Comprehensive NIE Guide: Your Essential Key to Spain

Introduction

The NIE (Número de Identificación de Extranjero) is the most important document for any foreigner wishing to carry out administrative procedures in Spain. It is a personal, unique, and mandatory identification number that serves as an access key for almost all administrative, fiscal, and legal interactions in the country. Without this number, you are invisible to the Spanish administration.

For a real estate buyer or seller, it's not an option; it's an absolute requirement. From opening a bank account to signing the deed of sale (Escritura) before a notary, or paying taxes (such as ITP), the NIE is required at every step. Understanding how to obtain it and its importance is the first step to securing your real estate investment in Spain.

What is the NIE and what is it used for?

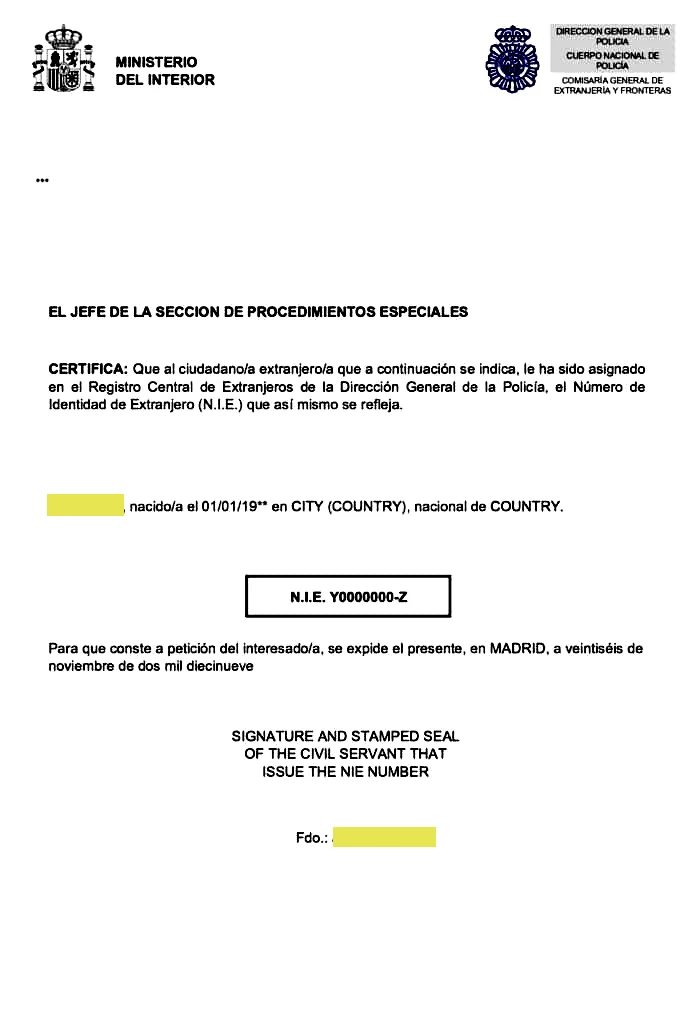

The NIE (Número de Identificación de Extranjero) is a number assigned by the General Directorate of Police in Spain. It is not a residence permit (unlike the TIE, the residence card), but an essential fiscal and administrative number for both non-residents and future residents.

Example of an NIE document issued in Spain

Why is the NIE essential?

This number is the cornerstone of your life in Spain. It is mandatory for:

- 🏠 Real estate transactions: Buying or selling property (the notary will block it without one).

- 🏦 Banking services: Opening a bank account or applying for a mortgage.

- 📁 Tax obligations: Paying all taxes (property tax IBI, non-resident income tax IRNR, capital gains...).

- 💼 Employment and work: Signing an employment contract or setting up a company (S.L.).

- 🚗 Everyday procedures: Registering a vehicle, subscribing to utility services (water, electricity, internet).

Legal Objectives of the NIE (Fiscal Control and Rights)

The NIE enables the Spanish State to fulfill two vital functions:

Fiscal Control and Transparency

It enables fiscal traceability of all economic activity (IRPF, VAT), anti-money laundering efforts (transactions > €10,000), and demographic statistics management.

Management of Rights and Responsibilities

It verifies your eligibility for healthcare services (Seguridad Social), the education system, social security contributions, and obtaining a driving license.

Who is legally required to obtain an NIE?

Any foreign national with economic, professional, or social interests in Spain must apply for an NIE. This includes a wide range of profiles, far beyond simple real estate buyers.

| Affected Profile | Reason for Requirement |

|---|---|

| 🏠 Real Estate Buyers | Notary signature, payment of taxes (ITP), registration in the Property Registry. |

| 💼 Workers (Employees) | Employment contract, Social Security contributions. |

| 🏢 Entrepreneurs | Company formation (S.L.), opening business accounts. |

| 🎓 Students (long stay) | Enrollment in a course lasting more than 3 months, housing rental. |

| 🏡 Future Residents | Access to public services, water and electricity contracts (utilities). |

Who does NOT need an NIE?

Theoretically, simple tourists (stays of less than 90 days) do not need one... unless they decide to purchase a property during their stay. Diplomats on official duty have a different regime.

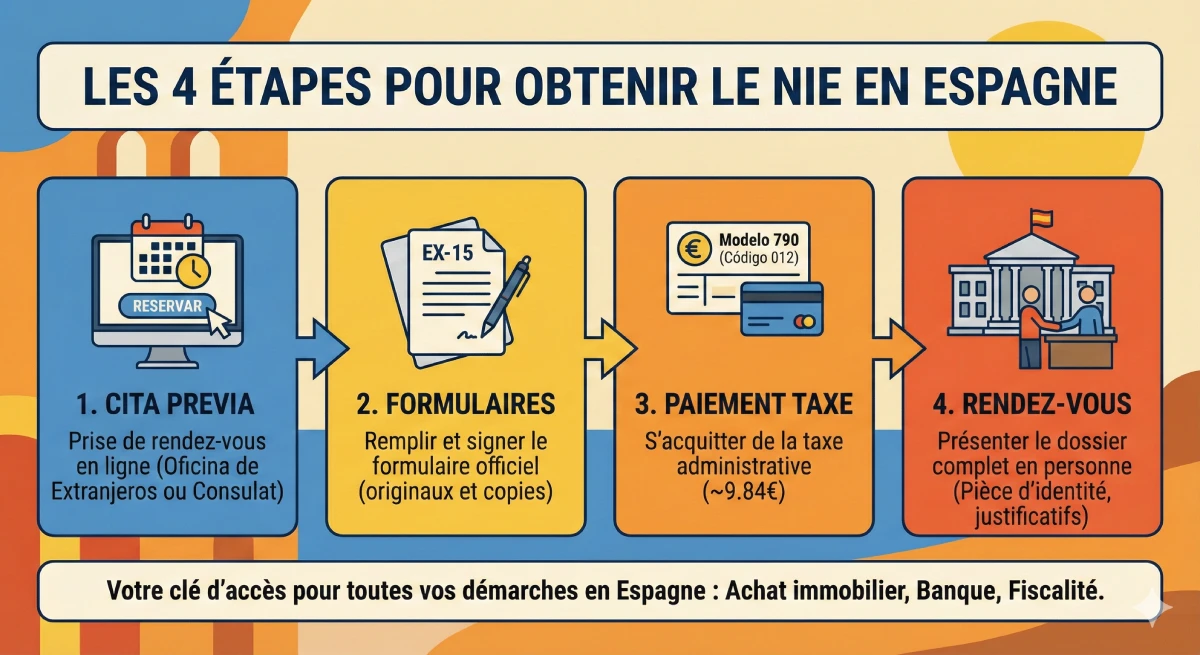

How to obtain your NIE: The Process

There are two main methods to apply for your NIE, depending on your location. Anticipation is key, as obtaining an appointment (cita previa) can take several weeks, or even several months in high-demand areas.

Option 1: From Spain (In Person)

This is the fastest method if you are already in Spain. The application is made at an Oficina de Extranjeros (Foreigners' Office) or, failing that, at a National Police Station (Comisaría de Policía). You must book an appointment (cita previa) online.

→ Guide to Oficinas de Extranjeros

Option 2: From Abroad (Consulate)

You can initiate the application from your country of residence via the Spanish Consulate. The processing time is often longer (several weeks) because the Consulate acts as an intermediary with the administration in Spain.

→ List of Consulates in France

Mandatory Documents for the Application

Whether in Spain or at the Consulate, you will need to submit a complete file (originals and copies):

- Form EX-15: The official NIE application form, completed and signed in duplicate. 📄 Download Form EX-15 - NIE (PDF)

- Proof of Identity: Valid passport (for all) or ID card (for EU citizens).

- Reason for Application: A document proving why you are applying for the NIE (e.g., a contrato de arras (deposit contract), a job offer, a pre-agreement with a bank).

- Tax Payment: The payment receipt for tax Modelo 790 (Código 012), amounting to approximately €9.84 (in 2024/2025). Official link to pay the tax

⚠️ Penalties: What happens without an NIE?

Not having an NIE in Spain is not just a simple administrative oversight; it is a blocking error with serious financial and legal consequences. The Spanish administration is becoming increasingly strict, especially regarding anti-money laundering efforts.

🏠 Risk #1: Real Estate Penalties (Notary Blockage)

Transaction Cancelled by the Notary

Legal Basis: Article 17 of the Spanish Mortgage Law. The notary (Notario) is legally prohibited from authenticating a deed of sale (purchase or inheritance) without the complete fiscal identification (NIE) of all parties.

Here are concrete examples of direct financial losses we have observed in clients who neglected this step:

| Specific Case (Buy/Sell) | Situation | ❌ Direct Consequences (Losses) |

|---|---|---|

| Case 1: Costa Blanca Purchase | Mr. Dupont signs a purchase agreement (€180,000) without an NIE. | Notary signature impossible. Deposit of €18,000 blocked. Legal fees (€1,500) + Late penalties (€2,000). |

| Case 2: Sale (Inheritance) | Ms. Martin inherits a villa (€320,000) without an NIE for the heirs. | Sale cancelled twice. Negotiated price reduction (-€15,000). Time lost: 8 months. |

| Case 3: Rental Investment | Mr. Leblanc buys 3 apartments (€450,000) for seasonal rental. | Blocking of all 3 transactions. Missed summer season (Loss: €25,000). Cancellation of tourist licenses. |

"Without an NIE, we cannot legally proceed with any sale or purchase deed. It is an absolute legal obligation, not a mere formality."

📋 Risk #2: Administrative Penalties (Fines)

Fines up to €10,000

Legal Basis: Article 53.1 of Organic Law 4/2000 on the rights and freedoms of foreign nationals in Spain.

| Infraction | Fine Amount | Example |

|---|---|---|

| Lack of NIE for economic activity | €500 - €10,000 | Working without an NIE detected during an inspection |

| Expired NIE (TIE not renewed) | €300 - €3,000 | Roadside check with expired documents |

| Transaction > €10,000 without an NIE | €1,000 - €10,000 | Purchase of a luxury vehicle without identification |

🏦 Risk #3: Banking Penalties (Frozen Account)

Account Frozen or Closed

Regulation: European Anti-Money Laundering Directive and Law 10/2010. Banks are obliged to know their customers (KYC) and must freeze any account without a valid fiscal identification (NIE).

"My Santander account was frozen overnight. I had €25,000 blocked for 6 weeks while I obtained my NIE. I missed my property deposit payment and almost lost my dream home in Altea."

Conclusion: Anticipate to Succeed

The NIE is far more than a mere formality; it is the cornerstone of your real estate project in Spain. Obtaining it should be your absolute priority, even before signing a deposit contract (arras) or opening a bank account. Penalties for not having an NIE (blocked transactions, frozen accounts, fines) are now systematically enforced by notaries and banks.

As a real estate agency with extensive experience, particularly with French-speaking clients, our primary advice is always the same: anticipate this step. Obtaining an appointment can be complex, which is why professional support is often key to avoiding months of delays and thousands of euros in losses.

Need urgent assistance? NIE Emergency: +33 6 47 20 11 09

Obtain your NIE stress-free?

Take advantage of market opportunities. Let's discuss your project.

Table of Contents

- Introduction

- What is the NIE and what is it used for?

- Why is the NIE essential?

- Legal Objectives of the NIE (Fiscal Control and Rights)

- Who is legally required to obtain an NIE?

- How to obtain your NIE: The Process

- Option 1: From Spain (In Person)

- Option 2: From Abroad (Consulate)

- Mandatory Documents for the Application

- ⚠️ Penalties: What happens without an NIE?

- 🏠 Risk #1: Real Estate Penalties (Notary Blockage)

- 📋 Risk #2: Administrative Penalties (Fines)

- 🏦 Risk #3: Banking Penalties (Frozen Account)

- Conclusion: Anticipate to Succeed

FAQ: Your 2025 Guide to the NIE Number in Spain for UK/US Investors

Comprehensive answers to navigate the NIE process smoothly and avoid pitfalls.

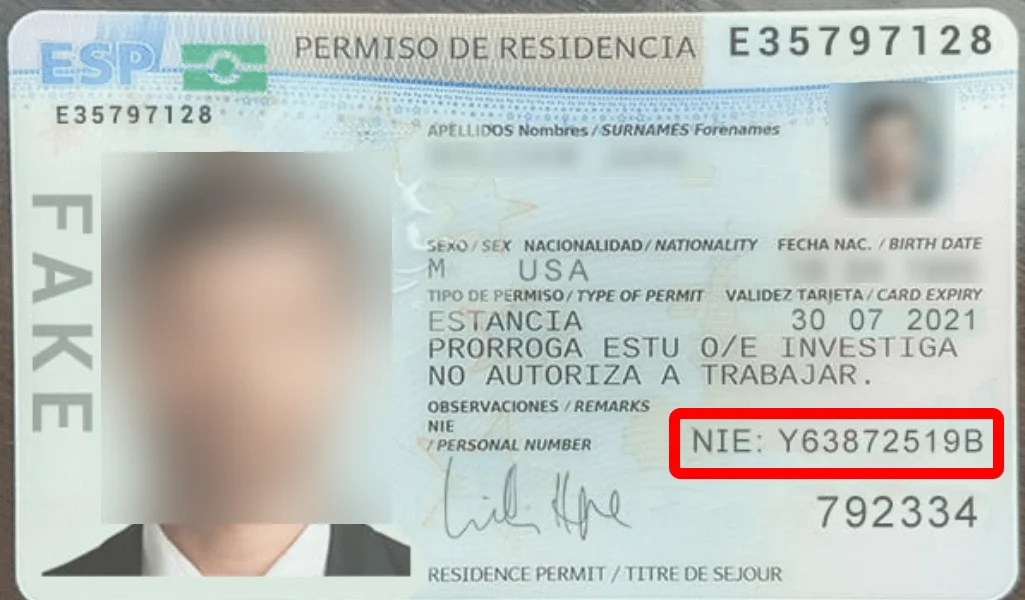

This is the most common confusion:

- NIE (Número): This is solely a tax identification number (e.g., Y-1234567-B). It is permanent and never changes. It is for both non-residents AND residents.

- "Green Card" (Certificado de Registro de la UE): This is the residency document for EU citizens living in Spain for more than 3 months. It's a green paper that states your NIE.

- TIE (Tarjeta de Identidad de Extranjero): This is the physical (biometric) residency card for non-EU citizens (e.g., US citizens, British nationals) living in Spain. It also states your NIE.

To purchase a property as a non-resident, you only need the NIE number (issued on a white A4 paper certificate).

No, the NIE number is permanent and never expires. Once assigned, it will stay with you for life for all your procedures in Spain.

What might expire is the physical residency document associated with it (like the TIE card for non-EU citizens) or the validity of a temporary certificate. But the number itself remains identical.

Yes, and it is often recommended. You can appoint a legal representative (lawyer, *gestor*, or real estate advisor) via a **power of attorney (*Poder Notarial*)** signed before a notary public (in your home country or in Spain).

This representative can then book the appointment, submit your application, and collect the document for you, which greatly simplifies the procedure and avoids language barriers or *cita previa* (appointment booking) issues.

This is often the most challenging part of the process. In high-demand areas (Alicante, Valencia, Barcelona, Madrid, Malaga), it can be **extremely difficult** to secure an appointment. Slots are released online at random times (often early mornings) and are taken within seconds.

It's not uncommon to have to wait **1 to 3 months** for an appointment. This is why anticipation is crucial, and the assistance of a professional who understands the booking system is a major asset.

The authorities require proof of the "economic reason" for your application. If you don't yet have a *contrato de arras*, the following documents are often accepted:

- A letter of intent to purchase (in Spanish), drafted by yourself or your lawyer, explaining that you are actively searching for a property.

- A document from a Spanish bank confirming that you have initiated an account opening or a loan application.

- A property search mandate with a real estate agency.

It's a catch-22. Most banks require the NIE to open a **resident account** or a full-service account, under anti-money laundering (KYC - Know Your Customer) laws.

However, some banks may temporarily open a **"non-resident account" (CNR)** with your passport, on the express condition that you provide your NIE within 30 to 90 days. If you fail to do so, they will freeze the account as mentioned in the article.

Absolutely not. This is a very common misconception. Tax residency is determined by facts (spending **more than 183 days per year** in Spain, or having the centre of your economic interests there).

The NIE is simply an identification number. You can perfectly well have an NIE and be a **non-tax resident**, and pay your taxes as such (for example, the IRNR on your property, which is Non-Resident Income Tax).

You must pay it **before** attending your appointment. The procedure is as follows:

- Secure your *Cita Previa*.

- Complete and print the Modelo 790-012 form online.

- Go to any Spanish bank (or pay online if you have an account) to pay the fee (approximately 9.84€).

- Bring the EX-15 form AND the proof of payment for the 790 fee to your appointment.

Without the payment receipt for the fee, your application will be immediately rejected.

Yes, if they have economic interests. If you are purchasing a property and your minor children need to be listed as owners (for example, as part of a gift or inheritance), they **must** have their own NIE. They will also need it to register with the Spanish social security system.

Yes, absolutely. The "white NIE" (the EX-15 form stamped by the police with your number) is the official document assigning your NIE for non-residents. It is **perfectly valid and sufficient** to sign the deed of sale (Escritura) before the notary, open a bank account, and pay your taxes. It is not "provisional"; it certifies your permanent number.

- Form EX-15: This is the **application for an NIE number**. This is what you complete to obtain your tax identification number as a non-resident.

- Form EX-18: This is the **application for registration as a resident** (to obtain the "Green Card") for EU citizens. You can only make this application if you already have an NIE.

The first step for everyone is the EX-15 form.

Your number is not lost, but you have lost the certificate. You must request a **duplicate (*duplicado*)**. The procedure is unfortunately similar to the initial application: you must obtain a *cita previa* at the police station (Oficina de Extranjeros), complete the EX-15 form again (checking the "duplicado por pérdida" box for "duplicate due to loss") and attend the appointment. You will generally not have to repay the fee.

Yes, it is highly recommended. Although some private landlords might omit it for short-term rentals, it is legally required for:

- Signing a long-term rental contract (1 year or more).

- Depositing the security deposit with the regional body (obligatory for the landlord).

- Subscribing to electricity, water, and internet contracts in your name.

If you prefer not to manage the complexity of the *cita previa* and paperwork, a *gestor* (administrative advisor) or a lawyer can do it for you. Fees vary depending on complexity and location, but in 2025, expect to pay **between 150€ and 300€ per person**.

This price includes booking the appointment (often the most difficult part), preparing the forms, and assistance on the day of the appointment.

This is a critical scenario. If you cannot sign the final deed of sale (Escritura) before the notary on the deadline set in the *contrato de arras* because you lack the NIE, you will be considered in **breach of contract (*incumplimiento de contrato*)**.

The consequence is (unless otherwise stipulated) the **total loss of your deposit** (generally 10% of the property price), to the benefit of the seller. This is the most costly penalty and the main reason why the NIE must be obtained BEFORE signing anything.