Tax Resident vs. Non-Resident: IRNR Guide 2025

Introduction

\r\nPurchasing property in Spain is a dream for many, but it comes with a complex administrative reality. The most important and critical question is your tax status. Are you considered a \"tax resident\" or a \"non-resident\"? This distinction is not a choice; it is a legal status determined by precise rules.

\r\nUnderstanding this difference is fundamental because it determines not only the type of tax you will pay but also the extent of your obligations to the Hacienda (the Spanish tax authority). A non-resident will pay the IRNR (Impuesto sobre la Renta de No Residentes), while a resident will pay IRPF. As experts assisting buyers, we demystify this subject to secure your investment.

\r\nHow Does Spain Determine Your Tax Residency?

\r\nThe Spanish tax administration (Agencia Tributaria) relies on clear criteria to determine if you are a tax resident in Spain. Simply holding a \"green card\" (CRUE) or a TIE does not automatically make you a *tax* resident. Your de facto situation is paramount.

\r\nThe 183-Day Rule (Primary Criterion)

\r\nThis is the most well-known and simplest criterion to verify. You are considered a tax resident in Spain if you spend more than 183 days in Spanish territory during a calendar year (from January 1st to December 31st). Temporary or \"sporadic\" absences are not deducted, unless you can prove your tax residency in another country.

\r\nCentre of Economic or Vital Interests (Secondary Criteria)

\r\nEven if you spend less than 183 days in Spain, you may be considered a tax resident if:

\r\n- \r\n

- ✅ The main nucleus of your economic activities (your job, your business) is located in Spain. \r\n

- ✅ Your unseparated spouse and minor children habitually reside in Spain (this is the presumption of \"centre of vital interests\"). \r\n

| Status | \r\nPrimary Criterion | \r\nSecondary Criterion | \r\n

|---|---|---|

| Tax Resident | \r\nSpends +183 days in Spain (per year) | \r\nOR the centre of their economic/vital interests is in Spain. | \r\n

| Non-Tax Resident | \r\nSpends -183 days in Spain (per year) | \r\nAND the centre of their economic/vital interests is not in Spain. | \r\n

IRPF vs. IRNR: The Fundamental Impact on Your Taxes

\r\nOnce your status is determined, your tax obligations change radically. This is the difference between being taxed on your Spanish income only or on your worldwide income.

\r\n

| Characteristic | \r\nTax Resident (IRPF) | \r\nNon-Tax Resident (IRNR) | \r\n

|---|---|---|

| Tax Payable | \r\nIRPF (Income Tax for Individuals) | \r\nIRNR (Non-Resident Income Tax) | \r\n

| Taxable Base | \r\nWORLDWIDE Income (salaries, pensions, rents, dividends... regardless of country) | \r\nSPANISH-SOURCE Income ONLY (e.g., rent from a property in Spain) | \r\n

| Rate Type | \r\nProgressive scale (by brackets, similar to UK/US) | \r\nFixed rate (generally 19% for EU/EEA residents, 24% for others) | \r\n

| Declaration | \r\nAnnual declaration (Declaración de la Renta) | \r\nDeclaration via Modelo 210 (occasional or annual) | \r\n

Focus: What is IRNR for a Non-Resident Property Owner?

\r\nThis is where the main challenge lies for a non-resident property buyer. As a non-resident owner of a property in Spain, you must pay IRNR, and this is true **even if you do not rent out your property**.

\r\n

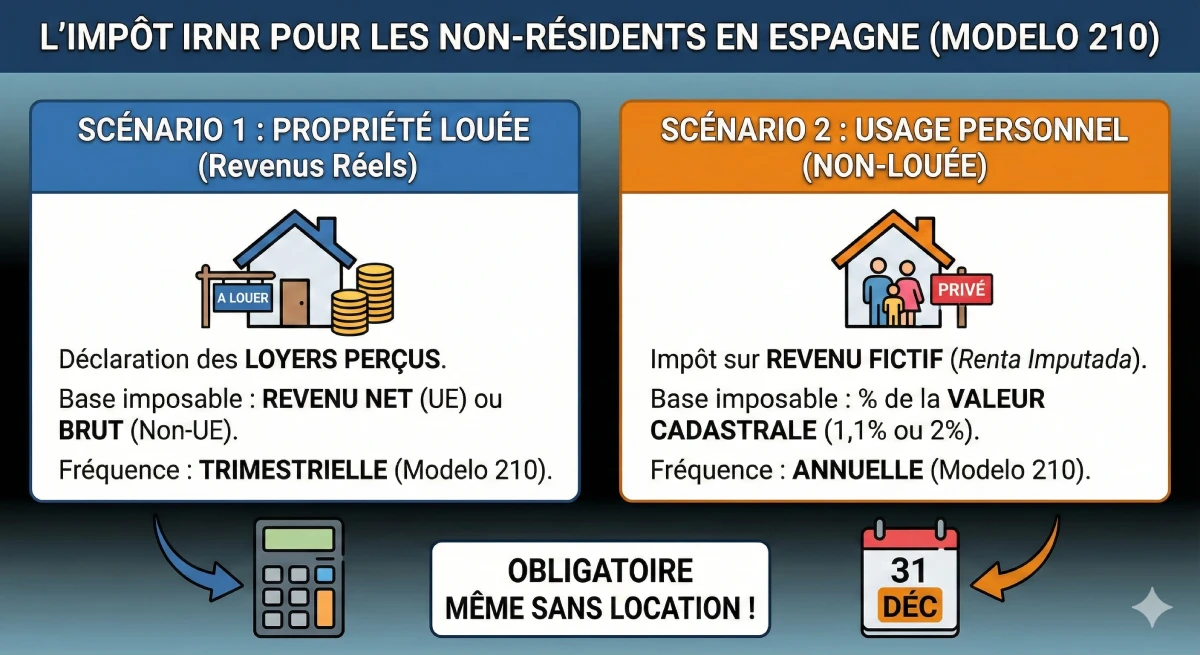

Scenario 1: You Rent Out Your Property

\r\nIf you rent out your property (short-term or long-term rental), you must declare the rents received. You will be taxed on the net income (if an EU resident) or gross income (non-EU resident). This declaration is made via Modelo 210 on a quarterly basis.

\r\nScenario 2: You Do Not Rent Out Your Property (Personal Use)

\r\nThis is often the most challenging concept for a foreign national to grasp. The Hacienda considers that merely owning a property provides you with a \"benefit\" or \"deemed income\" (renta imputada). Therefore, you must pay tax on this deemed income.

\r\n- \r\n

- Calculation Base: The tax is calculated on a percentage of the \"valor catastral\" (cadastral value) of your property, which you will find on your property tax notice (IBI). \r\n

- Rate: The deemed income is generally 1.1% or 2% of the cadastral value. \r\n

- Payment: You pay IRNR on this deemed income (at the fixed rate of 19% or 24%). This declaration is made via Modelo 210 on an annual basis (before December 31st of the following year). \r\n

\r\n\r\nExpert Tip: The Mistake to Avoid

\r\nMany non-resident owners \"forget\" to pay IRNR (especially the deemed income tax, as the Hacienda does not actively demand it every year). This is a serious error. The day you want to sell your property, the notary will verify if your payments are up to date. You will have to pay the last 4 years of outstanding IRNR, plus interest and late payment penalties, directly from your sale price.

\r\n

Official Resource & Disclaimer

\r\nTaxation is a complex subject that depends on your personal situation and the double taxation agreements between Spain and your country of origin. This article provides general expertise but does not replace personalized advice.

\r\nWe strongly recommend engaging an \"asesor fiscal\" (tax advisor) or a \"gestoría\" to manage your declarations. For official information, consult the portal of the Agencia Tributaria (Hacienda): Official IRNR Portal.

\r\nConclusion

\r\nThe difference between being a tax resident and a non-resident in Spain boils down to a simple rule: do you spend more or less than 183 days per year in the country? The answer to this question has major tax implications. If you are a resident, you declare your worldwide income via IRPF. If you are a non-resident, you only declare your Spanish-source income (including the deemed income from your property) via IRNR (Modelo 210).

\r\nFailing to declare and pay IRNR is a common mistake that can be very costly when reselling your property. Proper tax planning with an expert is as important as choosing your property for a successful investment in Spain.

Unsure About Your Tax Status?

Take advantage of market opportunities. Let's discuss your project.

Article Summary

- Introduction

- How Does Spain Determine Your Tax Residency?

- The 183-Day Rule (Primary Criterion)

- Centre of Economic or Vital Interests (Secondary Criteria)

- IRPF vs. IRNR: The Fundamental Impact on Your Taxes

- Focus: What is IRNR for a Non-Resident Property Owner?

- Scenario 1: You Rent Out Your Property

- Scenario 2: You Do Not Rent Out Your Property (Personal Use)

- Conclusion

FAQ: Tax Residency and Non-Resident Income Tax (IRNR) in Spain

Additional questions regarding the distinction between tax resident and non-resident status, and IRNR obligations for property owners.

YMYL (E-E-A-T) Disclaimer

The information provided in this FAQ is for informational and general purposes only. Taxation is a complex (YMYL) subject that depends on your personal situation and applicable double taxation treaties. This article does not constitute tax advice and should not replace consultation with a qualified professional (tax lawyer or *asesor fiscal*).

A tax resident (who pays IRPF, Spanish Personal Income Tax) is taxed in Spain on their worldwide income (salaries, pensions, rental income from all countries). A non-resident (who pays IRNR, Non-Resident Income Tax) is taxed in Spain only on their Spanish-sourced income (e.g., rental income generated in Spain).

Not automatically. The CRUE (Certificado de Registro de Ciudadano de la Unión) or TIE (Tarjeta de Identidad de Extranjero) proves your administrative residency. Hacienda (the Spanish tax authority) bases its assessment on facts: if you spend more than 183 days in Spain, you are a tax resident, regardless of whether you hold the card. However, applying for a CRUE or TIE indicates to the administration your intention to live in Spain, which is a significant indicator of your tax residency.

Hacienda can cross-reference numerous data points: your electricity and water consumption, bank withdrawals, flight tickets, your registration on the *padrón* (Empadronamiento - municipal register), social security affiliation, your children's school enrollment, etc. The burden of proof lies with you: it's up to you to prove that you spent *less* than 183 days in Spain if the tax authorities request it.

IRPF (Impuesto sobre la Renta de las Personas Físicas) is the Spanish Personal Income Tax for tax residents. It is a progressive tax (the rate increases in brackets, similar to income tax systems in many countries) that applies to all your worldwide income (salaries, pensions, rental income, capital gains, etc.).

IRNR (Impuesto sobre la Renta de No Residentes) is the Non-Resident Income Tax. It applies solely to income generated in Spain. For a property owner, this includes rental income received (scenario 1) or an imputed income tax on the property if it is not rented out (scenario 2).

No. You must declare your pension in Spain, but thanks to the Double Taxation Treaties signed between Spain and your home country, you will not be taxed twice. Depending on the nature of the pension (private or public), it will either be taxed solely in your country of origin or taxed in Spain with a tax credit equivalent to what you have already paid at source. This is a complex matter that should be discussed with an *asesor fiscal* (tax advisor).

For citizens of the EU/EEA (Iceland, Norway, Liechtenstein) and Switzerland, the fixed IRNR rate is 19%. For citizens of other countries (e.g., UK post-Brexit, Canada, USA), the fixed rate is 24%.

A major advantage for EU/EEA residents is that you pay 19% on your net income. You can deduct expenses proportional to the rental (e.g., mortgage interest, IBI, community fees, insurance, utility bills...). Non-EU/EEA residents (e.g., UK citizens, Americans) are taxed at 24% on the gross income, without deduction of expenses.

This is the concept of "renta imputada" (imputed income). Hacienda considers that simply owning a second home at your disposal (which you *could* rent out) constitutes a "benefit in kind" or "notional income". You are therefore taxed on this "imputed rental income" that you 'pay' to yourself. It is a legal obligation.

The Modelo 210 is the official tax form you must use to declare and pay the IRNR (Non-Resident Income Tax). You use it quarterly if you rent out your property, or once a year (by December 31st) if you are paying the imputed income tax (for personal use).

The "Valor Catastral" is the administrative value of your property, registered with the Spanish Cadastre (*Catastro*). It is significantly lower than the market price. You will find it on your annual property tax notice, the IBI (Impuesto sobre Bienes Inmuebles - Council Tax/Local Property Tax). This value serves as the basis for calculating the imputed income tax (IRNR) for non-residents.

Generally, the imputed income is 1.1% of the cadastral value (if it has been recently revised) or 2% (otherwise). You then pay 19% (if EU/EEA citizen) or 24% (if non-EU/EEA citizen) on this amount.

Example: Cadastral value of €100,000. Imputed income (1.1%) = €1,100. IRNR tax to pay: If EU/EEA citizen, 19% of €1,100 = €209 per year. If non-EU/EEA citizen (e.g., UK/US investor), 24% of €1,100 = €264 per year.

Hacienda can claim for the last 4 years. If you are audited, you will have to pay the last 4 outstanding declarations, plus a penalty (*sanción*) and late payment interest (*recargo*).

Yes. This is a critical point. When selling, the Spanish notary public will require proof of IRNR payments for the last 4 years. If you do not have them, the sale may be blocked, or the notary public will withhold the amount due (with penalties) from your sale price to pay it directly to Hacienda. You will lose money.

As experts (E-E-A-T), we strongly advise against it. Spanish taxation is complex. We recommend all our clients to appoint an "asesor fiscal" (tax advisor) or a "gestoría" (administrative agency). For a modest annual fee, they will manage your declarations (Modelo 210, etc.), ensure you are compliant, and optimize your situation, providing complete peace of mind.