegotiation is a complex YMYL (Your Money Your Life) topic. Terms and costs vary depending on your contract and specific banks. This article does not constitute financial advice. We recommend consulting the Bank of Spain and a qualified financial advisor.

It's quite simple. Novación (Novation) involves asking your current bank to modify your mortgage (e.g., lower the interest rate); they can refuse. Subrogación (Subrogation) is your right to transfer your mortgage to a competing bank that offers you better terms; your current bank cannot oppose this.

Because it has no legal obligation or commercial interest in doing so. You signed a contract with a rate (e.g., 4%) that earns them money. They will only agree to negotiate if forced, meaning when another bank sends them a "Subrogación" offer to "steal" you as a client.

The main cost is the "comisión por cancelación anticipada" (early repayment penalty) on your current mortgage. You must check this in your contract. Spanish law caps it: for recent fixed-rate mortgages, it's approximately 2% of the outstanding capital during the first 10 years (and 1.5% thereafter). Your profitability calculation should start here.

Due to the amortization system (similar to most amortization schedules). At the beginning of your mortgage, your monthly payments primarily repay interest. This is therefore the best time to reduce the interest rate. Towards the end of your mortgage, you are almost exclusively repaying capital, so changing the rate has virtually no financial impact.

This is a major advantage of the Spanish Mortgage Law (Ley 5/2019). The new bank (the one welcoming you) is obliged to pay the majority of the transaction fees: Notary fees, Land Registry fees, and Gestoría (administrative agency) fees. The client generally only pays for the new "Tasación" (valuation/appraisal) and the early repayment penalty.

No. A pure "Subrogación de acreedor" only changes the creditor (the bank) for the outstanding capital, under the same term conditions. If you want to change both the rate AND the term (or borrow more money), this is called a "Novación" or a "new mortgage," which is more complex and fiscally more expensive (you would have to pay the AJD tax – a form of documentary stamp duty – again).

No. If your current bank matches the offer (which is rare), you have a choice. You can accept their counter-offer (which is simpler) or refuse it and still go with the competitor. If your relationship of trust is broken, you are free to leave.

The legal process is exactly the same. The only difference is that the new bank will analyze your solvency as a non-resident. You will need to resubmit all your documents (e.g., tax returns from your home country, employment contract...). If your financial situation has deteriorated, the new bank may reject your application.

The only financial risk is paying for the new "Tasación" (property valuation/appraisal, approximately €300-€500) and the operation not going through. This could happen either because the new bank rejects your financial application, or because the "Tasación" is too low. In such a case, you would have lost these fees.

Yes, absolutely. This is even one of the main reasons. If you have a variable interest rate (e.g., Euribor + 1.2%) and are concerned about future increases, you can perform a "Subrogación" to transfer your mortgage to a fixed-rate offer with a competitor and secure your monthly payments.

Because it is much more expensive. Cancelling an existing mortgage (cancelación) and opening a new one (nueva hipoteca) forces you to pay all the fees associated with a new mortgage, including the AJD tax (Actos Jurídicos Documentados – a form of documentary stamp duty), which can represent 1.5% of the mortgage amount. "Subrogación" was specifically designed to avoid this tax and is therefore significantly less expensive.

It stands for *Ficha Europea de Información Normalizada* (European Standardised Information Sheet). It is the most important document. It is the new bank's official and binding mortgage offer, detailing the interest rate, fees, and penalties. It is the key document.

Probably not. A 0.5% difference is small. Don't forget that you will have to pay the early repayment penalty (potentially 2% of your capital!). It would take many years just to recoup this cost. This is why the E-E-A-T guide recommends a minimum difference of 0.75% to 1.0% for the operation to be cost-effective.

It is not mandatory, but it is highly recommended, especially for an international buyer. A broker knows which banks are most competitive with "Subrogación" offers (e.g., Bankinter, ING) and will manage the application for you, maximizing your chances of success.

Yes. You can transfer the mortgage. However, your old bank may cancel any discounts (bonificaciones) it was applying to you. Furthermore, the new bank will likely ask you to subscribe to its own products (new life insurance, etc.) to offer you its best rate. You must compare the total cost of both "packages".