Senior Mortgage Insurance in Spain: The Real Cost and the 75-Year Age Limit

Introduction

Purchasing a property for retirement in a sunny destination is a significant life goal. Spain, with its appealing climate and quality of life, remains a top choice. However, when it comes to financing this acquisition, "senior" buyers (typically aged 55 and above) often encounter a complex financial landscape. The challenge isn't just about obtaining a loan, but understanding the true cost and, crucially, the maximum repayment period.

As specialists in Spanish property financing for non-residents, we aim to debunk two common misconceptions. Firstly, while the cost of loan insurance (seguro de vida) does increase with age, it's not the sole hurdle. The primary constraint is the maximum repayment age limit, which most Spanish banks impose at 75 years old. This article delves into the genuine costs and restrictions faced by senior borrowers in Spain.

The Real Obstacle: The 75-Year Age Limit Rule

This is the overarching rule: most Spanish banks (including Sabadell, CaixaBank, BBVA, etc.) mandate that the borrower must have fully repaid their property loan before reaching their 75th birthday. While a select few institutions might extend this to 80, 75 remains the predominant market standard.

This rule has a direct and fundamental consequence: it significantly shortens your available loan term. The later in life you seek a mortgage, the more compressed the repayment period becomes. A shorter term inherently leads to higher monthly installments, which must still fall within the typical 30-35% debt-to-income ratio limit imposed on your earnings.

The impact of age on loan duration: the 'scissor effect'

For a property purchase, a short loan term is often a greater impediment than the interest rate itself. Here’s the "scissor effect" of the 75-year rule on your maximum loan term (plazo de amortización).

| Your Current Age | Maximum Loan Term | Consequence |

|---|---|---|

| 60 years old | 15 years | Manageable monthly payments. |

| 65 years old | 10 years | High monthly payments, reduced borrowing capacity. |

| 68 years old | 7 years | Very high monthly payments, loan often refused (debt-to-income ratio exceeded). |

| 70 years old & over | 5 years or less | Obtaining a standard mortgage is almost impossible. |

The Real Cost: Rates and Calculation of Senior Insurance (Seguro de Vida)

The second significant hurdle is the cost of life and disability insurance (Seguro de Vida). While not legally compulsory in Spain (unlike property insurance), it is invariably required by the bank to safeguard the loan. Its premium is determined by your age, health condition, and the principal amount borrowed.

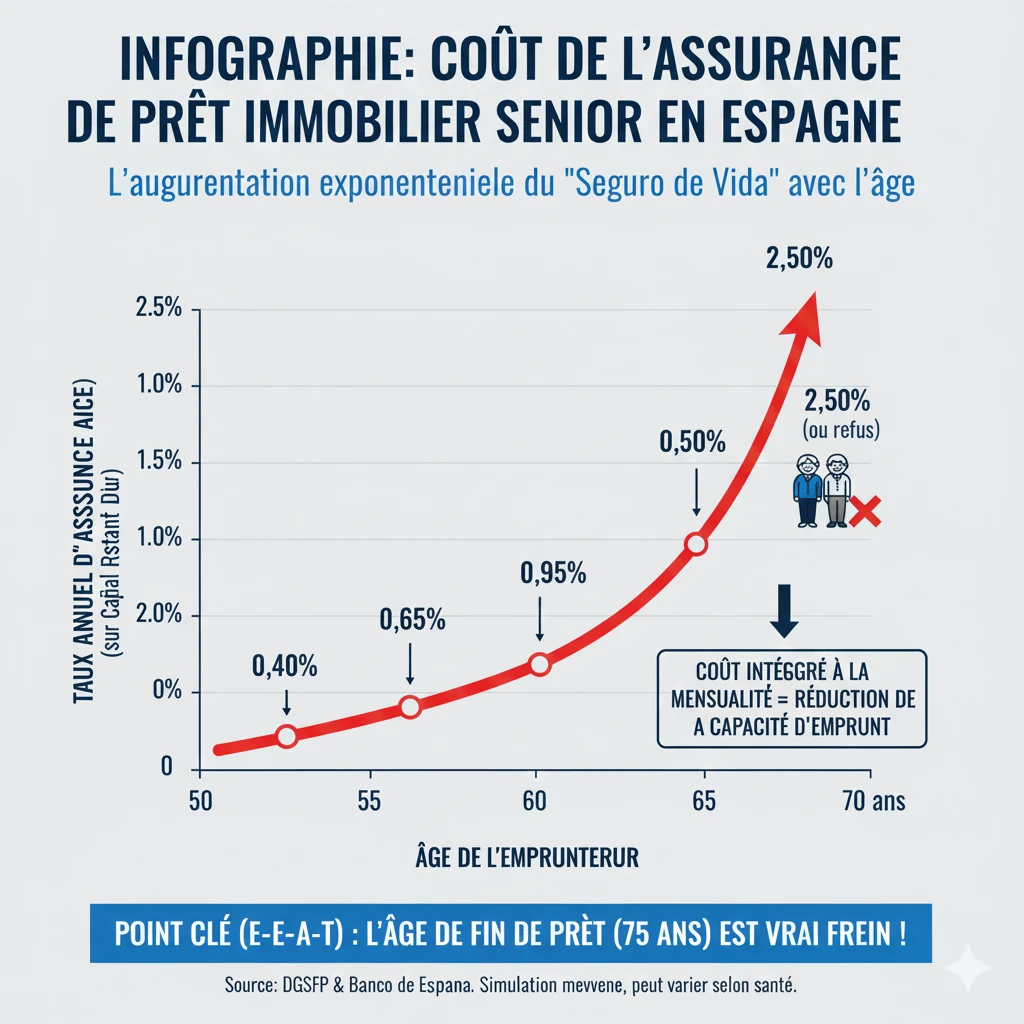

For senior applicants, this cost is substantial and escalates exponentially with age. It is directly incorporated into your monthly payment (APRC - Annual Percentage Rate of Charge) and consequently affects your overall debt-to-income ratio.

The Pitfall of "Prima Única Financiada" (Single Premium)

Many Spanish banks present senior applicants with the option of paying the insurance premium as a single upfront sum, known as a "Prima Única". They often suggest rolling this cost into the principal amount borrowed. This approach, however, is highly disadvantageous:

- Increased Borrowed Capital: If you borrow €100,000 and the insurance costs €15,000, the bank will essentially loan you €115,000.

- Interest on Insurance Premium: You end up paying interest (at your mortgage rate) on the cost of your insurance for the entire loan duration!

Our expert recommendation: Always insist on opting for an annual premium (Prima Anual) payment, even if the bank strongly pushes its proprietary 'single premium' insurance product.

| Age Bracket | Estimated Average Annual Rate |

|---|---|

| 50-55 years | 0.40% - 0.60% |

| 56-60 years | 0.65% - 0.90% |

| 61-65 years | 0.95% - 1.40% |

| 66-70 years | 1.50% - 2.50% (or refusal) |

What are the solutions for borrowing in retirement?

Given the dual constraints of the age limit (75 years) and escalating insurance costs, effective solutions for retirees primarily revolve around mitigating risk for the lending bank.

- Increase Your Personal Down Payment (Acompte)

This is often the most straightforward solution. For non-residents, the minimum down payment is typically 30% (plus around 12% in additional fees). As a senior, providing a substantial down payment of 50% or 60% significantly reduces the capital needed for the loan. A smaller loan amount over a shorter term (e.g., 10 years) can result in manageable monthly payments that comply with debt-to-income limits. - Add a Co-Borrower (Cotitular)

This is often the most impactful strategy. If you apply for a loan with a younger family member (such as a child) or a third party, the bank will typically calculate the loan term based on the age of the youngest co-borrower. For instance, if your daughter is 40, you could potentially secure a loan for 20 or 25 years, dramatically reducing the monthly repayments. - Pledging Assets (Pignoración)

Should loan insurance be unobtainable or excessively costly, you can offer the bank to pledge (ring-fence) a sum of money – for instance, from a life insurance policy or a securities account – as collateral. In the event of your passing, the bank would then draw upon this secured capital.

The Case of the "Hipoteca Inversa" (Reverse Mortgage)

Please note that the "Hipoteca Inversa" is not a loan for purchasing a property. It is a distinct financial product designed for seniors (typically aged 65+) who already own their home outright in Spain and wish to receive a regular monthly income by taking out a mortgage on their existing property.

Official Resource

The regulations governing mortgage-related insurance in Spain are overseen by the DGSFP (Dirección General de Seguros y Fondos de Pensiones – Directorate General of Insurance and Pension Funds) and the Bank of Spain. You can review your consumer rights on their official portal.

Conclusion

Securing a mortgage in Spain for retirement presents unique challenges, yet these are surmountable with careful planning. The primary hurdle is not merely the loan insurance premium, despite its elevated cost, but rather the stringent 75-year age limit enforced by Spanish banks.

This restriction automatically shortens your permissible borrowing period, often pushing monthly repayments beyond the acceptable debt-to-income threshold. Our extensive experience reveals that the two most viable strategies for senior property buyers are either to significantly reduce the loan amount through a substantial down payment (exceeding 50%) or to include a younger co-borrower to extend the overall loan term.

Is Your Senior Mortgage Plan Viable?

Take advantage of market opportunities. Let's discuss your project.

Article Summary

FAQ : Mortgages for Retirees in Spain (Senior Loans)

Our experts address the challenges of age limits (75 years) and insurance costs.

The true hurdle isn't the cost of insurance, but the maximum age for mortgage repayment. Most Spanish banks require the mortgage to be fully settled before your 75th birthday.

This is the golden rule for senior mortgage applicants in Spain. Banks (Sabadell, CaixaBank, BBVA...) calculate your mortgage term to ensure your final monthly repayment is made before you reach the age of 75. A few rare lenders might extend to 80 years, but 75 is the standard.

The maximum term for your mortgage will be 10 years (75 years - 65 years = 10 years). If you are 68, the maximum term drops to 7 years.

Because a short repayment term automatically results in a higher monthly repayment. This elevated monthly payment is likely to exceed the maximum debt-to-income ratio permitted by the bank (typically 30-35% of your income), leading to a mortgage application refusal.

It is almost impossible. At 70, the maximum term would be 5 years, generating such high monthly repayments that the debt-to-income ratio is almost always exceeded.

It's the second obstacle, but not the primary one. Its cost is high and impacts the debt-to-income ratio, but the main barrier remains the mortgage term imposed by the 75-year rule.

The cost increases exponentially with age. It is estimated that between 61 and 65 years old, the average annual rate is between 0.95% and 1.40% of the outstanding capital. Between 66 and 70 years old, it can climb from 1.50% to 2.50% per year, or even result in an insurance refusal.

No, it is not legally mandatory (unlike building insurance). However, it is practically required by the bank to secure the mortgage in case of death or disability.

This is a 'pitfall' offered by many Spanish banks. They propose you pay the insurance in a single lump sum (Single Premium) and to include this amount in the principal of your mortgage.

It's a very poor solution because you end up paying interest on the cost of your insurance. If you take out a mortgage for €100,000 and the insurance costs €15,000, the bank lends you €115,000, and you pay interest on the total amount.

You should insist on paying an annual premium (Prima Anual). You pay the insurance annually, its cost is calculated on the outstanding balance (and therefore decreases over time), and you do not pay interest on the insurance cost itself.

This article identifies three main solutions:

-

Increase your down payment (Acompte): Aim for a 50% or 60% down payment to reduce the capital borrowed.

-

Add a co-borrower (Cotitular): Apply for the mortgage with a younger person (e.g., a child).

-

Pledging assets (Pignoración): Secure a sum of money (e.g., a life insurance policy) as collateral if mortgage life insurance is refused.

The most effective solution is to add a younger co-borrower. The bank will calculate the maximum mortgage term based on the age of the youngest co-borrower, allowing you to secure a mortgage for 20 or 25 years and drastically reduce the monthly repayments.

While a typical non-resident international buyer usually needs to provide a 30% down payment (+ additional fees), a senior buyer is advised to aim for a 50% or 60% down payment. This significantly reduces the mortgage amount, making it more likely that the monthly repayments (even over a 10-year term) will fall within the permitted 35% debt-to-income ratio.

No. The article clearly states: the 'Hipoteca Inversa' is not a loan designed for purchasing a property. It is a financial product intended for seniors who are already homeowners in Spain and wish to receive an income or regular payments by leveraging the equity in their existing home.