TIE (for Non-EU Citizens) vs EU Registration Certificate (the 'Green Card' for Europeans)

Introduction

One of the most common confusions when relocating or purchasing property in Spain concerns the identification of foreign nationals. Many conflate the NIE, the TIE, and the "Certificado de Registro de la UE" (often referred to as the "Green Card" or "Green NIE"). Understanding this distinction is a critical step, as it defines your legal resident status in Spain, with direct impacts on your taxation, rights, and obligations.

Although these documents all serve to identify you, they are not interchangeable. Your nationality (EU Citizen or Third-Country National) non-negotiably determines which of these documents you must possess to legally reside in Spain for more than 90 days. Let's clarify once and for all who gets what, and why it is vital for your property project.

The Fundamental Difference: NIE vs. Residency Document

Before comparing the TIE and the "Green Card", it's essential to understand what the NIE (Número de Identificación de Extranjero) is. The NIE is not a residence card; it is a unique and permanent tax identification number, assigned for life to any foreign national with economic interests in Spain (such as purchasing property).

The TIE and the "Certificado de Registro" (CRUE) are, in contrast, residency documents. They prove that you live legally in Spain. The key difference is that the NIE is a number, while the TIE and CRUE are physical documents that contain your NIE number.

| Document | What is it? | What does it look like? |

|---|---|---|

| NIE (Number) | A tax and administrative number (e.g., Y-1234567-B). | A simple number, initially provided on a white A4 paper. |

| CRUE ('Green Card') | A residency document for EU citizens. | A small green paper certificate (A4 or credit card format). |

| TIE (Card) | A residency document for Non-EU citizens. | A plastic identity card (biometric) with photo. |

The "Certificado de Registro de la UE" (CRUE): The 'Green Card' for EU Citizens

If you are a citizen of an European Union (EU) country, the European Economic Area (EEA), or Switzerland and you plan to reside in Spain for more than 3 months, you are obliged to register with the Central Register of Foreigners (Registro Central de Extranjeros). Once your registration is validated, you will be issued the Certificado de Registro de la Unión Europea (CRUE).

This document, often mistakenly called the "Green NIE", is a green-colored paper that certifies your status as a legal resident in Spain. It includes your name, address, nationality, and NIE number.

Key Features and How to Obtain the CRUE

- ✅ For whom: EU / EEA / Swiss citizens.

- ✅ Appearance: Green paper certificate (no photo, no biometric chip).

- ✅ Expiration: The document itself has no expiration date. It certifies your permanent registration (as long as you remain a resident).

- ✅ Process: Submission of form EX-18, payment of tax 790, and proof of sufficient financial means (employment contract, own funds) and comprehensive health insurance.

The TIE: The "Tarjeta de Identidad de Extranjero" for Non-EU Citizens

If you are a citizen of a third country (non-EU/EEA member, such as post-Brexit United Kingdom, the United States, Canada, Morocco, etc.) and you have obtained a visa to reside in Spain for more than 6 months, you must apply for the Tarjeta de Identidad de Extranjero (TIE).

The TIE is your physical identity document as a resident foreign national in Spain. It is a modern plastic card, similar to a national identity card or a French driving license. It contains your photo, fingerprints (biometrics), your NIE number, and the type of residency authorization you possess (e.g., for work, non-lucrative, family reunification).

Key Features and How to Obtain the TIE

- ✅ For whom: Non-EU citizens (Americans, British, Canadians, etc.).

- ✅ Appearance: Plastic card (credit card type) with photo and biometric chip.

- ✅ Expiration: The TIE has a clear expiration date (1 year, 2 years, 5 years...) and must be renovated periodically.

- ✅ Process: Submission of form EX-17 (after obtaining the visa), payment of tax 790, and fingerprinting (toma de huellas) at the police station.

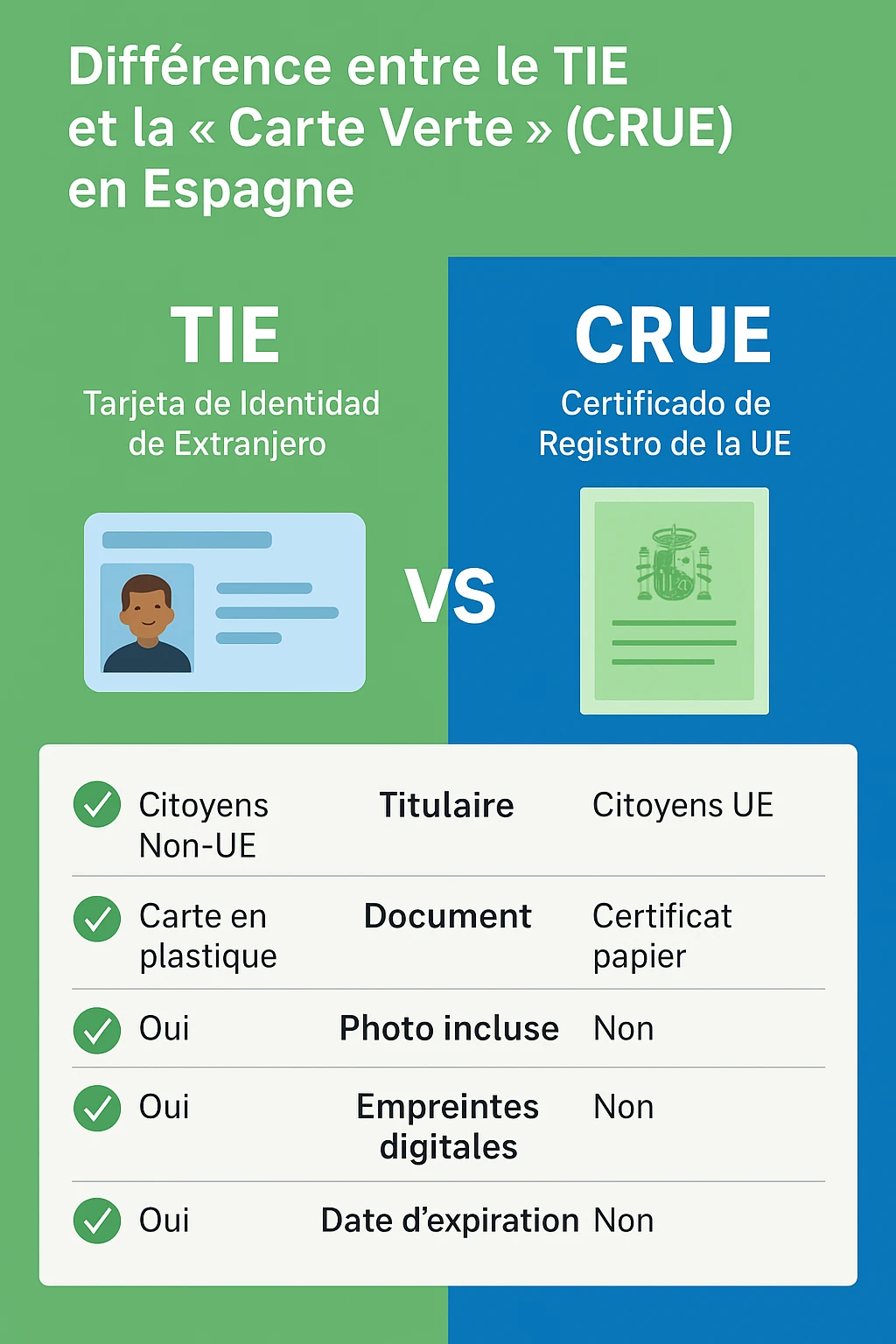

Infographic and Comparative Table: TIE vs. 'Green Card' (CRUE)

Your nationality is the sole factor determining the document you will receive. This infographic summarizes the decision-making process:

Here is a direct comparison of the two residency documents:

| Feature | CRUE ('Green Card') | TIE (Card) |

|---|---|---|

| Holder | EU / EEA / Swiss Citizens | Third-Country Nationals (Non-EU) |

| Document (Format) | Green paper certificate (card or A4 format) | Biometric plastic card |

| Photo included | No | Yes |

| Fingerprints | No | Yes |

| Expiration Date | No (permanent document) | Yes (must be renewed) |

| Application Form | Modelo EX-18 | Modelo EX-17 |

Real Estate Impact: Why is this Crucial for Your Property Purchase?

For a property purchase, you can sign the deed of sale (Escritura) with a simple non-resident NIE (the white paper). However, if you live in Spain for more than 183 days a year, you become a tax resident. The tax administration (Hacienda) expects you to regularize your administrative situation by also becoming a legal resident.

Possessing a valid CRUE or TIE is proof of this legal residency. This status has major tax and legal implications:

- Taxation: As a resident (with TIE/CRUE), you will pay income tax (IRPF) on your worldwide income, and not non-resident income tax (IRNR).

- Access to services: The CRUE or TIE is essential for obtaining the public health card (Tarjeta Sanitaria) on a permanent basis.

- Financing: Spanish banks may offer better mortgage conditions to residents (TIE/CRUE) than to non-residents.

Expert Advice

Do not consider these documents optional. If you live in Spain, they are mandatory. Failure to register (for EU citizens) or to renew your TIE (for non-EU citizens) can result in fines and severely complicate your future tax procedures or the resale of your property. For official information, always consult the Spanish Government's Immigration Portal.

Conclusion

In summary, the choice between the 'Green Card' (CRUE) and the TIE card does not exist: your passport decides for you. EU citizens receive the CRUE, a permanent registration certificate. Third-country nationals (Non-EU) receive the TIE, a biometric identity card that must be renewed.

Both documents prove the same thing: your status as a legal resident in Spain. Obtaining this status is a fundamental step in your expatriation, just like obtaining your NIE and Empadronamiento, and it is crucial for securing your long-term property project.

Need help with your residency procedures?

Take advantage of market opportunities. Let's discuss your project.

Article Summary

- Introduction

- The Fundamental Difference: NIE vs. Residency Document

- The "Certificado de Registro de la UE" (CRUE): The 'Green Card' for EU Citizens

- Key Features and How to Obtain the CRUE

- The TIE: The "Tarjeta de Identidad de Extranjero" for Non-EU Citizens

- Key Features and How to Obtain the TIE

- Infographic and Comparative Table: TIE vs. 'Green Card' (CRUE)

- Real Estate Impact: Why is this Crucial for Your Property Purchase?

- Conclusion

FAQ: Understanding NIE, TIE, and the EU 'Green Certificate' (CRUE) in Spain

Understanding the vital difference between your tax identification number (NIE) and your residency document (TIE/CRUE).

No. This is the most common confusion. The NIE (Número de Identificación de Extranjero) is a unique tax and administrative number (e.g., Y-1234567-B). The TIE and CRUE are physical residency documents (a card or certificate) that prove you legally reside in Spain and contain your NIE number.

It's your lifelong tax identification number in Spain. It does not prove your residency. You need it for all economic activities (buying a property, opening a bank account, paying taxes). It is initially issued on a simple white A4 paper.

The TIE is the mandatory residency document for citizens of non-European Union countries (e.g., Americans, British, Canadians...) who have obtained a visa to live in Spain for more than 6 months.

It is the 'Certificado de Registro de la UE'. This is the mandatory residency document for citizens of the European Union (e.g., French, Belgian, German...), EEA, or Switzerland, who plan to live in Spain for more than 3 months.

No. As an EU citizen, you cannot obtain a TIE. If you reside for more than 3 months, you are obliged to apply for the CRUE ('Green Certificate').

No. As a citizen of a third country (non-EU), you cannot obtain the CRUE. After obtaining your long-stay visa, you must apply for the TIE.

No. There is no choice. Your nationality (your passport) non-negotiably determines which document you must obtain.

-

EU / EEA / Swiss Passport ➔ CRUE

-

Non-EU Passport ➔ TIE

The difference is significant:

-

The TIE is a modern plastic card (credit card type) with your photo and fingerprints (biometrics).

-

The CRUE ('Green Certificate') is a simple green paper certificate (A4 format or small card) that contains neither a photo nor biometric data.

No. The CRUE document itself does not have an expiration date. It certifies your permanent registration in the Central Register of Foreigners (as long as you remain a resident in Spain).

Yes. The TIE always has a clear expiration date (1 year, 2 years, 5 years...). It is linked to the validity of your stay authorization and must be renued periodically at the police station.

No. For the deed of sale (the Escritura), you can sign with a simple non-resident NIE (the white paper).

Because if you live in Spain for more than 183 days a year, you become a tax resident. The TIE or CRUE is proof of your legal residency, which the tax authorities (Hacienda) will require.

Obtaining this legal resident status confirms your tax resident status. You will no longer pay Non-Resident Income Tax (IRNR), but you will have to declare your worldwide income in Spain via Personal Income Tax (IRPF).

They are in breach of the law. Registration is mandatory. Failure to do so can lead to fines and severely complicate other procedures (access to public healthcare, reselling a property, tax matters).

Yes. Being a legal resident (with a valid TIE or CRUE) is a key factor for banks. They can offer better financing conditions (for example, a higher loan-to-value percentage) to residents than to non-residents.