Registering Your French Car in Spain: Costs, Taxes, and Pitfalls

Introduction

Congratulations, you've found your dream home in Spain and are planning your move. The question then arises: what to do with your French car? Registering a foreign vehicle (matriculación de vehículo extranjero) in Spain is a notoriously complex administrative step, a true bureaucratic and fiscal obstacle course.

This is a critical financial and legal matter. An error can cost you thousands of euros in unexpected taxes or, worse, invalidate your insurance in case of an accident. As experts in settling in Spain, we see too many new homeowners fall into this trap. This guide details the steps, the real costs (especially the formidable Impuesto de Matriculación), and a simple calculation to determine whether you should sell your car in France before you leave.

1. When is Registration Mandatory? The Resident Trap

This is the first question to clarify. The rule depends on your status: tourist (non-resident) or resident.

- If you are a non-resident (you spend less than 183 days/year in Spain), you can drive with your French plates for a maximum of 6 months per year.

- If you are a resident (you have obtained your EU Registration Certificate (the "green NIE") or your TIE), Spanish law gives you a strict deadline (often 30 days, maximum 6 months) to register your vehicle with Spanish plates.

The Trap: Insurance and "Empadronamiento"

Our on-the-ground experience shows that the number one risk isn't the fine. If you are a resident (proven by your Empadronamiento) and have an accident with your car on French plates, your French insurance may refuse to cover you, arguing that the vehicle is no longer in "temporary circulation" but in illegal "permanent circulation". You would then be uninsured. This is an immense financial risk.

2. The 5 Key Steps to Register Your French Car

The process (trámites) is lengthy and must be followed in a precise order. Be prepared to collect numerous documents.

Step 1: Obtain Vehicle Documents (COC and Ficha Técnica)

Before paying anything, you must prove that your car complies with European standards. You will need:

- The European Certificate of Conformity (COC). If you don't have it, you must order it from the manufacturer (cost: €150-300).

- The "Ficha Técnica Reducida" (Reduced Technical Sheet), issued by an approved Spanish engineer (ingeniero técnico) who verifies the COC.

Step 2: Pass the Spanish Technical Inspection (ITV)

You must then present your vehicle, the COC, and the Ficha Técnica at an ITV (Inspección Técnica de Vehículos) station. This is the equivalent of the French technical inspection, but it is mandatory for any first registration. They will check compliance (headlights, pollution, etc.) and issue you the "Tarjeta de ITV", the official Spanish vehicle document.

Step 3: Pay the Taxes (The Costly Step)

This is where the budget can explode. You must pay two, or even three, taxes:

- Impuesto de Matriculación (Registration Tax): The most expensive, based on your car's CO2 emissions (details below).

- IVTM (Impuesto sobre Vehículos de Tracción Mecánica): The annual circulation tax ("road tax"), paid to your local town hall (Ayuntamiento) where you are registered (Empadronamiento).

- IVA (VAT) or ITP: If you purchased the car (new or used) specifically for import, you might be liable for VAT (IVA) or ITP. If it has been your personal vehicle for more than 6 months, you are generally exempt.

Step 4: Registration with the DGT (Dirección General de Tráfico)

Once the taxes are paid and the ITV has been passed, you can finally apply for final registration at the "Jefatura de Tráfico" (DGT). You will need all your documents: NIE, Empadronamiento, Tarjeta de ITV, proofs of tax payment, and your French registration certificate (permiso de circulación).

Step 5: Physical Plates and Insurance

The DGT assigns your Spanish license plate number. You must then:

- Go to a specialized shop (e.g., "Tienda de Recambios") to have the physical plates (placas de matrícula) made.

- Obtain Spanish car insurance. Your French insurance is no longer valid once the car is registered in Spain.

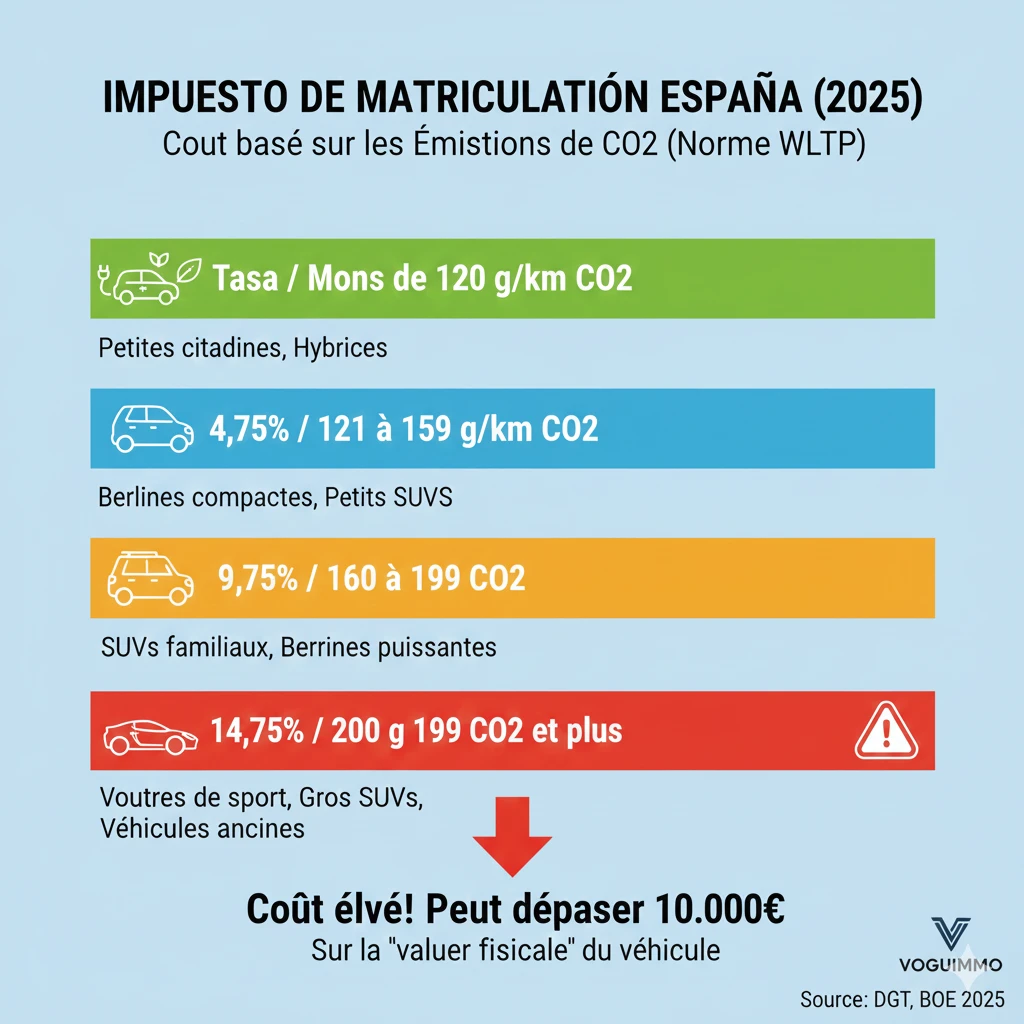

3. The True Cost: The Impuesto de Matriculación Based on CO2

Is it cost-effective? The answer depends almost entirely on the Impuesto de Matriculación. This tax is a percentage of your car's "taxable value" (base imponible), determined by official tables (BOE), and not by the purchase price. The percentage depends on the CO2 emissions.

Note: these rates are set by the State, but Autonomous Communities (e.g., Catalonia, Valencia) may slightly increase them.

| CO2 Emissions (WLTP) | Tax Rate (on taxable value) | Vehicle Example |

|---|---|---|

| Less than 120 g/km | 0% | Small city cars, recent hybrids |

| 121 to 159 g/km | 4.75% | Compact sedans, small SUVs |

| 160 to 199 g/km | 9.75% | Powerful sedans, family SUVs |

| 200 g/km and above | 14.75% | Sports cars, large SUVs, older vehicles |

| Service | Estimated Average Cost |

|---|---|

| COC (if not owned) | 150 € - 300 € |

| Ficha Técnica Reducida (Engineer) | ~ 100 € |

| Technical Inspection (ITV) | ~ 50 € - 100 € |

| DGT Tax (Tráfico) | ~ 100 € |

| Circulation Tax (IVTM - Town Hall) | 50 € - 200 € (annual) |

| Physical Plates | ~ 30 € |

| Total Fixed Costs (Excluding CO2 Tax) | ~ 480 € - 830 € |

Official Resource

The only competent authority for vehicle registration is the Dirección General de Tráfico (DGT). You can consult the official procedures (in Spanish) on their portal.

Conclusion: Sell in France or Register in Spain?

Registering a French car in Spain is a burdensome administrative process and can be extremely costly if your vehicle has high CO2 emissions (over 160 g/km). For large SUVs, sports cars, or slightly older diesel vehicles, the registration tax can easily reach €3,000 to €10,000.

Our advice is simple: before moving your car, request a quote from a "gestor" (administrative advisor). Very often, our experience shows that it is financially more sensible to sell your car in France (where the used car market is typically higher) and use that money to buy a vehicle already registered in Spain (new or used), saving you weeks of bureaucracy and thousands of euros in taxes.

Need help with your procedures?

Take advantage of market opportunities. Let's discuss your project.

Article Summary

- Introduction

- 1. When is Registration Mandatory? The Resident Trap

- 2. The 5 Key Steps to Register Your French Car

- Step 1: Obtain Vehicle Documents (COC and Ficha Técnica)

- Step 2: Pass the Spanish Technical Inspection (ITV)

- Step 3: Pay the Taxes (The Costly Step)

- Step 4: Registration with the DGT (Dirección General de Tráfico)

- Step 5: Physical Plates and Insurance

- 3. The True Cost: The Impuesto de Matriculación Based on CO2

- Conclusion: Sell in France or Register in Spain?

FAQ: Registering a French Vehicle in Spain

General Questions, Tax Pitfalls, Insurance, and Legalities

The Impuesto de Matriculación (Registration Tax) is often the most expensive tax when importing a vehicle into Spain. It is calculated by applying a tax rate to the vehicle's taxable value, with the percentage determined by its CO2 emissions (according to the WLTP cycle).

National rates vary according to the CO2 emission bracket (WLTP):

-

Less than 120 g/km: 0%.

-

From 121 to 159 g/km: 4.75%.

-

From 160 to 199 g/km: 9.75%.

-

200 g/km and above: 14.75%.

The main financial pitfall is that for vehicles with high CO2 emissions (often large SUVs, sports cars, or older diesels), the Impuesto de Matriculación can easily reach €3,000 to €10,000, making selling the vehicle in France often more financially advantageous.

Generally, if the vehicle has been your personal property for more than 6 months and you are registering it as part of your transfer of residency, you are exempt from VAT (IVA) or ITP (Impuesto sobre Transmisiones Patrimoniales). If the car was purchased specifically for import, you might be liable.

It becomes mandatory as soon as you become a resident in Spain (spending more than 183 days a year in the country). Spanish law sets a strict deadline (often 30 days, maximum 6 months) after obtaining your residency document (such as the "green NIE" or TIE) to complete the vehicle registration.

The most significant risk is related to insurance. In the event of an accident, your French insurance policy might refuse to cover you, arguing that the vehicle is no longer in "temporary circulation" but in "permanent illegal circulation" in Spain. This represents an immense financial risk.

The Empadronamiento is the mandatory registration with your local town hall in your municipality of residence. It serves as official proof of your permanent residence in Spain and can be used by authorities to establish your resident status, thus confirming your obligation to register your vehicle.

The official Spanish vehicle document, issued after the technical inspection (ITV), is the "Tarjeta de ITV" (Vehicle Technical Inspection Card).

The Certificate of European Conformity (COC) is necessary to prove that your car complies with European standards. The "Ficha Técnica Reducida" (Reduced Technical Data Sheet) is a document issued by an authorized Spanish engineer to verify the COC.

No, your French car insurance is no longer valid once the car is registered with Spanish license plates. You must take out a Spanish car insurance policy.

The registration process includes:

-

Obtain vehicle documents (COC and Ficha Técnica).

-

Pass the Spanish technical inspection (ITV).

-

Pay the taxes (Impuesto de Matriculación, IVTM).

-

Register with the DGT (Dirección General de Tráfico - General Directorate of Traffic).

-

Have physical license plates manufactured and take out Spanish insurance.

The fixed costs (COC, Ficha Técnica, ITV, DGT fees, and physical license plates) are estimated to be between €480 and €830.

The IVTM (Impuesto sobre Vehículos de Tracción Mecánica) is the annual vehicle road tax, similar to the UK's VED (Vehicle Excise Duty) or US registration fees, whose amount varies depending on the municipality (Ayuntamiento) where you are "Empadronado" (registered).

A "gestor" (administrative advisor) is a professional often hired to manage this lengthy and complex process (trámites, or paperwork). It is advisable for UK/US investors to request a quote from them to assess the cost-effectiveness of registering the vehicle compared to selling it in France.

The main recommendation is to request a quote beforehand, as experience shows it is often financially more sensible to sell your car in France and purchase an already registered vehicle in Spain, thus avoiding bureaucracy and high taxes.