Retirement in the Sun: Alicante or the French Riviera? The Complete Comparison

Introduction

The dream of a golden retirement by the Mediterranean Sea is a life project for many. Two leading destinations are vying for the hearts of future retirees: the province of Alicante in Spain and the legendary French Riviera in France. Both offer sunshine, sea, and an enviable quality of life.

However, beyond the postcard image, these two regions present fundamental differences, particularly in terms of budget, lifestyle, and practical advantages. As real estate experts for expatriates, such an important decision merits an honest analysis. Here is a point-by-point comparison to help you make the best choice.

Financial Comparison: The Battle of Budgets

Let's not beat around the bush: budget is the primary differentiating factor. The impact on your retirement purchasing power will be radically different.

1. Cost of Living: The Crucial Point

- Alicante: This is the clear winner. The cost of living in Spain, and particularly in the province of Alicante, is significantly lower than in France. It is estimated to be on average 30% to 40% cheaper. This is evident across all daily expenses: groceries, dining out (a complete menú del día costs between €10 and €15), leisure activities, and services.

- French Riviera: As one of France's most sought-after regions, the French Riviera boasts a very high cost of living, comparable to that of Paris. Restaurants, services, and even groceries significantly impact the budget.

Alicante Advantage: Your retirement purchasing power will be significantly higher, allowing you to enjoy more leisure and comfort with the same pension.

2. Real Estate: Buying or Renting Your Dream Home

The real estate budget directly reflects the cost of living.

- Alicante: The market is much more accessible. It is possible to find modern apartments with sea views or villas with pools for prices that would be unimaginable in France. The average price per square meter is often two to three times lower than on the French Riviera.

- French Riviera: The real estate market is one of the most expensive in France. Property ownership is challenging, and a substantial budget is required, even for a small apartment. Even the slightest sea view comes at a high price.

3. Taxation: Optimizing Retirement Income

- Alicante: By becoming a Spanish tax resident (more than 183 days per year), you will be taxed in Spain. The Franco-Spanish tax treaty prevents double taxation. Taxation is often advantageous for wealth: wealth tax has been virtually abolished in the Valencian Community, and inheritance taxes are gentler.

- French Riviera: You remain within the French tax system: income tax, social contributions (CSG/CRDS) on your pensions, and IFI (Real Estate Wealth Tax) if applicable.

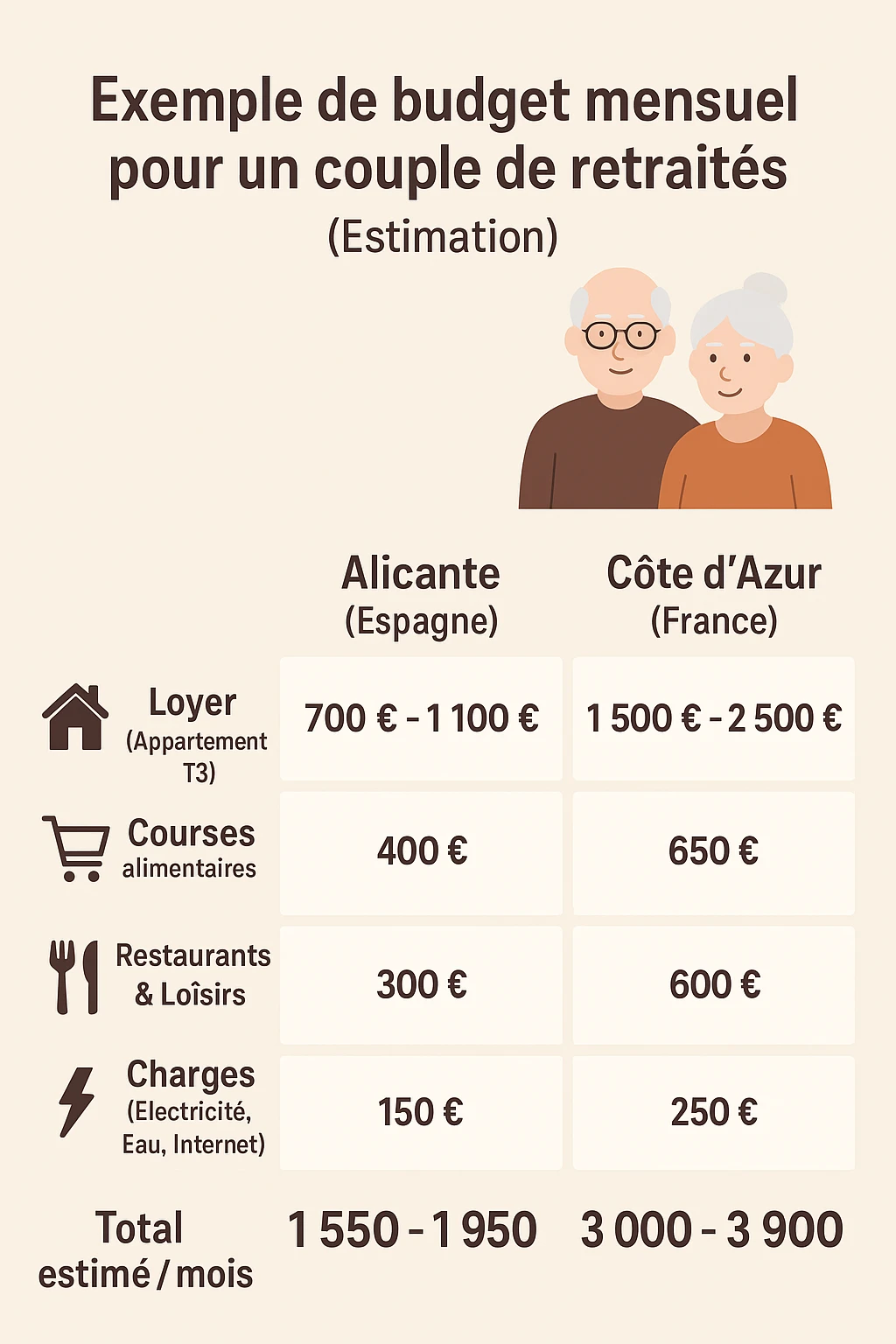

| Expense Item | Alicante (Spain) | French Riviera (France) |

|---|---|---|

| Rent (2-Bedroom Apartment) | 700 € - 1 100 € | 1 500 € - 2 500 € |

| Groceries | 400 € | 650 € |

| Restaurants & Leisure | 300 € | 600 € |

| Utilities (Electricity, Water, Internet) | 150 € | 250 € |

| Estimated Total / Month | 1 550 € - 1 950 € | 3 000 € - 3 900 € |

Quality of Life: Healthcare, Climate, and Integration

1. Healthcare System: Security and Access to Care

- Alicante: Spain boasts an excellent public healthcare system (Seguridad Social), accessible to residents (including European retirees via the S1 form). The network of private hospitals (Hospiten, Quironsalud) is also highly developed, with very affordable private insurance options (mutuas), often between €50 and €100 per month for comprehensive coverage.

- French Riviera: France benefits from one of the best healthcare systems in the world. As a French retiree, you retain your affiliation with the Social Security system. The quality and density of care are impeccable.

Expert Advice

For retirement in Spain, request the S1 form from your pension provider in France. This will allow you to register with the Spanish public healthcare system and receive treatment there as a local, while remaining covered during your visits back to France.

2. Climate and Environment: Shared Sunshine

- Alicante: The climate is semi-arid, one of the sunniest in Europe with over 320 days of sunshine per year. Winters are particularly mild and dry (often 18-20°C during the day), a major asset for people suffering from rheumatism.

- French Riviera: The climate is very pleasant, but winters are cooler and more humid. The region is greener, with a higher risk of rainy spells in autumn and spring.

3. Lifestyle, Culture, and Integration

- Alicante: The lifestyle is relaxed, outdoor-oriented, and less formal. A very large international and French-speaking community (especially in El Campello, Villajoyosa, Altea...) greatly facilitates integration. Learning Spanish remains a pleasure and a valuable tool for integration.

- French Riviera: The lifestyle is more glamorous and sophisticated. The obvious advantage is the absence of a language barrier and cultural shock for a French retiree. You remain within your familiar administrative and social environment.

Summary Table: Alicante vs French Riviera

| Criterion | Alicante (Spain) | French Riviera (France) |

|---|---|---|

| Cost of Living | Very Affordable (€) | Very High (€€€€) |

| Real Estate (Accessibility) | ✅ Very Accessible | ❌ Very Expensive |

| Healthcare System | ✅ Excellent | ✅ Excellent |

| Winter Climate | ☀️ Very Mild and Dry Winters | 🌤️ Cooler and More Humid Winters |

| Lifestyle | Relaxed, International | Glamorous, Sophisticated |

| Taxation (Wealth) | Often Advantageous | Standard French (IFI...) |

| Language Barrier | Yes (but strong French-speaking community) | None |

Conclusion

The choice between Alicante and the French Riviera ultimately depends on your priorities and budget.

- Choose the French Riviera if: Your budget is very comfortable, you absolutely wish for no language or administrative barriers, and you want to stay close to your family in France with easy access by car or TGV.

- Choose Alicante if: You want to maximize your purchasing power, access a dream property within a controlled budget, enjoy an exceptional climate all year round, and you are open to the adventure of an expatriate life in a warm and welcoming country.

For the majority of retirees, the budget/quality of life equation clearly tips the balance in favor of Alicante and its province.

Article Summary

- Introduction

- Financial Comparison: The Battle of Budgets

- 1. Cost of Living: The Crucial Point

- 2. Real Estate: Buying or Renting Your Dream Home

- 3. Taxation: Optimizing Retirement Income

- Quality of Life: Healthcare, Climate, and Integration

- 1. Healthcare System: Security and Access to Care

- 2. Climate and Environment: Shared Sunshine

- 3. Lifestyle, Culture, and Integration

- Summary Table: Alicante vs French Riviera

- Conclusion

FAQ: Retirement in the Sun: Alicante or the French Riviera?

Investing in your Mediterranean retirement between Spain and France. Understanding the tax advantages and cost of living in Alicante province versus the French Riviera.

Alicante province in Spain and the French Riviera in France are two prime Mediterranean destinations for future UK/US retirees. Both attract with their sunny climate and an enviable quality of life. However, they present fundamental differences in terms of budget, lifestyle, and practical advantages, making a comparison essential for making an informed choice for your retirement.

The cost of living is a decisive factor, and Alicante province is the big winner on this point. It is estimated that the cost of living there is on average 30% to 40% cheaper than in the UK/US or other major Western European countries. This means your retiree's purchasing power will be significantly higher in Spain, allowing you to enjoy more leisure and comfort with the same pension. Conversely, the French Riviera boasts a very high cost of living, comparable to major Western European capitals.

For example, a menú del día (complete daily menu) costs between 10 and 15 € in Alicante, a sum hardly comparable to a similar offer on the French Riviera.

Yes, the real estate market in Alicante province is much more accessible. It is common to find modern apartments with sea views or villas with pools at prices that would be unimaginable in the UK/US or other Western European countries. The average price per square meter is often two to three times lower than on the French Riviera. This represents a major opportunity for retirees looking to acquire a dream property without heavily burdening their budget.

Please note, although the general trend favors Alicante, prices always vary locally, and it is crucial to clearly define your project.

By becoming a Spanish tax resident (spending more than 183 days a year), you will be taxed in Spain. Tax treaties between Spain and your home country (e.g., UK or US) aim to avoid double taxation.

- In Alicante (Spain): Taxation on wealth is often advantageous. The Wealth Tax (which applied to total net worth in some countries) has been largely abolished in the Valencian Community, and inheritance taxes are generally more lenient, especially for direct line descendants.

- On the French Riviera (France): You would remain subject to the French tax system, including income tax on pensions, social security contributions (known as CSG/CRDS in France), and potentially the IFI (French Real Estate Wealth Tax) if your property assets exceed a defined threshold.

For UK/US retirees becoming tax residents in Spain, taxation can prove more lenient, particularly concerning assets. As mentioned, the Wealth Tax has been largely abolished in the Valencian Community. Inheritance taxes can also be more favorable, especially between parents and children, depending on the autonomous region. It is always recommended to consult a tax expert specializing in international expatriation for a personalized analysis of your situation.

Spain has an excellent public healthcare system (Seguridad Social). It is accessible to legal residents, including EU/EEA retirees via European coordination mechanisms. For non-EU/EEA citizens (such as those from the US or post-Brexit UK), access usually requires private health insurance or a contribution to the Spanish social security system if working or self-employed. The network of private hospitals (such as Hospiten or Quironsalud) is also very developed, offering high-quality services. Mutuas (private health insurance companies) are very affordable in Spain, often providing comprehensive coverage for a monthly cost between 50 and 100 €.

For an eligible UK/EU/EEA retiree wishing to register for the Spanish public healthcare system, the procedure is as follows:

- Request the S1 form (document for coordination of European social security systems) from your pension provider in your home country (e.g., UK's DWP, or similar body in your EU/EEA country) before you leave.

- Once in Spain and officially resident (with your NIE number, Foreigner's Identification Number, and your residency registration), present this S1 form to the INSS (Instituto Nacional de la Seguridad Social), the Spanish social security institution.

- After validation, you will obtain your Spanish social security number and can request your local health card, giving you access to care like a Spanish citizen.

This S1 form is a crucial document as it guarantees your right to medical care in Spain, paid for by your country of origin, and allows you to remain covered during your temporary returns home.

Please note: The S1 form process is applicable to EU/EEA citizens and UK state pensioners. US citizens typically need to secure private health insurance for residency in Spain, or contribute to the Spanish social security system if they are working or self-employed.

Alicante province benefits from a semi-arid climate, one of the sunniest in Europe with over 320 days of sunshine per year. Winters are particularly mild and dry, with daytime temperatures often between 18 and 20°C, which is a major asset for people suffering from rheumatism or looking to avoid the cold.

The French Riviera also offers a very pleasant climate, but its winters are generally cooler and more humid. The region is greener, but this comes with a higher risk of rainy episodes in autumn and spring.

The lifestyle in Alicante is relaxed and outdoor-oriented, favoring outdoor activities and conviviality. There is a very large international community, including many English speakers, especially in coastal towns like El Campello, Villajoyosa, or Altea, which greatly facilitates integration.

Learning Spanish is, of course, an advantage for complete immersion, but the presence of many expatriates and adapted services allows for a smooth transition. The general atmosphere is warm and welcoming.

While it is always beneficial to learn some basic Spanish for better cultural immersion and to facilitate daily exchanges, the language barrier is not an insurmountable obstacle. Thanks to the strong presence of the international and English-speaking community in Alicante province, many services, shops, and even health professionals speak English or other European languages. At Voguimmo, we also assist you with all your steps to overcome these linguistic and administrative aspects, offering you a smooth transition.

| Expense Category | Alicante (Spain) | French Riviera (France) |

|---|---|---|

| Rent (2-bed Apartment) | 700 € - 1 100 € | 1 500 € - 2 500 € |

| Groceries | 400 € | 650 € |

| Dining & Leisure | 300 € | 600 € |

| Utilities (Electricity, Water, Internet) | 150 € | 250 € |

| Estimated Total / Month | 1 550 € - 1 950 € | 3 000 € - 3 900 € |

This comparative table clearly illustrates the significant difference in budgets. The cost of living in Alicante province allows you to double your purchasing power for the same pension level compared to the French Riviera, offering increased financial freedom.

Alicante province offers numerous assets for a successful and fulfilling retirement:

- A very affordable cost of living, allowing you to maximize your purchasing power.

- An accessible real estate market for acquiring your dream residence.

- An exceptional climate all year round, with mild and sunny winters (over 320 days of sunshine).

- A quality public healthcare system, complemented by affordable private insurance.

- A relaxed lifestyle and great ease of integration thanks to a significant international community.

For international buyers, the French Riviera offers undeniable advantages, including:

- A sophisticated European lifestyle with rich cultural and gastronomic offerings.

- Access to a highly regarded French healthcare system.

- Exceptional transport links across Europe.

- A glamorous and refined living environment.

However, these advantages come with a significantly higher cost of living and real estate, which can impact your retirement budget.

The French Riviera is the preferred choice if:

- Your budget is very comfortable, and the high cost of living is not a major constraint.

- You prioritize a sophisticated and established European lifestyle, possibly with existing cultural ties or French language proficiency.

- You value close proximity to other major European centers with excellent transport links.

- You seek a glamorous and refined living environment without predominant budget considerations.

Alicante province is the ideal choice if you are looking to:

- Maximize your purchasing power and live comfortably on your pension.

- Access a dream property (apartment or villa) within a controlled budget.

- Enjoy an exceptional climate with over 320 days of sunshine per year, particularly mild in winter.

- Experience a new adventure as an expatriate in a warm and welcoming country, with a strong international community.

- Benefit from a quality healthcare system at reasonable costs.

For the majority of UK/US retirees concerned about their budget and quality of life, the equation clearly tips the balance in favor of Alicante and its province.