Becoming an "Autónomo" (Self-Employed) in Spain: The Complete Guide 2025

Introduction

Moving to Spain and planning to work for yourself? Whether you aim to become a real estate agent, a consultant, or actively manage your rental investments, you'll encounter an essential status: the "Régimen Especial de Trabajadores Autónomos" (RETA), more commonly known as "autónomo". This is the Spanish equivalent of a sole trader or self-employed individual.

Registering as an autónomo is a fundamental step that directly impacts your social security coverage, taxation, and the legality of your activity in Spain. As experts in Spanish administration, we guide you through a process that may seem complex but is crucial for any professional project, including in real estate.

1. What is an "Autónomo"?

An "autónomo" is a natural person who habitually, personally, and directly carries out an economic activity for profit, without being subject to an employment contract. Unlike a company (SL - Limited Company), an autónomo does not have a separate legal personality. You, as an individual, are responsible for your professional debts with all your assets (personal and professional).

Who is concerned? The real estate sector case

Registration is mandatory if you regularly carry out an independent activity. In the real estate sector, this includes :

- Real Estate Agents: In Spain, almost all real estate agents (API) work under the autónomo status (as independent collaborators for an agency).

- Tradespeople and Renovators: All construction professionals (plumbers, electricians, masons) invoicing for their services.

- Rental Property Investors (specific case): If you manage a large number of properties (generally 5 or more) or if rental is considered your primary economic activity (with active management), the administration may require your registration as an autónomo to deduct your expenses.

2. The Dual Registration (El "Alta"): Tax Agency (Hacienda) and Social Security (Seguridad Social)

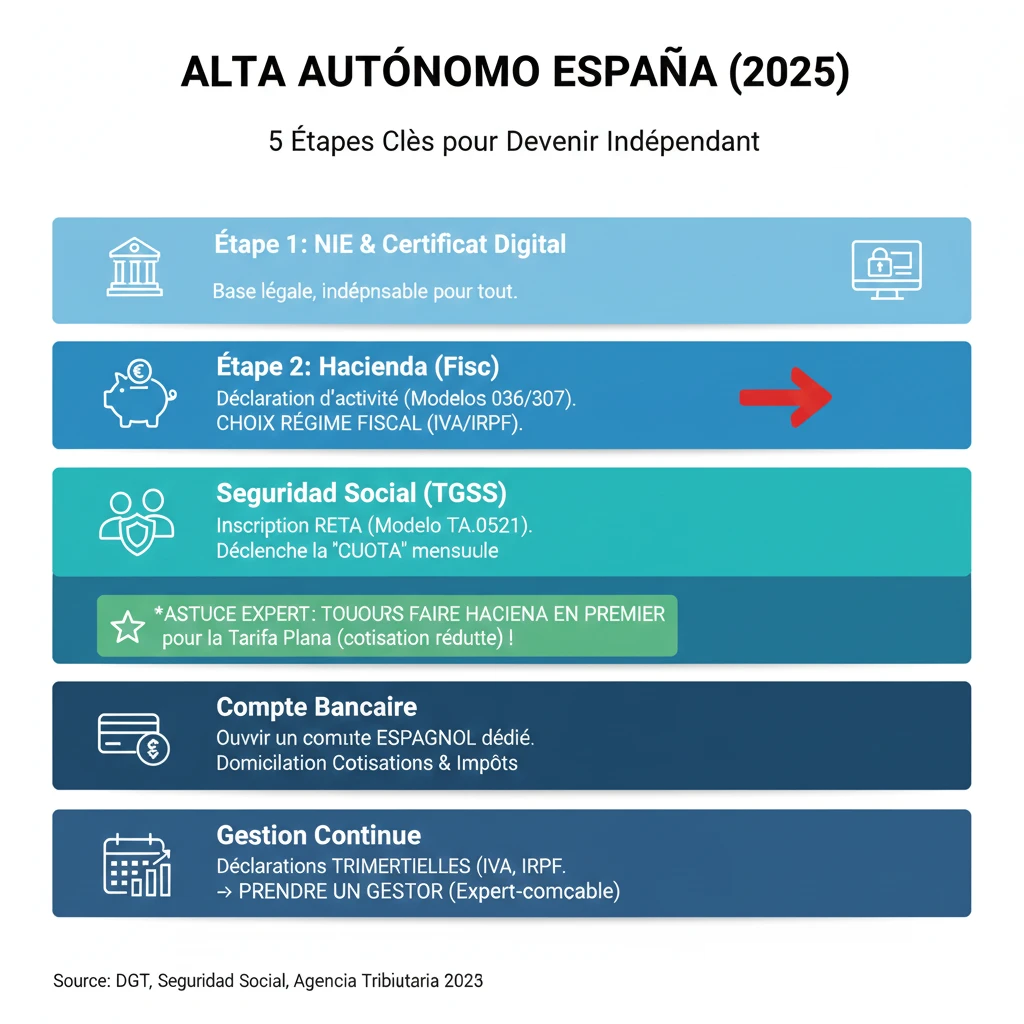

Becoming an autónomo in Spain requires a dual registration process ("alta") with two distinct administrations. The order is crucial.

Here are the 5 key steps for successful registration:

- Obtain a NIE (Foreigner's Identification Number): This is the foundation of everything.

- Obtain a Digital Certificate: Essential for all online procedures (highly recommended).

- Step 1: Register with the Agencia Tributaria (Hacienda - The Tax Agency): You must declare yourself to the tax authorities via Modelo 036 or Modelo 037 (simplified version). This is where you choose your VAT (IVA) and Income Tax (IRPF) regime.

- Step 2: Register with the Seguridad Social (TGSS - Social Security): Once registered with the tax authorities, you have 60 days to register for the "Special Regime for Self-Employed Workers" (RETA) via Modelo TA.0521. This registration triggers the payment of your social security contributions (the "cuota").

- Open a dedicated Spanish bank account to direct debit your contributions and taxes.

Expert Advice: The Order Pitfall

Our experience shows that the most costly mistake is to register with Social Security before the Tax Agency (Hacienda). If you do this, you will not be able to benefit from the "Tarifa Plana" (reduced contribution) and will pay the full rate from day one. Always the Tax Agency (Hacienda) first!

3. Costs and Taxation: The "Cuota" and Quarterly Taxes

This is the most critical topic for new autónomos: how much will you pay?

Social Security Contribution (The "Cuota"): Tarifa Plana and Real Earnings

Since 2023, Spain has reformed its system. Contributions are no longer fixed but based on your real earnings ("ingresos reales"). Fortunately, a support measure for new registrants is maintained: the "Tarifa Plana" (flat rate).

| Period | Monthly Contribution ("Cuota") | Conditions |

|---|---|---|

| Months 1 to 12 | ~ €80 | Automatic for all new registrations. |

| Months 13 to 24 | ~ €80 | Only if your net earnings remain below the Minimum Wage (SMI). |

| After 24 months | Contribution based on your real earnings | Refer to the Tax Agency's table. |

After the Tarifa Plana, you enter the system of contributions based on real earnings brackets, which adjusts annually. This is a complex calculation that your accountant (gestor) should estimate for you.

Quarterly Taxes: IVA and IRPF

In addition to the monthly "cuota", the autónomo acts as the state's tax collector. You must submit quarterly declarations (every 3 months).

| Tax | Form (Modelo) | Description |

|---|---|---|

| IVA (VAT) | Modelo 303 | You declare the VAT you have charged (IVA repercutido) and deduct the VAT you have paid (IVA soportado). You pay the difference to the tax authorities. |

| IRPF (Income Tax) | Modelo 130 | This is an advance payment on your final income tax. You pay 20% of your net quarterly profit (Revenue - Expenses). |

Official Resource

Managing the autónomo status is complex. The official source for registration and contributions is the Spanish Social Security (TGSS).

Conclusion

Becoming an "autónomo" in Spain is a comprehensive administrative step, but essential to legally carry out an independent activity as a real estate agent or tradesperson. This is a significant matter: an error in the "alta" (registration) can cost you the loss of reduced contributions ("Tarifa Plana").

Our experience shows that while the registration procedure (the "altas") can be managed, the quarterly management of taxes (IVA, IRPF) and the calculation of contributions based on real earnings are complex. We strongly recommend seeking the assistance of a "gestor" (accountant / tax advisor) from day one to secure your activity.

Ready to Become an Autónomo?

Take advantage of market opportunities. Let's discuss your project.

Article Summary

- Introduction

- 1. What is an "Autónomo"?

- Who is concerned? The real estate sector case

- 2. The Dual Registration (El "Alta"): Tax Agency (Hacienda) and Social Security (Seguridad Social)

- 3. Costs and Taxation: The "Cuota" and Quarterly Taxes

- Social Security Contribution (The "Cuota"): Tarifa Plana and Real Earnings

- Quarterly Taxes: IVA and IRPF

- Conclusion

FAQ: Becoming an 'Autónomo' in Spain (Self-Employed Status)

The 'autónomo' status (equivalent to a sole trader or independent contractor) is essential for any independent economic activity, including in real estate. Understanding this status is crucial for your legal and tax compliance in Spain. Status, Obligations, and Administrative Pitfalls.

An autónomo is an individual carrying out a for-profit economic activity regularly and directly, without an employment contract. This is similar to a sole trader or independent contractor in the UK or US.

The main difference is that an autónomo does not have a separate legal personality from the individual. The individual is personally liable for business debts with all their assets. An S.L. (Sociedad Limitada), similar to a UK Private Limited Company (Ltd) or a US LLC, offers limited liability to the company's capital contributions.

Almost all real estate agents (API - Agente de la Propiedad Inmobiliaria) working for an agency or construction professionals (tradespeople) must register. Investors actively managing a significant number of rental properties (often 5 or more) may also be required to register.

The first essential step is to obtain your NIE (Número de Identificación de Extranjero - Foreigner Identification Number). This is the foundation for all administrative registrations in Spain.

The order is crucial to benefit from the "Tarifa Plana" (reduced contribution rate). You must always register with the Tax Agency (Hacienda) first, using Modelo 036/037, and then with the Social Security (TGSS - Tesorería General de la Seguridad Social) via Modelo TA.0521 within 60 days. If the order is reversed, the full rate will be applied from day one.

The Tarifa Plana is a flat-rate contribution designed for new registrants. For the first 12 months, the monthly contribution ("cuota") is approximately 80 €.

Since 2023, contributions are based on your real income ("ingresos reales"). The autónomo pays contributions according to income brackets, which are adjusted annually.

The autónomo is subject to VAT (IVA - Impuesto sobre el Valor Añadido) and Income Tax for Individuals (IRPF - Impuesto sobre la Renta de las Personas Físicas) on their profits.

The quarterly VAT (IVA) declaration is made via Modelo 303. You declare the VAT charged and deduct the VAT paid.

Modelo 130 is the quarterly advance payment for IRPF (Income Tax for Individuals). This is an advance payment on your final tax liability, generally 20% of your quarterly net profit (Income - Expenses).

The official source for registration and legislation related to contributions is the 'Trabajadores Autónomos' portal of the Spanish Social Security (TGSS).

Yes, opening a dedicated Spanish bank account is necessary to process your social security contributions and tax payments.

A "gestor" is a professional administrative and tax advisor, similar to an accountant or tax consultant. Their role is crucial for managing quarterly taxes (IVA, IRPF) and for the complex calculation of contributions based on real income.

The main advice is to engage a "gestor" from day one to ensure the security and proper management of your activity. Errors in quarterly tax management are common and costly for UK/US investors.

Registration with the Tax Agency (Hacienda) is done via Modelo 036 (standard form) or Modelo 037 (simplified version).